Liquidation

Share

Liquidation occurs when a trader’s collateral is no longer sufficient to cover their leveraged position’s losses, triggering an automated forced closure by the exchange's liquidation engine. It is a critical risk-management mechanism that ensures the solvency of lending protocols and derivative platforms. In 2026, the focus has moved toward MEV-resistant liquidation models that protect users from predatory "cascades." This tag provides essential information on maintenance margins, health factors, and how to avoid liquidation in high-volatility environments.

14404 Articles

Created: 2026/02/02 18:52

Updated: 2026/02/02 18:52

Recommended by active authors

Latest Articles

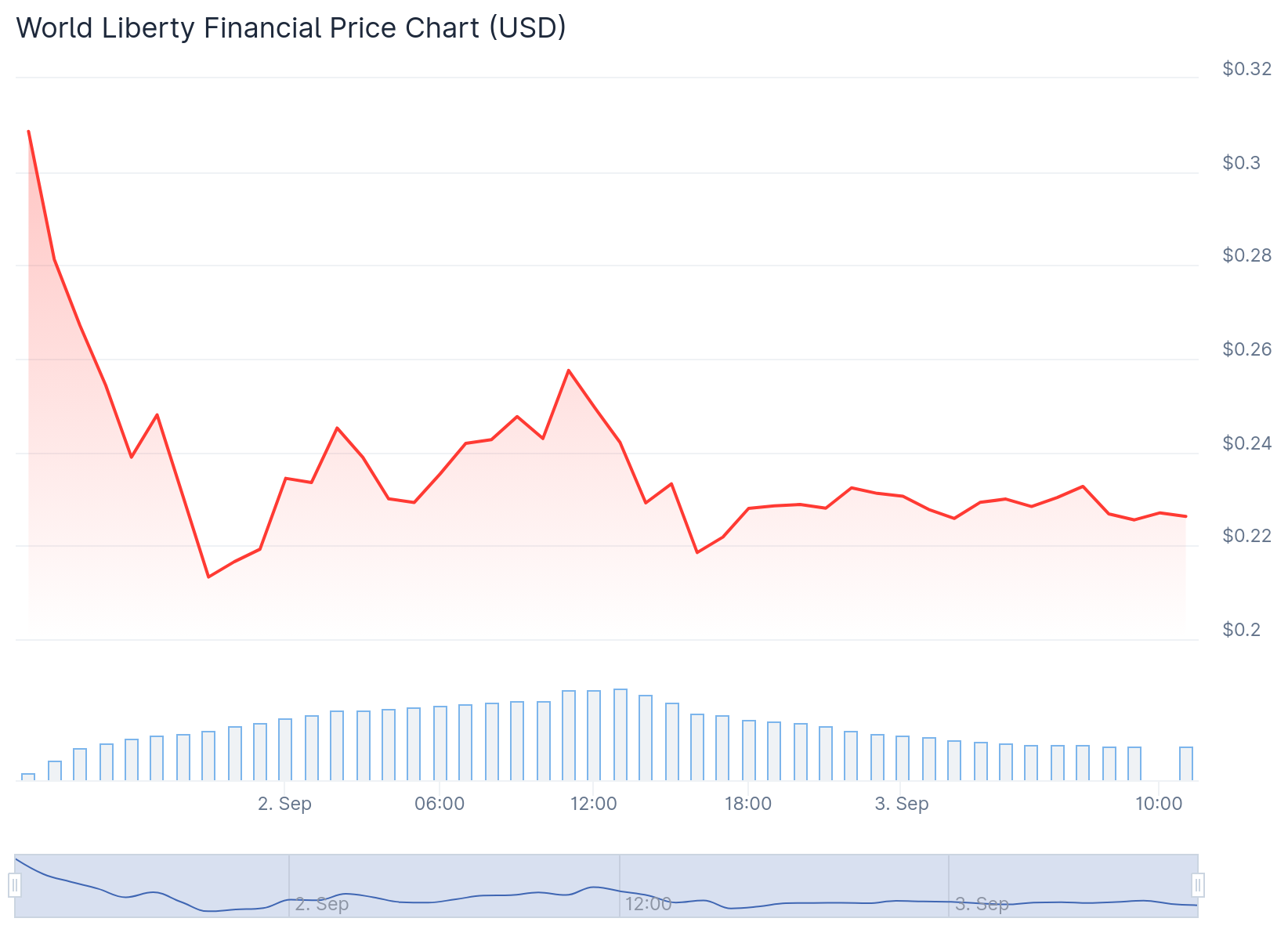

Trump-Linked World Liberty Financial Under Fire After UAE Investment

2026/02/05 16:32

Social Media Now Talking Sub-$60,000 Bitcoin Prices As Fear Rises

2026/02/05 16:00

Solana Recovery Narrative Strengthens as RWA Market Hits $1.15B and Regulation Turns Positive

2026/02/05 16:00

The One Thing AI in Architecture Still Didn’t Solve, Until Now

2026/02/05 16:00

Why Multicoin Capital’s Kyle Samani Is Leaving Crypto for AI and Robotics

2026/02/05 15:58