ETF

Share

A crypto ETF is a regulated investment fund that tracks the price of one or more digital assets and trades on traditional stock exchanges like the NYSE or Nasdaq.Following the success of Bitcoin and Ethereum ETFs, the 2026 market now includes Solana ETFs and diversified Altcoin Baskets. ETFs serve as the primary vehicle for institutional capital and retirement funds (401k/IRA) to enter the Web3 space. This tag tracks regulatory approvals, AUM (Assets Under Management) inflows, and the impact of Wall Street on crypto liquidity.

39606 Articles

Created: 2026/02/02 18:52

Updated: 2026/02/02 18:52

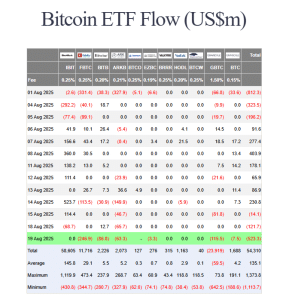

A Dark Day For Crypto ETF As Markets Tumble

Author: Coinstats

2025/08/21

Share

Recommended by active authors

Latest Articles

Tether Invests $100M In Anchorage Digital: HYPER Soars

2026/02/06 07:37

TESDA Skills Passport: A mobile app for job hunting, training, scholarships

2026/02/06 07:28

Wave 2 Ends, Wave 3 Begins

2026/02/06 07:20

The Payments Giants Quietly Supporting Bitcoin Circular Economies

2026/02/06 07:07

Ripple’s $234 Million Move To Unknown Wallet Sparks Intense Scrutiny

2026/02/06 07:02