Binance Lists TSLA? Why Smart Traders Have Been on MEXC All Along

The crypto headlines are buzzing today: Binance has announced the listing of Tesla (TSLA) Perpetual Contracts.

While this news validates a massive industry trend—the merger of traditional stocks with crypto liquidity—it brings a smile to the faces of veteran traders on MEXC.

Why? Because while others are just arriving at the party, MEXC users have been trading TSLA with USDT for a long time.

If you are reading this because of the Binance news, you are looking in the right direction (Stock Tokens), but you might be looking at the wrong platform. Here is why the "Smart Money" chooses MEXC for trading assets like TSLA.

1. The "First Mover" Advantage: Depth Matters

MEXC didn't just add TSLA today to chase a trend; we have supported TSLA/USDT futures for a significant period.

Mature Order Books: While new listings often suffer from initial volatility and thin order books, MEXC’s TSLA market is mature. We have established deep liquidity and historical data, ensuring smoother execution during high-volatility events like Earnings Calls or Elon Musk’s tweets.

Stability: We have already stress-tested our engine against TSLA's wildest moves. You are trading on a battle-tested infrastructure, not a new experiment.

2. The MEXC Edge: 4 Reasons We Beat the Competition

In trading, brand loyalty doesn't pay the bills. Math does. Here is the breakdown of why MEXC offers a mathematically superior environment for trading TSLA compared to competitors.

1. Zero Fees (The Killer Feature)

This is the game-changer. Trading stock indices or individual stocks often involves grinding out small percentages.

The MEXC Advantage: We offer 0 Maker & Taker Fees on select trading pairs.

The Impact: If you are scalping TSLA intraday, fees on other platforms can eat 10-20% of your profits. On MEXC, 100% of your alpha belongs to you.

2. 50x Leverage (Capital Efficiency)

Traditional brokers often cap you at 2x or 4x leverage. Even other crypto exchanges play it safe with stock tokens.

The MEXC Advantage: We empower you with up to 50x Leverage on TSLA.

The Strategy: You don't need $10,000 to trade Tesla. With 50x leverage, a small USDT margin can control a significant position, allowing you to turn small volatility into meaningful PnL.

3. World’s #1 Liquidity

Liquidity is your insurance policy against slippage.

The MEXC Advantage: MEXC is widely recognized for having the world’s top-tier liquidity. Whether you are entering a $100 position or a $100,000 position, our order book absorbs the impact, ensuring you get the price you clicked.

4. Seamless 24/5 Access

The MEXC Advantage: Forget the hassle of opening a traditional brokerage account, KYC delays, or T+2 settlement times. On MEXC, you use the USDT you already have. You can jump from trading BTC to trading TSLA in seconds, all within the same interface.

3. How to Trade TSLA on MEXC

The listing on Binance will bring massive attention to TSLA, likely increasing volatility across the board. You can use MEXC’s superior tools to profit from this influx of interest:

The "Gap" Play: TSLA often "gaps" (jumps in price) when the market opens on Monday. Use MEXC’s high leverage to position yourself for these moves (with strict stop-losses).

The Scalp: With the increased volume from the news, TSLA will be moving fast. Use MEXC’s 0 Fees to scalp small movements throughout the trading day without worrying about commission costs.

Conclusion: Don't Just Follow the News, Follow the Alpha

The fact that major exchanges are catching up to MEXC validates our vision: Tokenized Stocks are the future.

But as a trader, you shouldn't settle for "new." You should demand "best." With 0 fees, 50x leverage, and established depth, MEXC remains the undisputed heavyweight champion for trading TSLA with USDT.

⚠️ Risk Warning

Stock Token Volatility: Trading tokenized stocks like TSLA involves significant risk. Unlike crypto, stocks have specific trading hours and can experience "Price Gaps" over weekends where stop-losses may not trigger at your desired price.

Leverage Risk: While 50x leverage offers high potential returns, it also increases the risk of rapid liquidation.

Market Hours: TSLA/USDT generally moves in correlation with the US Stock Market hours.

DYOR: This article is for educational purposes only. Please manage your risk strictly when trading on MEXC.

