Prediction-Market

Share

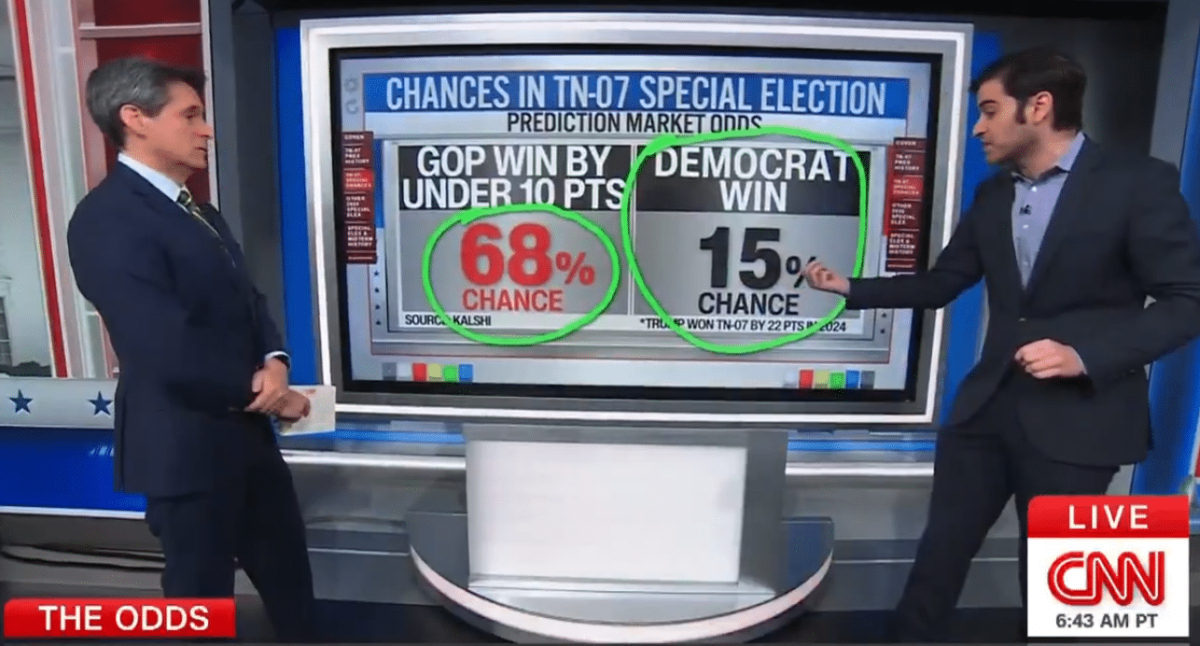

Prediction Markets are decentralized platforms where users trade shares based on the outcome of future events, ranging from elections to sports and crypto prices.By leveraging the "wisdom of the crowd," platforms like Polymarket provide highly accurate, censorship-resistant forecasting data. In 2026, these markets serve as a primary source of sentiment analysis and risk hedging. This tag covers the technology behind decentralized oracles, event-based liquidity, and the growing role of prediction markets in global information discovery.

910 Articles

Created: 2026/02/02 18:52

Updated: 2026/02/02 18:52

CNN Adds Kalshi Live Forecasts

Author: BitcoinEthereumNews

2025/12/04

Share

Recommended by active authors

Latest Articles

Trump Token Launch Expands Digital Footprint as ‘Gym Bro’ Narrative Fuels $MAXI

2026/02/05 00:41

ZKP Crypto, Deepsnitch AI, Bitcoin Hyper, & More!

2026/02/05 00:09

Top Features To Integrate In Your Crypto Exchange Like Coinbase

2026/02/05 00:08

VectorUSA Achieves Fortinet’s Engage Preferred Services Partner Designation

2026/02/05 00:02

Trump and Xi Engage in Pivotal Dialogue

2026/02/04 23:58