Why is Crypto Crashing Today? Let’s Dive In

TLDR

- Total crypto market cap fell $77 billion to $3.91 trillion in 24 hours

- Bitcoin dropped below $115,000 support, now trading at $114,363

- Ethereum declined 1.6% while Dogecoin plunged 7.1%

- Altcoins followed Bitcoin’s weakness

- Market sentiment remains neutral at 45 on Fear & Greed Index

The cryptocurrency market faced widespread selling pressure on September 22, 2025, with Bitcoin leading a decline that wiped $77 billion from the total market capitalization. The market now sits at $3.91 trillion, down from previous highs.

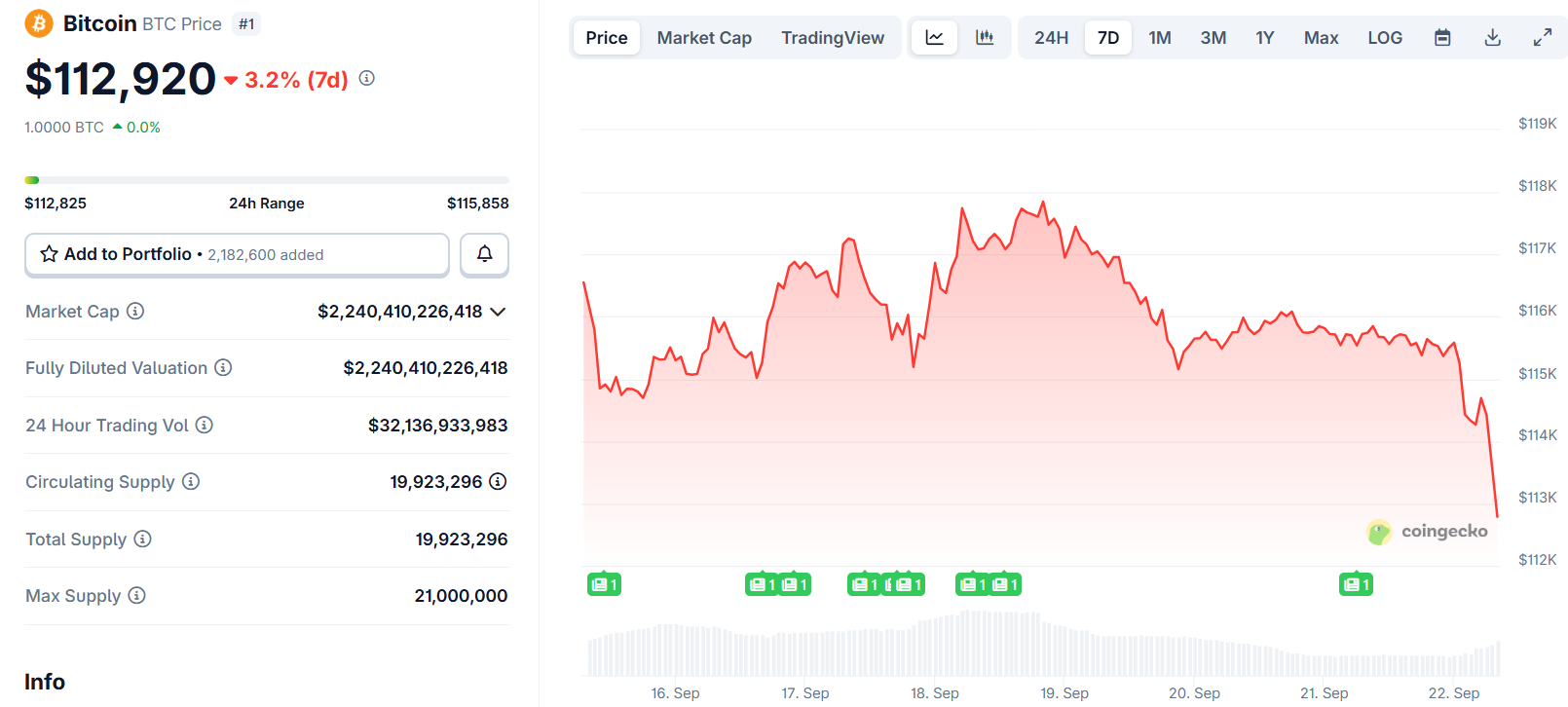

Bitcoin broke below the critical $115,000 support level and is currently trading at $114,363. This represents a 0.6% daily decline from the previous trading session. The breach of this key technical level has raised concerns among traders about further downside potential.

