Bitcoin and Altcoins are Recovering Ahead of FOMC Meeting This Month – Could $WEPE Gain as a Result?

The crypto market is starting to heat up again after a cool-down following $BTC’s recent all-time high. Bitcoin increased by 4.78% on Sunday, while altcoins performed even better. $ETH grew by 7.22%, and $SOL shot up by 22.65%.

Altcoins tend to perform better after significant growth in $BTC, so we’re expecting a strong winter for Wall Street Pepe, a coin with a proven track record in the meme coin space that’s making a bold shift from the Ethereum network to Solana.

We’ll discuss how the $WEPE (SOL) transfer is the perfect opportunity to get involved with this coin soon. In the meantime, let’s explore why the altcoin market is improving.

What’s driving the Crypto Market’s Surge?

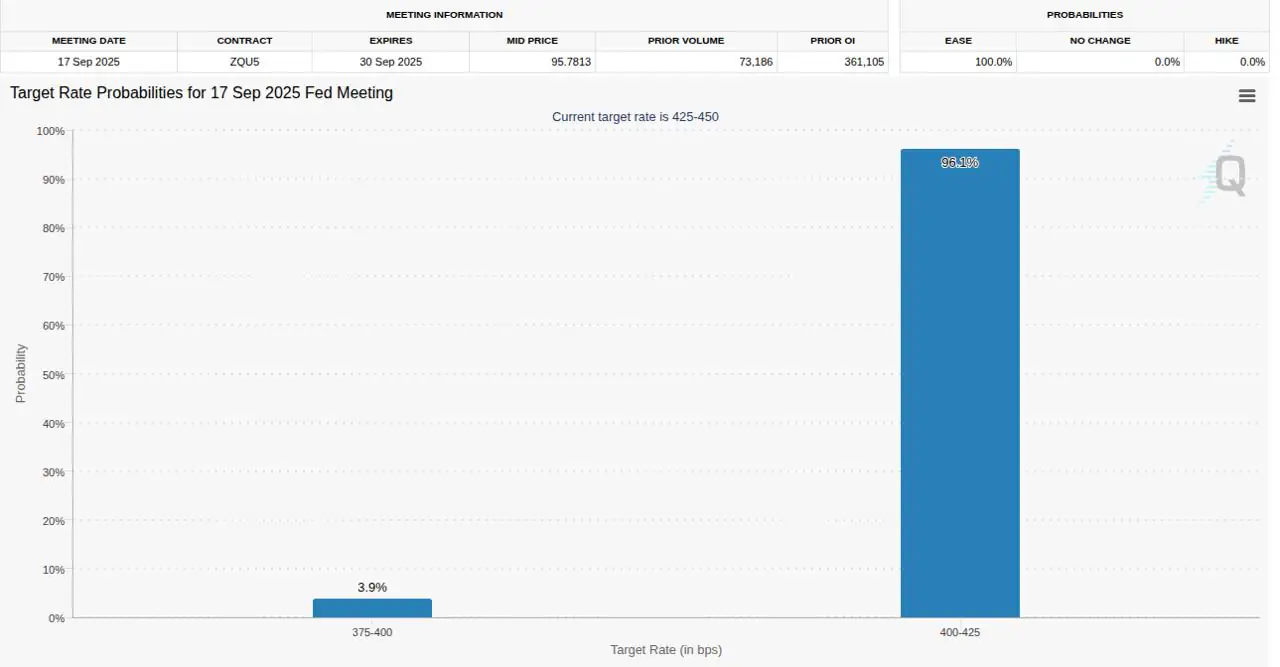

Most of the market’s surge can be attributed to rising hopes that the Federal Reserve will announce a 0.25% rate cut. In turn, this will lead to capital shifting into higher-yield assets like crypto as returns on federal bonds decrease.

Source: CME Group’s FedWatch

Source: CME Group’s FedWatch

Inflation data released by the US on Wednesday also helped boost the markets. The latest stats from the Department of Labor showed that the Producer Price Index actually decreased by 0.1% month to month.

As a result, while inflation still impacts the markets, there’s a general feeling that it’s not worsening, and the US is taking measured steps to address the issue. With confidence returning to crypto, we believe it’s time to explore a token that supports the future growth of the markets.

We’re discussing $WEPE, a token with a solid history on the Ethereum blockchain that is now expanding to Solana. Let’s explore why $WEPE is about to benefit from a more active crypto market this winter.

Wall Street Pepe (SOL) – A Meme Coin with Real Market Intelligence

$WEPE is a meme coin token that merges meme culture with real alpha plays in both crypto and stock markets, creating a community that’s both fun and dedicated to the success of other Wall Street Pepe holders.

That’s part of why $WEPE is transitioning to the Solana network. While Ethereum works well for DeFi, it doesn’t match Solana’s level of scalability. It’s also the hub for the most successful meme coin market now, with a market cap exceeding $12B.

As part of $WEPE’s move to Solana, the token supply on Ethereum is being burned at a 1:1 ratio to maintain value parity between the two networks. This buyback scheme ensures that $WEPE will become a truly multichain token without devaluing the original $WEPE investment for Ethereum holders.

Attracting Solana-native traders could significantly boost this meme coin, which has already experienced nearly a 10x increase from May to July of 2025.

The $WEPE buyback event keeps price pegged to $WEPE on Ethereum

The $WEPE buyback event keeps price pegged to $WEPE on Ethereum

That’s the thing about $WEPE – it’s not just a meme. It’s also a community of degen traders who are hunting for the best market intelligence and sharing it among an exclusive group of $WEPE holders, all working towards the same goal: beating the whales in trades.

$WEPE holders can join the Wepe Army. In addition to trading tips, they can also receive regular updates on the top performers in the meme coin market.

The best traders in the $WEPE ecosystem can take part in the VIP Group, where they submit their best trades and take part in private trading competitions with weekly rewards.

Right now, you can buy $WEPE for just $0.001 on Solana before the Token Generation Event. Over 3.6 billion $WEPE (ETH) has already been migrated to Solana, but it’s not too late to get involved. Plus, if you join now, you have the chance to complete exclusive quests to secure a spot on the NFT whitelist.

Purchase $WEPE on Solana today and lock in your seat at the table.

All crypto products are volatile. Make sure to always do your own research before investing and only invest what you’re prepared to lose. This article is not financial advice.

This publication is sponsored. Coindoo does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or any other materials on this page. Readers are encouraged to conduct their own research before engaging in any cryptocurrency-related actions. Coindoo will not be liable, directly or indirectly, for any damages or losses resulting from the use of or reliance on any content, goods, or services mentioned. Always do your own research.

The post Bitcoin and Altcoins are Recovering Ahead of FOMC Meeting This Month – Could $WEPE Gain as a Result? appeared first on Coindoo.

Ayrıca Şunları da Beğenebilirsiniz

Trump-Backed WLFI Plunges 58% – Buyback Plan Announced to Halt Freefall

Son of filmmaker Rob Reiner charged with homicide for death of his parents