Liquidation

Share

Liquidation occurs when a trader’s collateral is no longer sufficient to cover their leveraged position’s losses, triggering an automated forced closure by the exchange's liquidation engine. It is a critical risk-management mechanism that ensures the solvency of lending protocols and derivative platforms. In 2026, the focus has moved toward MEV-resistant liquidation models that protect users from predatory "cascades." This tag provides essential information on maintenance margins, health factors, and how to avoid liquidation in high-volatility environments.

15238 Articles

Created: 2026/02/02 18:52

Updated: 2026/02/02 18:52

Recommended by active authors

Latest Articles

Why Some Traders Say Bitcoin’s 21 Million Cap Is Being Diluted Off-Chain

2026/02/08 01:37

Stellar (XLM) Eyes $0.57 Recovery as Rails Launches Institutional-Grade Vaults

2026/02/08 01:30

Trend Research Concludes Major ETH Liquidation

2026/02/08 00:58

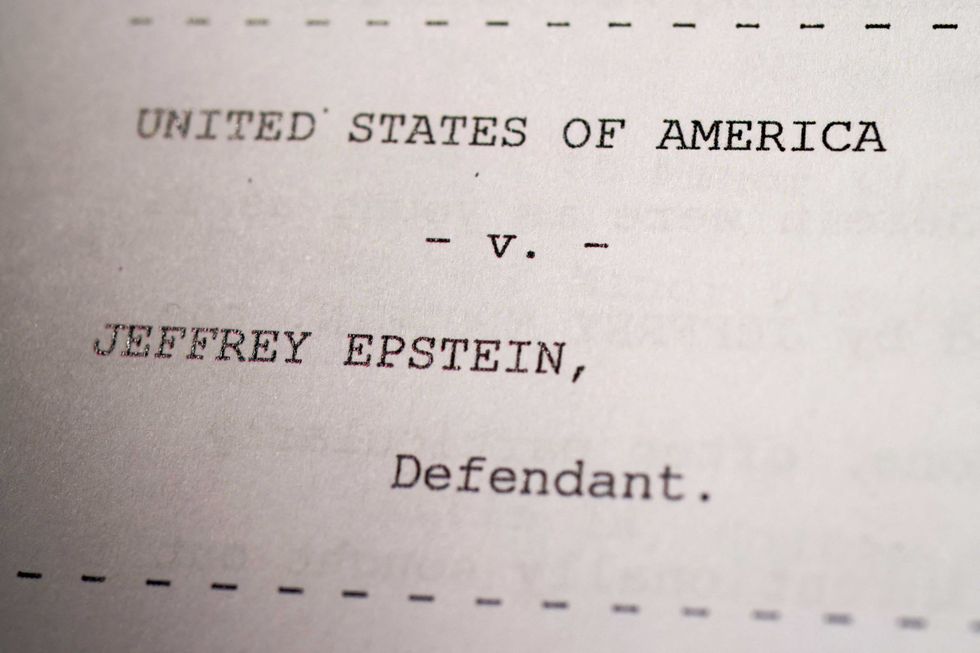

Students stage walkout after professor and former US ambassador named in Epstein files

2026/02/08 00:55

Trump isn't the real threat — the 'MAGA apparatus' is: analysis

2026/02/08 00:52