Trading time: Gold hits a new high before PCE data comes, OpenAI's new model detonates Ghibli concept

1. Market observation

Keywords: Ghibli, ETH, BTC

Spot gold broke through $3,070/ounce in the Asian session on Friday, setting a new record high, and the year-to-date increase has exceeded 16%. New York gold futures stood at $3,100/ounce. Many investment banks such as Goldman Sachs and JPMorgan Chase have raised their gold target prices. Goldman Sachs believes that the central bank's gold purchase demand and gold ETF fund inflows are the main driving factors. JPMorgan Chase analysts predict that gold may hit the $4,000 mark in the future. At the same time, OpenAI's latest multimodal model GPT-4o has set off a wave of remaking MEME pictures in the style of Hayao Miyazaki's animations on social media. Its excellent image generation capabilities, especially its performance in reproducing the Ghibli style, have driven the rapid increase of $Ghibli tokens.

In terms of market performance, Bitcoin and Ethereum have shown divergent trends. The BTC ETF has seen a steady inflow of $944.9 million since March 14, while the ETH ETF has seen an outflow of $112.1 million during the same period, reflecting a clear divergence in the attitudes of institutional investors towards the two major cryptocurrencies. From the perspective of on-chain data, Glassnode tracking shows that Bitcoin whales have increased their holdings by more than 129,000 BTC since March 11, the largest increase since late August 2024. It is worth noting that QCP Capital analysis pointed out that despite GameStop's plan to raise $1.3 billion for BTC allocation, market sentiment remains sluggish. From a valuation perspective, the cryptocurrency market still has a lot of room for development. Analyst PlanB pointed out that compared with the $20 trillion gold market, the current $2 trillion market value of Bitcoin is significantly undervalued, especially considering that Bitcoin's 120-year scarcity ratio (S2F) far exceeds gold's 60 years. At present, the market forecasting platform Polymarket expects Bitcoin's target price in 2025 to be $138,000, which still has about 60% room to rise from the current price. Market participants believe that BTC needs to hold key price areas to maintain the bull market, including the previous high of $73,800 and the 2021 peak of $69,000. The "Minimum Price Prediction" model created by network economist Timothy Peterson shows that there is a 95% probability that BTC will not fall below $69,000, and the annual average price of $76,000 is also seen as important support.

However, the uncertainty of the macroeconomic environment is bringing new challenges to the market. The annual rate of the core PCE price index in the fourth quarter of the United States remained at 2.8%, the final value of the annualized quarterly rate of GDP exceeded expectations by 2.4%, and the number of unemployment benefit applicants fell to 224,000, indicating that the economic fundamentals are still solid. However, Boston Fed President Collins warned that a new round of tariff measures may inevitably push up inflation levels and suggested maintaining the current interest rate level unchanged. In addition, the potential trade policy adjustments of the Trump administration have also brought new uncertainties to the market, prompting investors to be more cautious in making decisions and pay close attention to policy trends and market changes. The market will pay attention to the US PCE inflation data released tonight to further judge the health of the economy and the direction of the Fed's policy.

2. Key data (as of 13:30 HKT on March 28)

-

Bitcoin: $86,192.01 (-7.91% year-to-date), daily spot volume $23.855 billion

-

Ethereum: $1,924.41 (-42.28% year-to-date), with a daily spot volume of $14.935 billion

-

Fear of corruption index: 44 (neutral)

