Lending

Share

Lending protocols form the backbone of the decentralized money market, allowing users to lend or borrow digital assets without intermediaries. Using smart contracts, platforms like Aave and Morpho automate interest rates based on supply and demand while requiring over-collateralization for security. The 2026 lending landscape features advanced permissionless vaults and institutional-grade credit lines. This tag covers the evolution of capital efficiency, liquidations, and the integration of diverse collateral types, including LSTs and tokenized RWAs.

14776 Articles

Created: 2026/02/02 18:52

Updated: 2026/02/02 18:52

Recommended by active authors

Latest Articles

xAI co-founder Wu Yuhuai announces his departure.

2026/02/10 16:36

Vàng Cán Mốc Lịch Sử 5.000 USD: Khi Dự Báo Của CEO Bitget Gracy Chen Trở Thành Hiện Thực Và Tầm Nhìn Về Đích Đến 5.400 USD

2026/02/10 16:26

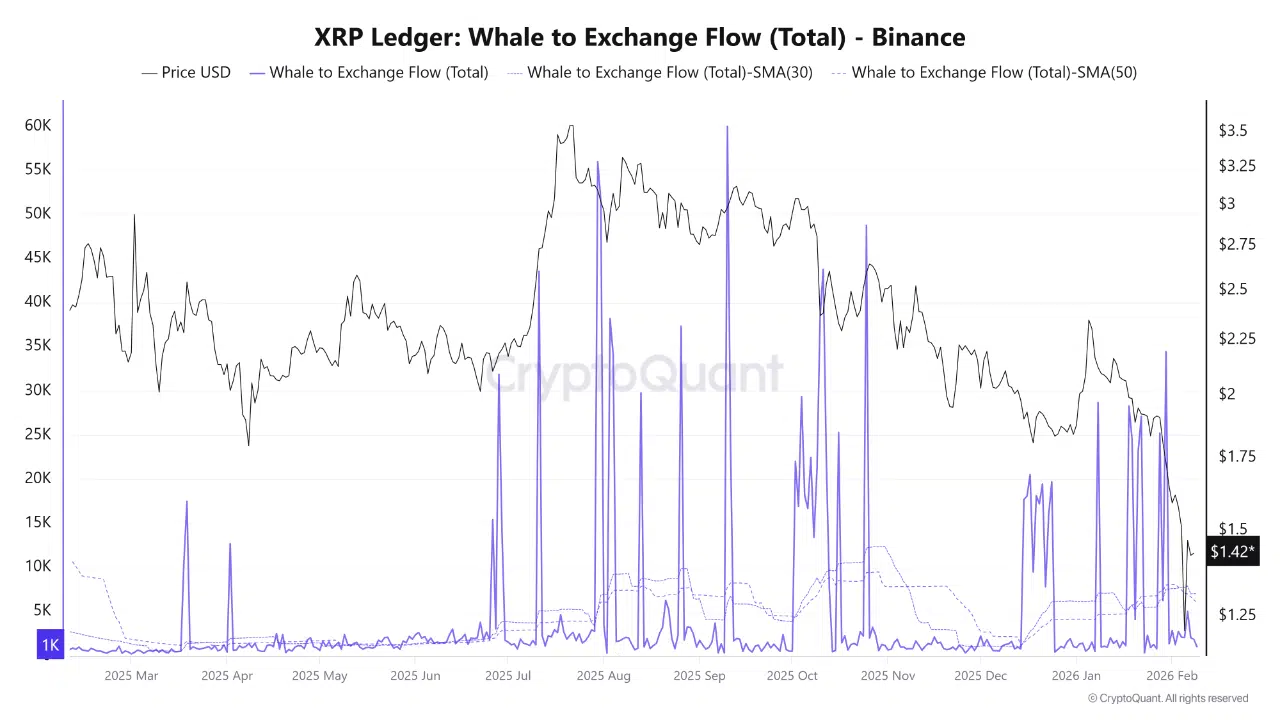

XRP Whale Selling Remains Absent as Price Slides

2026/02/10 16:14

XRP price prediction: How could China’s Treasury sell call impact XRP?

2026/02/10 16:00

Why the Bitcoin Boom Is Not Another Tulip Mania

2026/02/10 15:44