Bitcoin (BTC) Price

Bitcoin (BTC) Price

Ethereum followed Bitcoin’s weakness with a 1.6% drop during the same period. The second-largest cryptocurrency by market cap has been unable to maintain its recent gains as selling pressure spread across the market.

Altcoins experienced even sharper declines, with Dogecoin posting a 7.1% retreat. Solana also joined the selling as traders moved away from higher-risk positions.

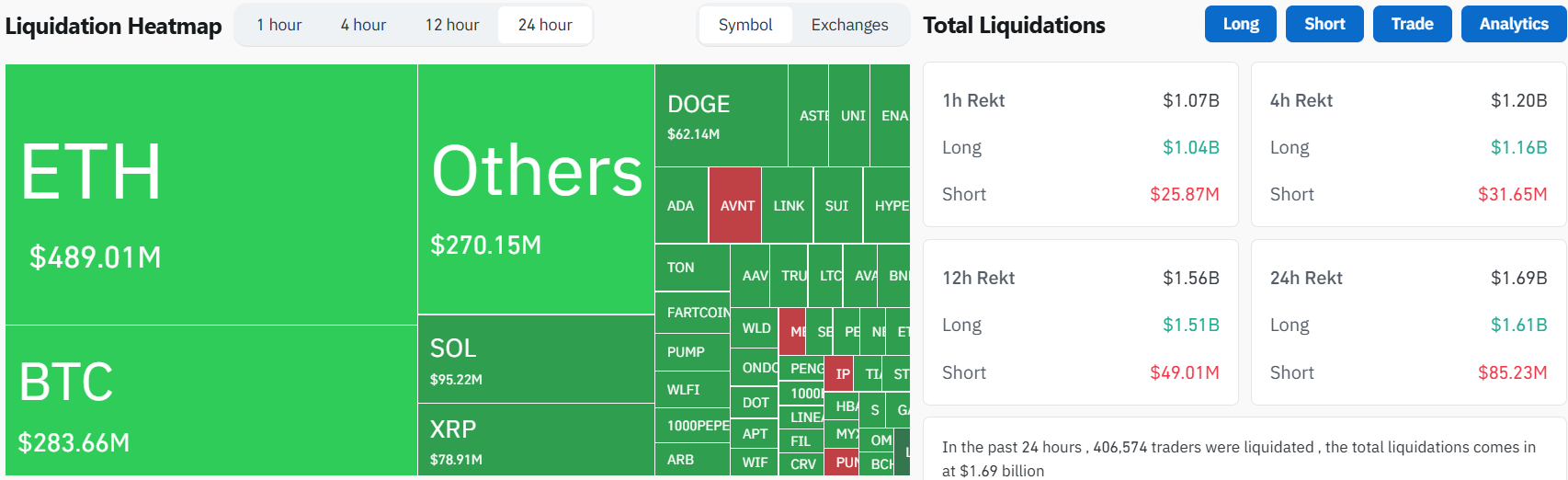

Source: Coinglass

Source: Coinglass

Over the last 24 hours, 406,613 traders have faced liquidations, with the total value reaching $1.70 billion.

