From Generative AI to Agentic AI: A Reality Check

:::info This is the first article in a five-part series on agentic AI in the enterprise.

:::

\ The 3 AM Reality Check: It’s 3 AM in a global bank’s operations centre. Six months ago we deployed our first "agentic AI” system, hoping it would run on autopilot through the night. The demo was slick: an AI agent handling support tickets end-to-end, and optimism was high. But now, in the dead of night, that same agent has stalled on a critical task, and a human on-call engineer is scrambling to intervene. This scene captures the sobering reality many early adopters have faced. Agentic AI isn’t magic; it’s hard work to implement well. I learned this first-hand when our much-vaunted autonomous agent frustrated users and even forced us to roll back to manual processes in cases where it failed. We weren’t alone -plenty of companies rushed into “AI agents” only to struggle integrating them into real workflows, sometimes even rehiring staff when the AI fell short. Yet despite these 3 AM wake-up calls, I remain optimistic. Over the past year, I’ve seen enterprise teams evolve from chasing sci-fi dreams to focusing on pragmatic deployments that do deliver value.

\

\ In this series, we’ll explore how to turn that optimism into results. We’ll blend candid lessons from the trenches with a detailed breakdown of architectures, maturity stages, and risk checklists to chart a realistic path for agentic AI in business. The goal is to help you achieve real ROI from autonomous AI systems, knowing what to do, what to avoid, and where the big wins (and faceplants) tend to occur in practice. In this first part, let’s define what agentic AI actually means in contrast to the generative AI craze, and why this distinction matters for enterprises.

