The post Vitalik Buterin Warns: Quantum Threat to Ethereum by 2028 appeared first on Coinpedia Fintech News At the Devconnect conference, Vitalik Buterin warned that quantum computers could break Ethereum’s elliptic curve cryptography before the 2028 U.S. presidential election. He urged the Ethereum community to upgrade to quantum-resistant cryptography within four years to safeguard the network. Buterin also advised that innovation should focus on Layer 2 solutions, wallets, and privacy tools, rather …The post Vitalik Buterin Warns: Quantum Threat to Ethereum by 2028 appeared first on Coinpedia Fintech News At the Devconnect conference, Vitalik Buterin warned that quantum computers could break Ethereum’s elliptic curve cryptography before the 2028 U.S. presidential election. He urged the Ethereum community to upgrade to quantum-resistant cryptography within four years to safeguard the network. Buterin also advised that innovation should focus on Layer 2 solutions, wallets, and privacy tools, rather …

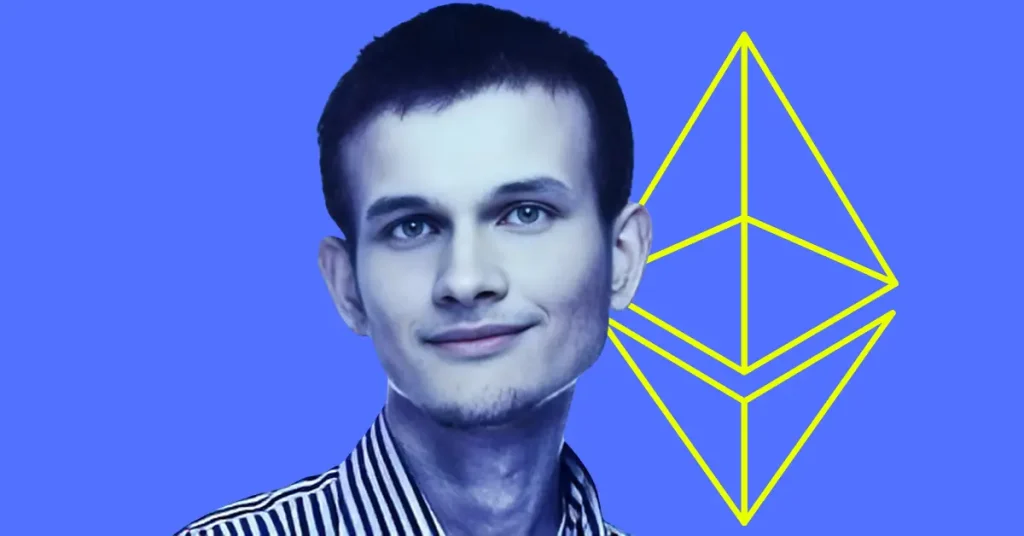

Vitalik Buterin Warns: Quantum Threat to Ethereum by 2028

The post Vitalik Buterin Warns: Quantum Threat to Ethereum by 2028 appeared first on Coinpedia Fintech News

At the Devconnect conference, Vitalik Buterin warned that quantum computers could break Ethereum’s elliptic curve cryptography before the 2028 U.S. presidential election. He urged the Ethereum community to upgrade to quantum-resistant cryptography within four years to safeguard the network. Buterin also advised that innovation should focus on Layer 2 solutions, wallets, and privacy tools, rather than frequent changes to the core protocol. This shift aims to strengthen Ethereum’s security and stability amid growing technological risks.

Disclaimer: The articles reposted on this site are sourced from public platforms and are provided for informational purposes only. They do not necessarily reflect the views of MEXC. All rights remain with the original authors. If you believe any content infringes on third-party rights, please contact service@support.mexc.com for removal. MEXC makes no guarantees regarding the accuracy, completeness, or timeliness of the content and is not responsible for any actions taken based on the information provided. The content does not constitute financial, legal, or other professional advice, nor should it be considered a recommendation or endorsement by MEXC.