Popular Articles

The Next Crypto Narrative: Why Payments and Utility Are Replacing Layer 1 Hype

Crypto has cycled through several major phases of attention. Early market energy focused on Layer 1 ecosystems competing for speed, scale, and developer traction. That narrative dominated for years un

Stablecoin Dominance & Market Liquidity: Infrastructure,Settlement, and Systemic Trade-offs

The TCP/IP of Money: How $186 Billion in Stablecoins Became Crypto's Settlement BackboneStablecoins have quietly evolved into the fundamental settlement layer of digital asset markets, processing over

Why PIPPIN Coin Surged? Analyzing the "Unicorn" Phenomenon on Solana

In the crowded world of cryptocurrency, most meme coins are fleeting sparks. They surge, they crash, and they are forgotten.However, PIPPIN has defied this lifecycle. Today, PIPPIN is flashing green o

What is BIRB? Complete Guide to Moonbirds Meme Coin and Collectibles Ecosystem

In the evolving landscape of cryptocurrency, BIRB emerges as a groundbreaking token that bridges meme culture with tangible business value. Unlike traditional memecoins that rely purely on social medi

Hot Crypto Updates

View More

On-Chain Data Reveals: Why Are Whales Accumulating BEEG in Q1 2026? Complete Smart Money Tracking Guide

In-depth analysis of BEEG on-chain data in 2026: Whale addresses continue accumulating, holder count hits all-time high. Learn how to use Whale Tracking tools to follow smart money. Discover why

2026 Ultimate Guide to Gold Gifting: Which Offers Better Value—PAXG, XAUT, or Physical Gold Bars?

Discover why smart gifters in 2026 choose tokenized gold (PAXG, XAUT) over physical bars. Learn about fractional ownership, instant transfers, transparent verification, and why MEXC offers the best

XRP Price Prediction 2026: Why Seasoned Traders Choose MEXC to Position for XRP's Next Bull Run

In-depth XRP price prediction analysis for 2026 reveals why smart traders choose MEXC. Zero trading fees, deep liquidity, and 100x leverage help you capture XRP's potential growth from $2 to $5. Key

Why Are Sui Whales Secretly Accumulating BEEG? In-Depth On-Chain Data Analysis for 2026

Comprehensive analysis of BEEG on-chain data and whale movements. Discover why smart money is accumulating BEEG, explore whale tracking techniques, deflationary mechanisms, and why MEXC is the best

Trending News

View More

Binance BEP20 Suspension: Essential Maintenance Update for January 23

BitcoinWorld Binance BEP20 Suspension: Essential Maintenance Update for January 23 Global cryptocurrency exchange Binance has announced a temporary but essential

Ethereum Staking Breakthrough: Buterin’s Crucial DVT Proposal to Slash Validator Penalties

BitcoinWorld Ethereum Staking Breakthrough: Buterin’s Crucial DVT Proposal to Slash Validator Penalties In a pivotal move for the world’s leading smart contract

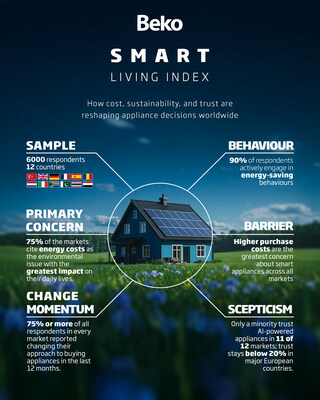

Beko’s Smart Living Index finds Economic Pressure Drives Surge in Sustainable Living

ISTANBUL, Jan. 22, 2026 /PRNewswire/ — Beko, the leading global home appliance company, today unveiled its proprietary Smart Living Index (SLI). The study revealed

XRP Price Prediction: Can Ripple Really Become A $10 Crypto or Are Smart Whales Diversifying to More Lucrative Opportunities?

Few debates in crypto spark as much emotion as XRP price prediction. For years, Ripple supporters have argued that a $10 XRP isn’t just possible; it’s inevitable

Related Articles

The Next Crypto Narrative: Why Payments and Utility Are Replacing Layer 1 Hype

Crypto has cycled through several major phases of attention. Early market energy focused on Layer 1 ecosystems competing for speed, scale, and developer traction. That narrative dominated for years un

Stablecoin Dominance & Market Liquidity: Infrastructure,Settlement, and Systemic Trade-offs

The TCP/IP of Money: How $186 Billion in Stablecoins Became Crypto's Settlement BackboneStablecoins have quietly evolved into the fundamental settlement layer of digital asset markets, processing over

Binance Lists TSLA? Why Smart Traders Have Been on MEXC All Along

The crypto headlines are buzzing today: Binance has announced the listing of Tesla (TSLA) Perpetual Contracts.While this news validates a massive industry trend—the merger of traditional stocks with c

Why PIPPIN Coin Surged? Analyzing the "Unicorn" Phenomenon on Solana

In the crowded world of cryptocurrency, most meme coins are fleeting sparks. They surge, they crash, and they are forgotten.However, PIPPIN has defied this lifecycle. Today, PIPPIN is flashing green o