Liquidation

Share

Liquidation occurs when a trader’s collateral is no longer sufficient to cover their leveraged position’s losses, triggering an automated forced closure by the exchange's liquidation engine. It is a critical risk-management mechanism that ensures the solvency of lending protocols and derivative platforms. In 2026, the focus has moved toward MEV-resistant liquidation models that protect users from predatory "cascades." This tag provides essential information on maintenance margins, health factors, and how to avoid liquidation in high-volatility environments.

15192 Articles

Created: 2026/02/02 18:52

Updated: 2026/02/02 18:52

Recommended by active authors

Latest Articles

Robinhood (HOOD) Stock Jumps 14% on Market Rally and Analyst Upgrades

2026/02/07 20:44

Pi Network Targets Open Mainnet 2026, Millions Prepare as Utility and Migration Accelerate

2026/02/07 20:41

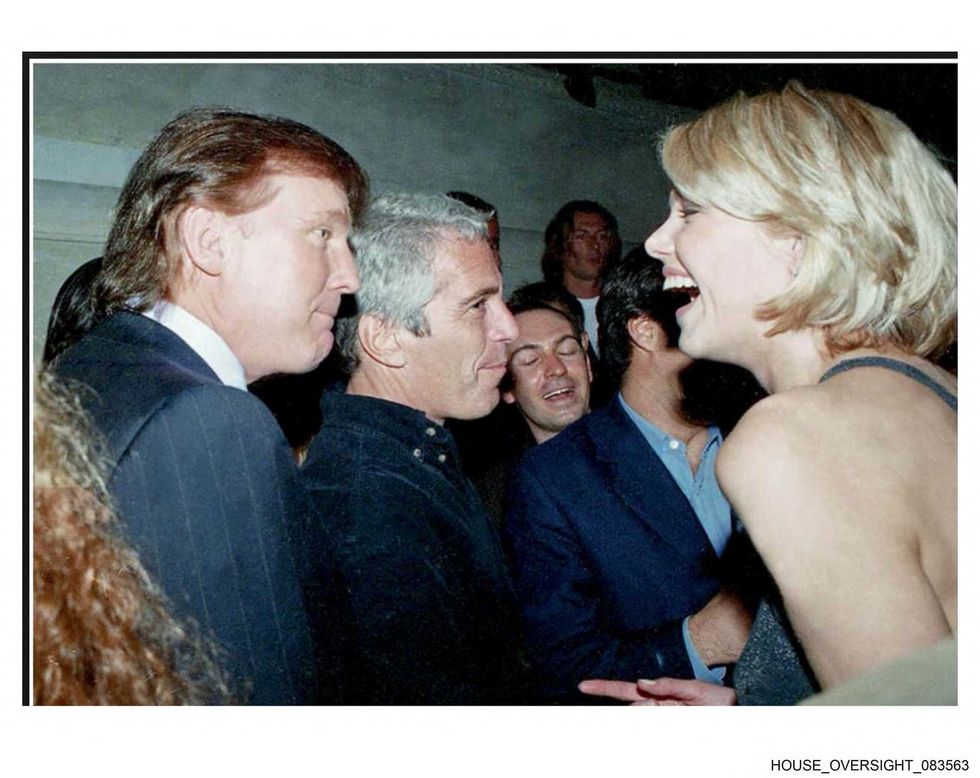

Trump named in explosive tip regarding Epstein’s death: ‘Authorized murder’

2026/02/07 20:37

Trump Administration Approves New Crypto-Friendly Bank

2026/02/07 20:37

XRP eyes $3 amid whale buying – Reversal or relief rally?

2026/02/07 20:19