You May Also Like

Qfin Holdings Inc – Sponsored ADR (QFIN) Q3 earnings lag estimates

The post Qfin Holdings Inc – Sponsored ADR (QFIN) Q3 earnings lag estimates appeared on BitcoinEthereumNews.com. Qfin Holdings Inc. – Sponsored ADR (QFIN – Free Report) came out with quarterly earnings of $1.52 per share, missing the Zacks Consensus Estimate of $1.68 per share. This compares to earnings of $1.74 per share a year ago. These figures are adjusted for non-recurring items. This quarterly report represents an earnings surprise of -9.52%. A quarter ago, it was expected that this company would post earnings of $1.79 per share when it actually produced earnings of $1.78, delivering a surprise of -0.56%. Over the last four quarters, the company has surpassed consensus EPS estimates two times. Qfin Holdings Inc. – Sponsored ADR, which belongs to the Zacks Financial – Miscellaneous Services industry, posted revenues of $731.25 million for the quarter ended September 2025, surpassing the Zacks Consensus Estimate by 6.86%. This compares to year-ago revenues of $622.74 million. The company has topped consensus revenue estimates four times over the last four quarters. The sustainability of the stock’s immediate price movement based on the recently-released numbers and future earnings expectations will mostly depend on management’s commentary on the earnings call. Qfin Holdings Inc. – Sponsored ADR shares have lost about 42.1% since the beginning of the year versus the S&P 500’s gain of 13.4%. What’s next for Qfin holdings Inc – Sponsored ADR? While Qfin Holdings Inc. – Sponsored ADR has underperformed the market so far this year, the question that comes to investors’ minds is: what’s next for the stock? There are no easy answers to this key question, but one reliable measure that can help investors address this is the company’s earnings outlook. Not only does this include current consensus earnings expectations for the coming quarter(s), but also how these expectations have changed lately. Empirical research shows a strong correlation between near-term stock movements and trends in earnings…

Share

BitcoinEthereumNews2025/11/19 17:18

Stay Ahead in the Crypto Market with This Cutting-Edge App

Navigating the ever-evolving cryptocurrency landscape requires precise tools that provide timely information. A compelling solution to this need is CryptoAppsy, a new application available on both iOS and Android platforms.Continue Reading:Stay Ahead in the Crypto Market with This Cutting-Edge App

Share

Coinstats2025/11/19 16:25

What is actual shelter inflation? – Standard Chartered

The post What is actual shelter inflation? – Standard Chartered appeared on BitcoinEthereumNews.com. Shelter inflation measured by out-of-pocket expenses is likely to have remained elevated. OER likely understates mortgage costs but overstates costs for those without mortgages in recent years. Removing owners without mortgages from the data lowers shelter inflation; but still above shelter CPI, Standard Chartered’s economists Dan Pan and Steve Englander report. Rough time to be a homeowner “US housing affordability remains at historic lows despite CPI shelter inflation easing recently. The CPI measures homeowners’ shelter costs through owners’ equivalent rent (OER), which closely correlates with rent price indices but does not capture homeowners’ actual out-of-pocket costs. Fed Governor Miran has argued that easing rent inflation for properties that are turning over should help contain shelter inflation. While that may be the case for CPI, our findings suggest that out-of-pocket shelter inflation likely remains elevated amid high costs for US homeowners.” “To measure actual out-of-pocket shelter inflation, we create an alternative shelter inflation index by replacing the OER with mortgage costs, i.e., what households actually pay each month out of pocket, while keeping the same relative weights. We find that historically, out-of-pocket shelter inflation has been well below shelter CPI, thanks to low mortgage interest rates and relatively contained housing-price growth. However, the trend reversed after the COVID pandemic, with homeowners’ costs remaining close to historical highs amid high mortgage interest costs and rising house prices during the pandemic.” “Miran has advocated using the BLS new rent index as a better measure of shelter inflation given that all-tenant rent data tends to have significant lags. We do not agree with his assessment, as new rent data only includes the costs faced by tenants signing a new lease, not those who have already locked in a fixed-term lease and face stable rent expenses month-to-month. Even when the CPI all-tenant rent index is…

Share

BitcoinEthereumNews2025/11/19 17:15