Liquidation

Share

Liquidation occurs when a trader’s collateral is no longer sufficient to cover their leveraged position’s losses, triggering an automated forced closure by the exchange's liquidation engine. It is a critical risk-management mechanism that ensures the solvency of lending protocols and derivative platforms. In 2026, the focus has moved toward MEV-resistant liquidation models that protect users from predatory "cascades." This tag provides essential information on maintenance margins, health factors, and how to avoid liquidation in high-volatility environments.

15097 Articles

Created: 2026/02/02 18:52

Updated: 2026/02/02 18:52

Recommended by active authors

Latest Articles

US Stock Market Could Double By End Of Presidential Term

2026/02/07 10:43

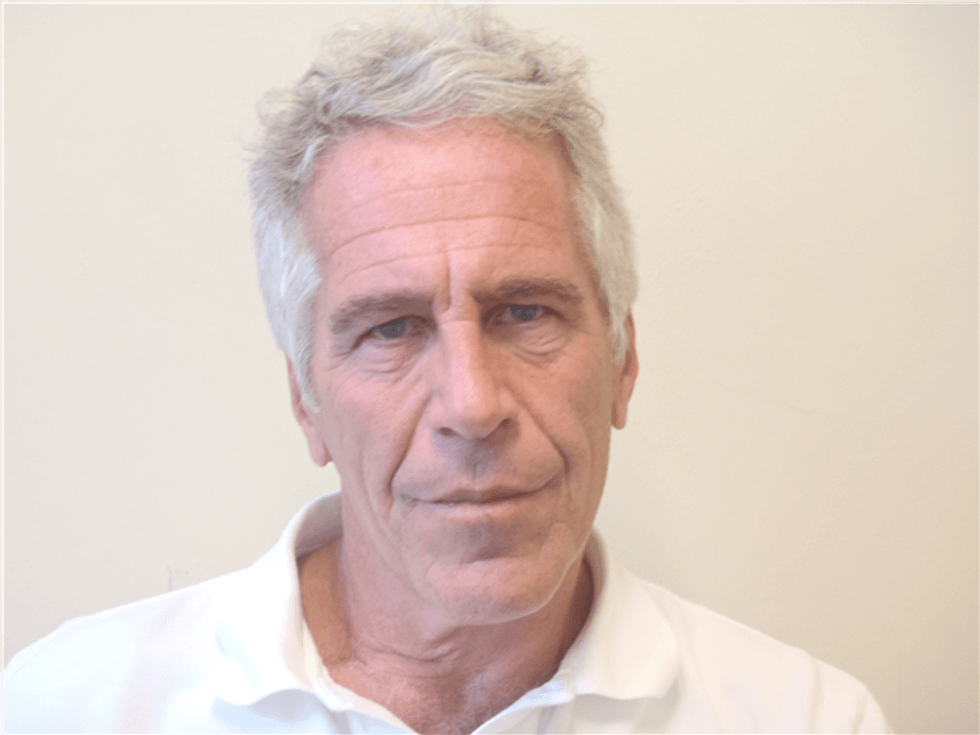

Trump official bought business with Epstein years after claiming to cut ties: report

2026/02/07 10:32

Republic Europe Enables Retail Investors’ Indirect Access to Kraken

2026/02/07 10:31

Top Altcoin News: Chainlink and Maker Dip – Is APEMARS the Next Big Crypto to Buy Now With $160K Raised and 6.2B Tokens Sold?

2026/02/07 10:15

Kraken's Big Hint: Pi Coin Set for Exchange Listing In 2026

2026/02/07 09:25