XRP News: Evernorth Holdings Moves $280 Million in XRP as Market Stirs

Evernorth Holdings moves $280M in XRP amid market decline, as XRP price slips below $2.20 and prepares for Nasdaq listing.

Evernorth Holdings has recently moved over $280 million in XRP, drawing significant attention within the cryptocurrency community.

The massive transfer involved more than 126 million XRP and has sparked speculation about the reasons behind the move. This comes as XRP’s price is facing downward pressure, slipping below the $2.20 mark.

The crypto market is watching closely as Evernorth prepares for major business developments.

Evernorth Holdings Moves $280 Million in XRP

On November 7, Whale Alert reported a massive transfer of 126,791,448 XRP, valued at around $280.2 million. This transfer took place between two wallets owned by Evernorth Holdings, a Ripple-backed treasury company.

On-chain analysis confirmed that both wallets belong to Evernorth, with the new wallet having been created on November 5.

The exact reason for this large transaction remains unclear. Some speculate it could be an internal transfer or part of a strategic move.

The newly created wallet now holds 126 million XRP, while the original wallet still holds over 261 million XRP. This transfer is the latest move by Evernorth, which recently boosted its holdings with an additional 84 million XRP.

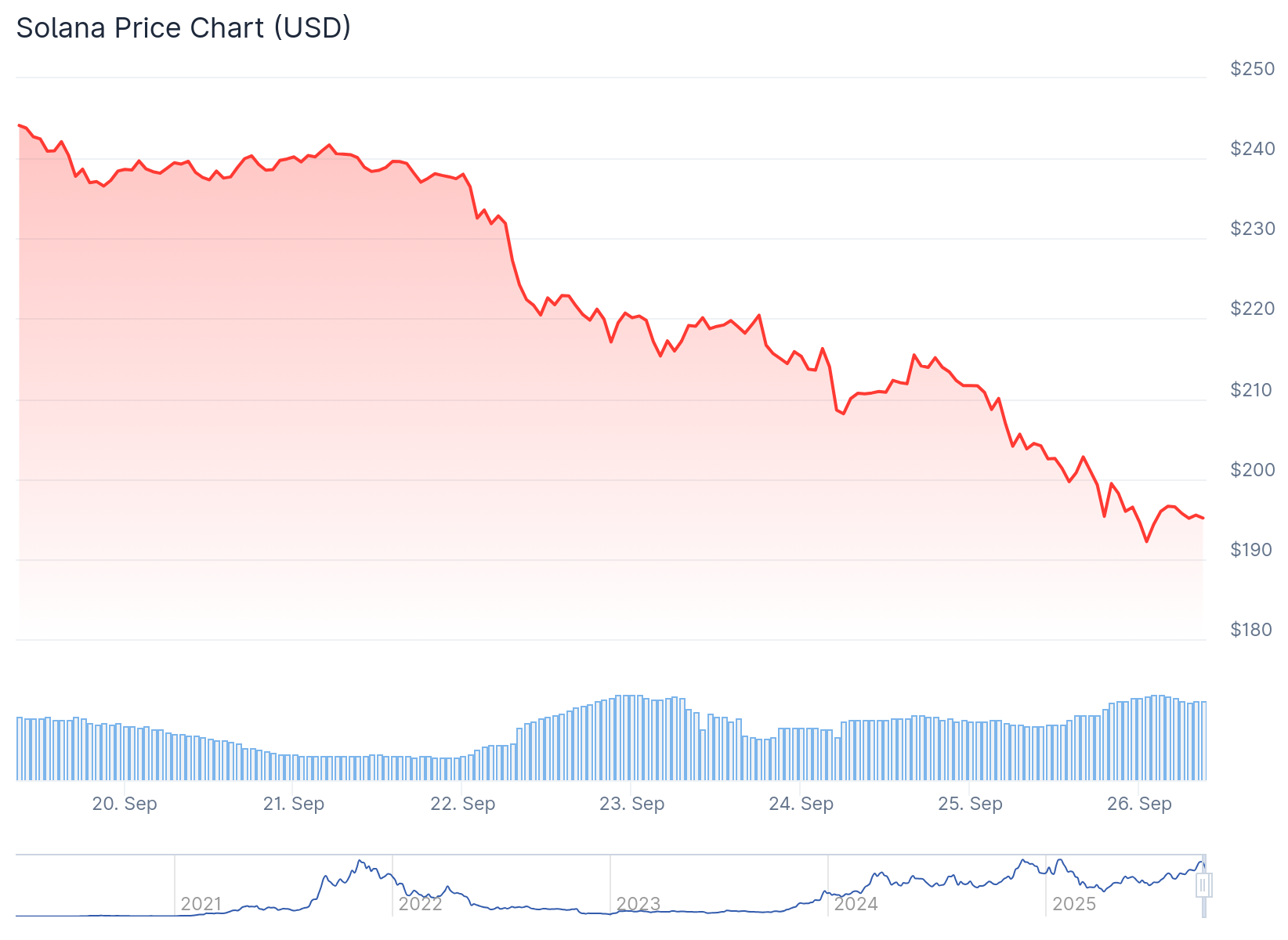

XRP Price Faces Pressure Amid Market Conditions

Despite the large XRP transfer, the cryptocurrency’s price continues to struggle. XRP recently fell more than 4%, dropping below the $2.20 support level.

The price fluctuation comes after Ripple’s efforts to hold the $2.50 mark, which was seen as crucial for market sentiment.

Currently, XRP is trading at around $2.22, with a low of $2.19 and a high of $2.33 in the past 24 hours. Along with the price drop, trading volume has decreased by 12%. This decline in volume and the drop below the 50-week moving average signal weak momentum in the market.

Evernorth Holdings Prepares for Nasdaq Listing

Evernorth Holdings is also in the process of merging with Armada Acquisition Corp II, a move that will bring it to Nasdaq.

As part of the merger, Ripple will contribute 126 million XRP to Evernorth in exchange for shares in the new company. This will make Evernorth the largest XRP treasury once the merger is complete.

The merger has led to a change in Evernorth’s ticker symbol to XRPN, marking a significant shift. Many see the move as a step toward greater institutional legitimacy for Evernorth and XRP.

However, the market remains cautious, as XRP’s price faces continued volatility. Investors are closely monitoring Evernorth’s progress and its potential impact on XRP’s value.

The post XRP News: Evernorth Holdings Moves $280 Million in XRP as Market Stirs appeared first on Live Bitcoin News.

You May Also Like

Crypto News: JPMorgan IBIT Exposure Up 64% as Ethereum Allocation Shrinks

EUR/CHF slides as Euro struggles post-inflation data