-

Average GAS: BTC 1.06 sat/vB, ETH 0.38 Gwei

-

Market share: BTC 61.2%, ETH 8.3%

-

Upbit 24-hour trading volume ranking: WAL, XRP, SAFE, ORCA, CARV

-

24-hour BTC long-short ratio: 0.9712

-

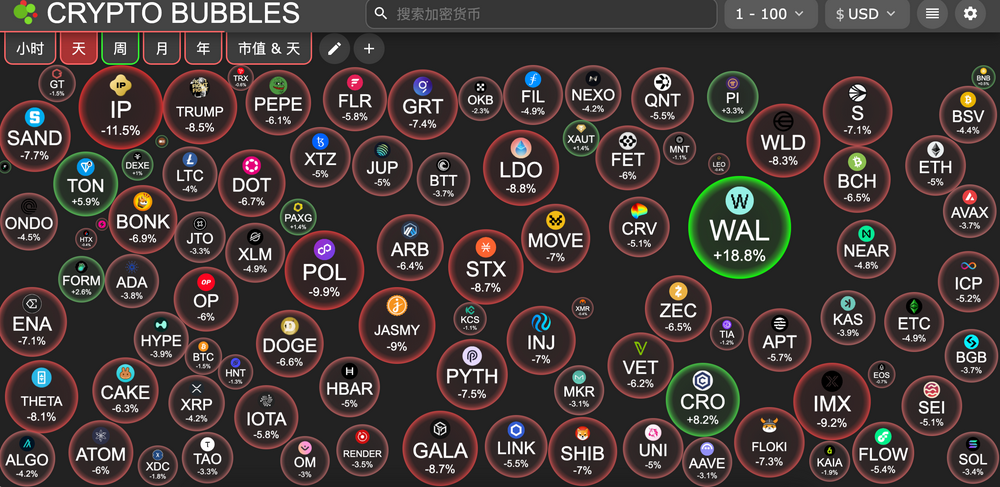

Sector gains and losses: Meme sector fell 6.88%, GameFi sector fell 6.71%

-

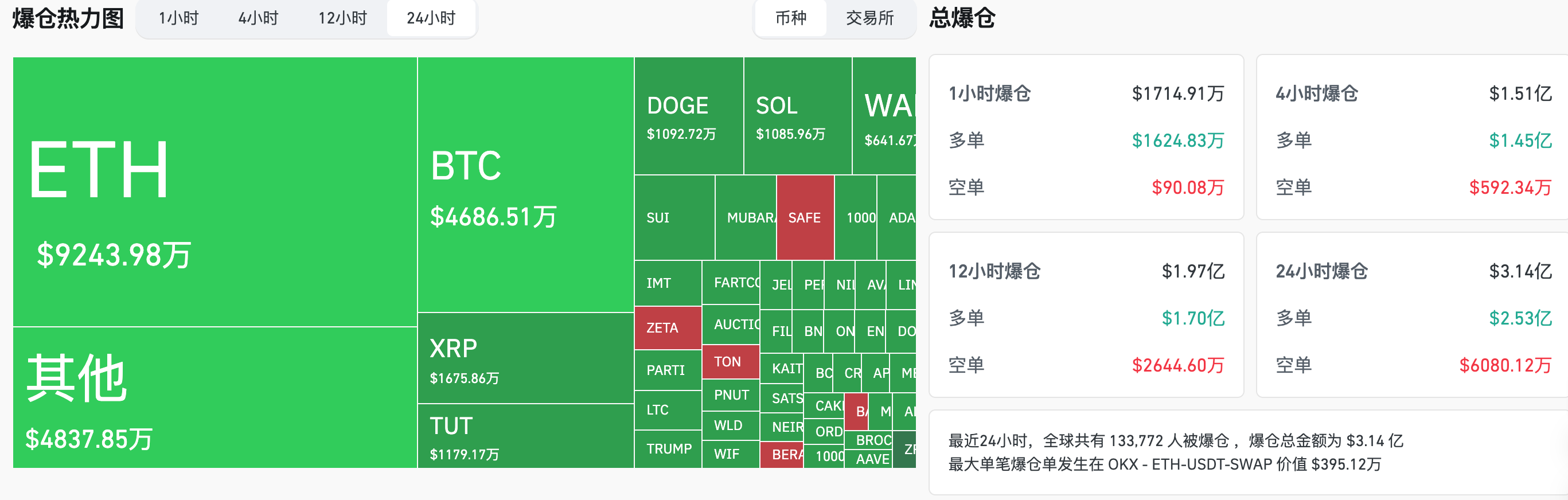

24-hour liquidation data: A total of 133,772 people were liquidated worldwide, with a total liquidation amount of US$314 million, including BTC liquidation of US$46.86 million and ETH liquidation of US$92.43 million

3. ETF flows (as of March 27 EST)

-

Bitcoin ETF: $89,063,800

-

Ethereum ETF: -$4,215,900

4. Today’s Outlook

-

21Shares plans to liquidate two Bitcoin futures and one Ethereum futures around March 28

-

Binance’s first batch of voting tokens has ended, and the “Voting” pool includes 21 tokens

U.S. core PCE price index annual rate in February (March 28, 20:30)

-

Actual: Not announced / Previous: 2.6% / Expected: 2.7%

The biggest gains among the top 500 by market value today: CRO up 7.99%, ORCA up 7.11%, TON up 5.64%, FORM up 2.93%, BERA up 1.73%.

5. Hot News

-

Binance Finance, one-click coin purchase, instant exchange, leverage listings of MUBARAK, BROCCOLI714, TUT, BANANAS31

-

Bithumb will launch ORCA Korean Won trading pair

-

GhibliCZ (Ghibli) and Ghiblification (Ghibli) are now available on Binance Alpha

-

Arthur Hayes: April will be a turning point for the market, and global liquidity will explode again

-

South Carolina drops collateral lawsuit against Coinbase

-

Spot gold hits a new high, reaching $3,060

-

Binance announces the first batch of voting results: Mubarak, CZ'S Dog, Tutorial and Banana For Scale will be listed

-

Ethereum testnet Pectra is tentatively scheduled to be launched on the mainnet on April 30

-

The Ethereum L2 network Corn, which focuses on Bitcoin DeFi, is launched on the airdrop query page

-

Binance Launchpool Lists GUNZ (GUN)

-

KiloEx (KILO) listed on Binance Alpha

-

Glassnode: Bitcoin whales have increased their holdings by more than 129,000 BTC since March 11

-

Incoming SEC Chairman Paul Atkins Owns $6 Million in Crypto-Related Assets

-

QCP Capital: The market generally lacks short-term optimism and upside will remain limited

-

Deribit: Over $14.3 billion of BTC and ETH options will expire in Q1

-

Hurun Global Rich List 2025: Musk retains title of world's richest man, Zhao Changpeng continues to be the richest man in the crypto field with a wealth of 160 billion yuan

-

Upbit to List WAL in KRW, BTC, USDT Markets

You May Also Like

‘Great Progress’: Cardano Founder Shares Update After CLARITY Act Roundtable

Read the full article at coingape.com.

Going For Huma Finance Vanguard On Solana