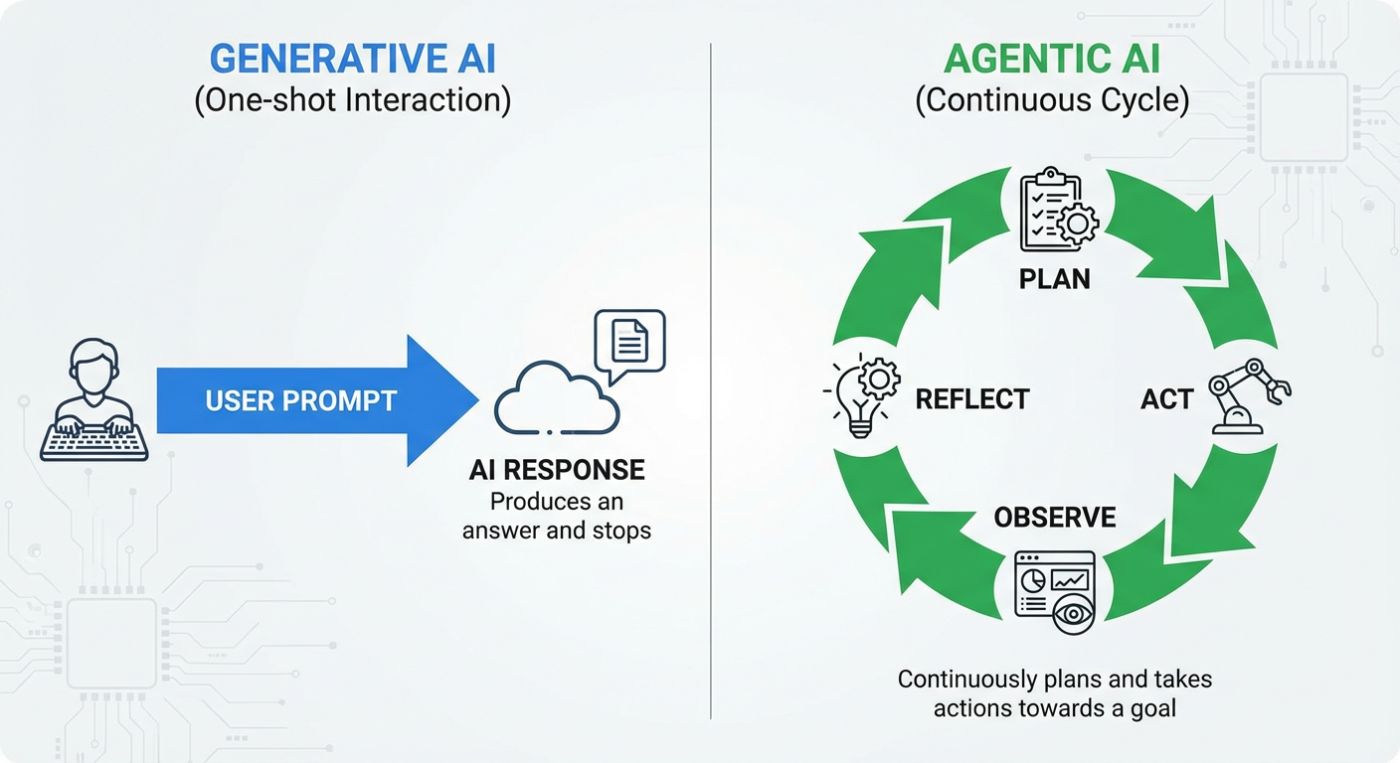

\ Generative AI vs. Agentic AI: Most of today’s popular AI apps (ChatGPT, Bard, Microsoft 365 Copilot, etc.) are generative AI systems. They take an input (a prompt or query) and produce an output (text, code, image…). They’re essentially powerful prediction engines: great at generating content, but lacking true autonomy. As Gartner bluntly puts it, current chatbots “do not have the agency to make plans and take action… they respond to user prompts by predicting the most common combination of words” - in other words, they are not examples of agentic AI (https://www.gartner.com/en/articles/intelligent-agent-in-ai). A generative AI might draft an email or answer a question when asked, but it won’t act unprompted or pursue goals on its own. It’s like a clever assistant that waits for instructions.