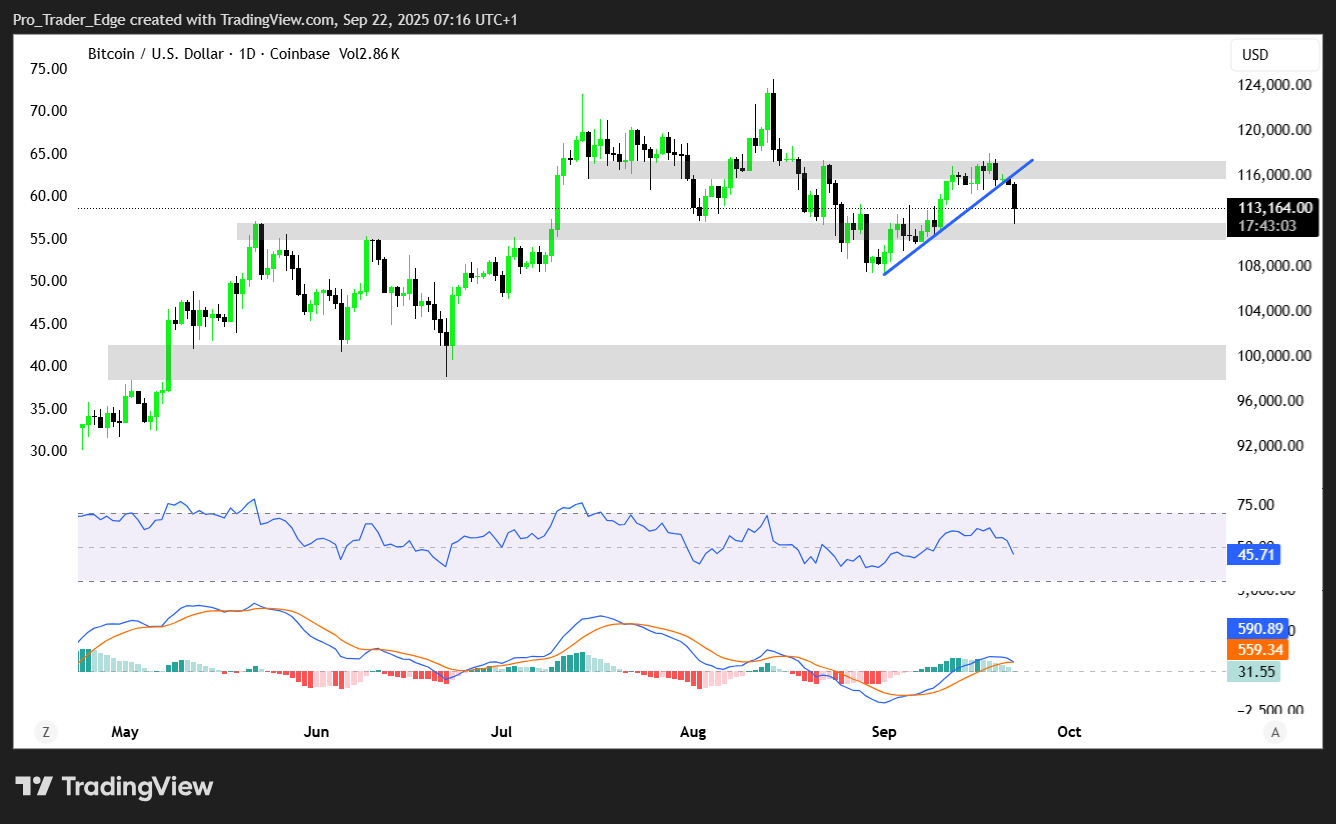

Market Structure Under Pressure

The total crypto market cap now faces a test at the $3.89 trillion support level. Technical analysts suggest this level could determine whether the current weakness extends or finds a floor. A break below this support could lead to further selling pressure.

Source: TradingView

Source: TradingView

Market sentiment indicators show mixed signals, with the Crypto Fear & Greed Index remaining neutral at 45. This reading suggests investors are neither extremely fearful nor greedy, but lack clear directional conviction.

Source: Alternative.me

Source: Alternative.me

U.S. Bitcoin spot ETFs recently saw $163 million in new inflows, providing some positive momentum. However, traders remain cautious about whether these institutional flows can sustain current price levels given the broader market uncertainty.

Technical Levels to Watch

Bitcoin now faces potential support at $112,500 if the current selling continues. A move to this level could push more investor holdings into losses and intensify selling pressure. Recovery attempts would need to reclaim the $115,000 level to stabilize sentiment.

Source: TradingView

Source: TradingView

For the broader market, a bounce from the $3.89 trillion support could target a recovery toward $3.94 trillion. Breaking above this resistance would be needed to attempt a retest of the $4.00 trillion psychological level.

Traditional financial markets have shifted into risk-off mode following last week’s rally in tech and crypto-exposed stocks. Central banks signaling less dovish policy stances heading into the fourth quarter has contributed to reduced appetite for riskier assets.

Regulatory developments continue to provide mixed signals for the market. While some U.S. states like Michigan have advanced pro-crypto legislation, uncertainty remains about whether these moves will generate sustained demand.

Metaplanet expanded its Bitcoin holdings with a $633 million purchase of 5,419 BTC, bringing its total to 25,555 BTC in the most recent corporate adoption news.

The post Why is Crypto Crashing Today? Let’s Dive In appeared first on CoinCentral.

Ayrıca Şunları da Beğenebilirsiniz

American Bitcoin’s $5B Nasdaq Debut Puts Trump-Backed Miner in Crypto Spotlight

Why Scalable Blockchain Infrastructure Is Critical for India’s Web3 Revolution?