ETF

Share

A crypto ETF is a regulated investment fund that tracks the price of one or more digital assets and trades on traditional stock exchanges like the NYSE or Nasdaq.Following the success of Bitcoin and Ethereum ETFs, the 2026 market now includes Solana ETFs and diversified Altcoin Baskets. ETFs serve as the primary vehicle for institutional capital and retirement funds (401k/IRA) to enter the Web3 space. This tag tracks regulatory approvals, AUM (Assets Under Management) inflows, and the impact of Wall Street on crypto liquidity.

40032 Articles

Created: 2026/02/02 18:52

Updated: 2026/02/02 18:52

Recommended by active authors

Latest Articles

XRP Now Hosts Over $1B Worth of Tokenized Commodities

2026/02/07 14:28

Revealing Long/Short Ratios Show Remarkable Market Equilibrium Across Top Exchanges

2026/02/07 14:01

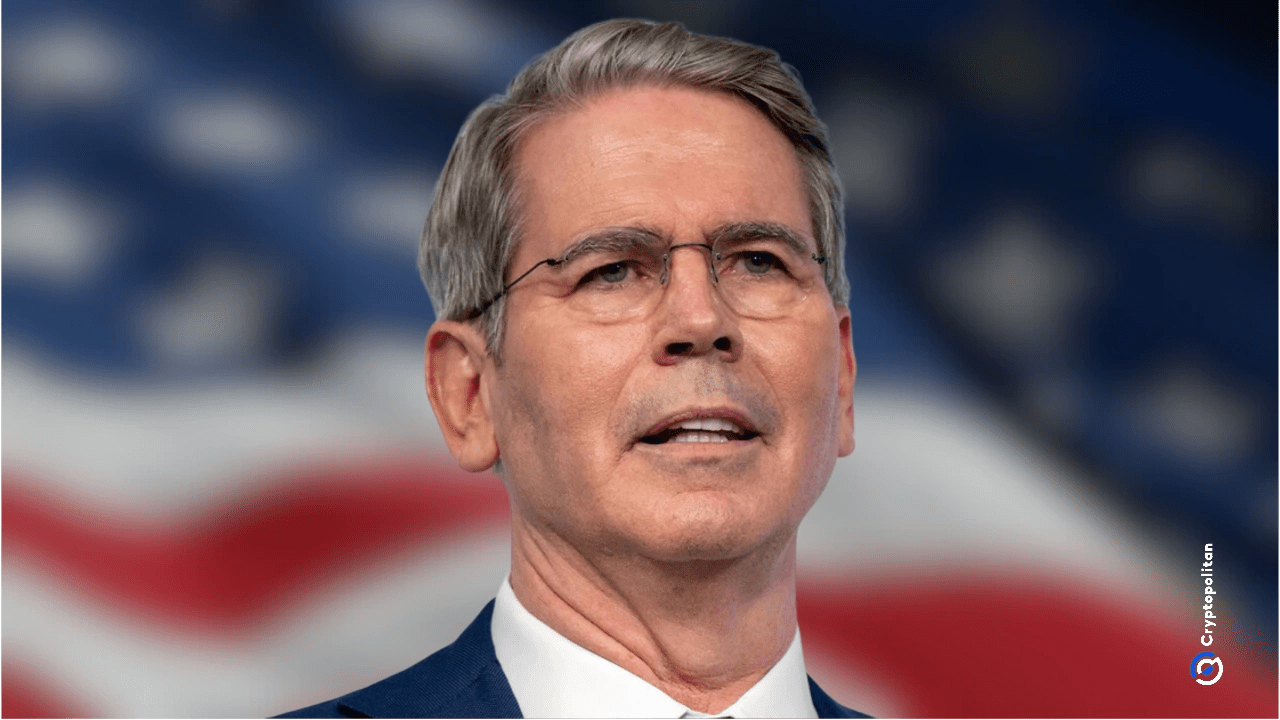

Trump’s Scott Bessent says “false choice” to pit his strong‑dollar line against the president’s

2026/02/07 13:58

The ENS will launch its ENSv2 on Ethereum, leaving its own L2.

2026/02/07 13:50

The Critical Analysis Of HBAR’s Journey To $0.5

2026/02/07 13:48