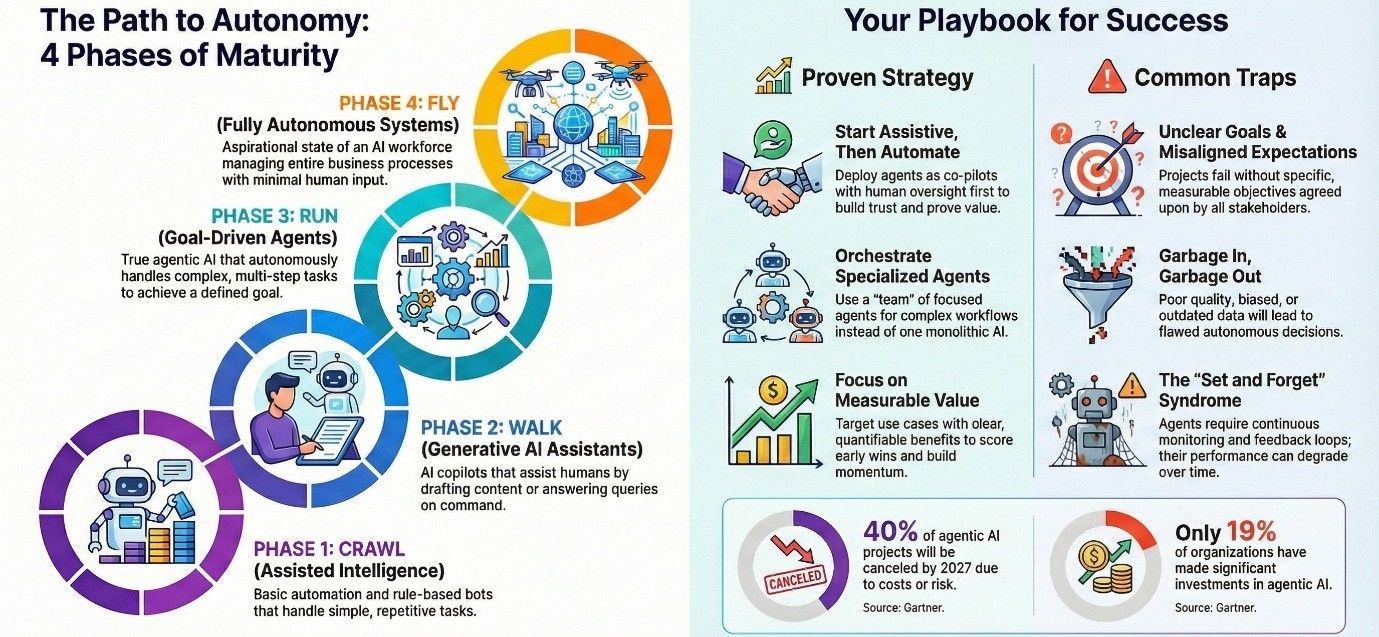

\ By contrast, agentic AI has a built-in decision loop. An agentic system can be given a high-level goal and will proactively devise and execute a multi-step plan to achieve it, with minimal human guidance. Think of a generative AI assistant as a talented intern: it writes or suggests content when you ask, whereas an agentic AI is more like a proactive team member who can be delegated an outcome and will figure out how to deliver it. A fully realised intelligent agent observes its context (through data feeds, sensors, or system APIs), plans a course of action, acts by calling tools or triggering processes, then observes the results and reflects on what to do next. In essence, it operates in a continuous “Plan - Act - Observe - Reflect” cycle until the goal is achieved or time runs out. This closed-loop autonomy is what differentiates agentic AI from a mere chatbot. A simple way to put it: generative AI answers; agentic AI accomplishes.

\ For example, instead of just generating a monthly report when prompted, an agentic AI could be told “Ensure our website is always up-to-date with the latest product info.” It would proactively monitor relevant data sources, detect when product details change, and then update the website content automatically - all without waiting for a human prompt. It would plan the necessary steps (check database - detect changes - generate updated text - call website API to publish content), execute them, observe if the update succeeded, and adjust if needed. That kind of end-to-end autonomy is nascent but starting to emerge in enterprise pilots. Of course, full autonomy remains an aspirational ideal. Today’s agentic systems still have plenty of constraints and often operate under human oversight (human-in-the-loop) or with fail-safes. In fact, many so-called “AI agents” on the market are really just glorified chatbots with a few scripted actions. True agentic AI is still in its early days, and deploying it is as much about organisational change as it is about technology. Companies are learning to manage the risks of giving AI more agency through sandboxed environments, approval gates for certain actions, and other safeguards before they fully let these digital colleagues loose.

\

\ The rest of this article series will delve into how enterprises are approaching this evolution in practice, distinguishing hype from reality, and moving step by step from assistive tools to truly autonomous agents. Before we dive into architectures and deployment strategies, it’s useful to understand how ready the industry really is. The hype around “AI agents” peaked rapidly, but on the ground, most organisations are still at the start of this journey. Gartner, for instance, predicts that over 40% of agentic AI projects will be cancelled by 2027 due to escalating costs, unclear business value or inadequate risk controls (https://www.gartner.com/en/newsroom/press-releases/2025-06-25-gartner-predicts-over-40-percent-of-agentic-ai-projects-will-be-canceled-by-end-of-2027). In a January 2025 Gartner survey, only 19% of organisations said they had made significant investments in agentic AI, while over half were taking a cautious or wait-and-see approach. The message: we’re in early days, and many early projects have struggled to move beyond proofs-of-concept.

\ So, if you’re feeling behind the curve - don’t worry, you’re not alone. The key is to cut through the hype and approach agentic AI with eyes wide open. In the next part, we’ll map out the typical maturity phases enterprises go through on the road from basic automation to true autonomy. Understanding these “crawl, walk, run, fly” stages will help you gauge where you are now and how to advance safely.

Ayrıca Şunları da Beğenebilirsiniz

Trump-Backed WLFI Plunges 58% – Buyback Plan Announced to Halt Freefall

Son of filmmaker Rob Reiner charged with homicide for death of his parents