The Ubiquitous NFL Problem: Comparing Bosonization, Eikonal, and Holographic Techniques

Table of Links

- Prologue

- Diagrammatic(s) Rules

- Straight-forward Eikonal

- Legacy Bosonization

- Wonton Holography

- Holographic Propagators

- Strange Cuprates

- Stranger Things

- Epilogue

Wonton Holography

Compared to what it has been just recently [26], the seemingly endless flurry of holographic publications in JHEP, PRD, and other traditional ’condensed matter oriented’ venues has been steadily coming to a mere trickle. Those few holographic exercises that do occasionally pop out still tend to begin with the mantra ’holography is well known to be an established method for studying strongly correlated systems’. However, this optimistic reassurance often appears to be in a rather stark contrast with the typical summary that sounds more like ’as no unambiguous agreement with experiment was found, the problem is left to future work’.

\ Also, much of the original thrust towards boldly treating an arbitrary condensed matter system of interest as yet another application of some opportunistically chosen weakly-coupled semiclassical gravity has retreated into a ’safer-haven’ topic of hydrodynamics (which, while highlighted and revitalized by holography, can be - and of course had long been - successfully discussed without ever mentioning the latter).

\ On the outside, it may seem as though the heuristic ’holo-hacking’ (a.k.a. ’bottom up’ or ’non-AdS/nonCFT’) approach tends to pick out its favorite gravity-like bulk theory on the basis of such physically compelling reasons as an existence of the previously found classical solutions and normal modes’ spectra, availability of the numerical simulation software, or mere need to engage students with the tangible computational tasks.

\ However, apart from having become a massive and customary practice, there hasn’t been much effort made towards any serious justification of neither the overall holographic scheme, nor its specific ’dictionary’ which was copy-pasted from the original string-theoretical framework. In that regard, it might be worth keeping in mind that just because everyone else on a highway may be driving above the posted speed limit does not by itself make it legal.

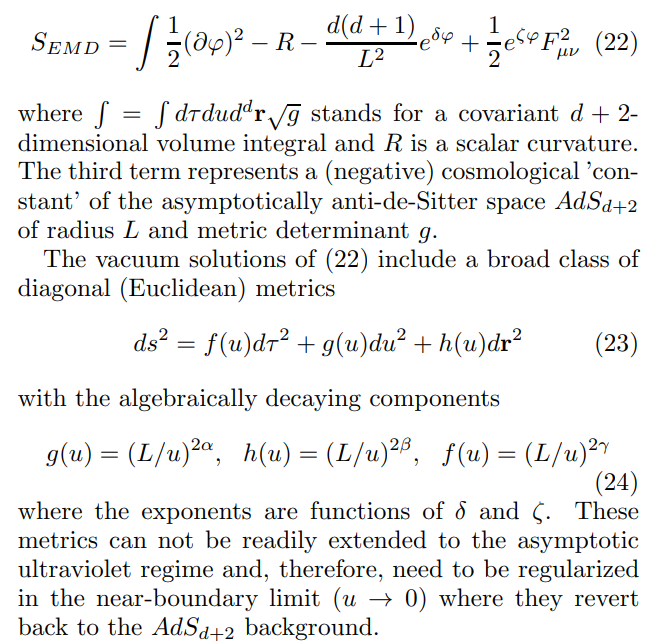

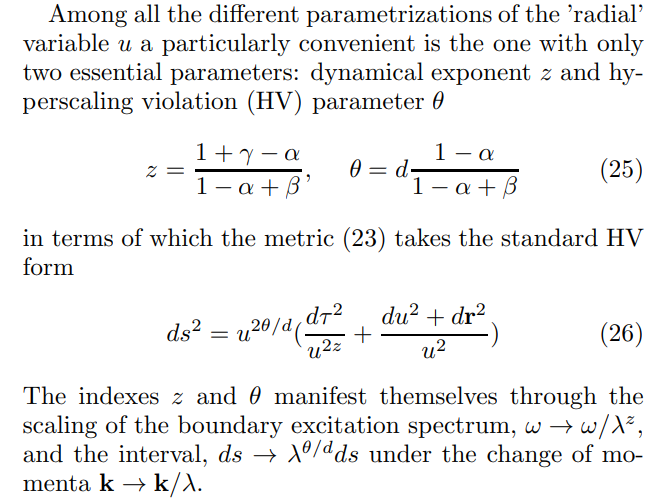

\ In light of the above, comparing holographic propagators to the predictions of other techniques could provide an additional testing ground for, both, the alternate methods as well as the holographic approach itself. the bulk metric, gauge, and scalar (dilaton) fields [26]

\

\

\ Among all the classical solutions of the theory (22) there is a special class of Lifshitz metrics (θ = 0) which were discovered in the semiclassical (ThomasFermi) analysis of matter back-reaction on the metric, as well as in the ’electron star’ scenarios, etc. [27].

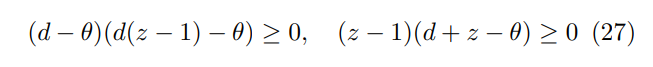

\ More generally, any viable solutions of (22) must obey certain stability (’null energy’) conditions [26]

\

\

:::info Author:

(1) D. V. Khveshchenko, Department of Physics and Astronomy, University of North Carolina, Chapel Hill, NC 27599.

:::

:::info This paper is available on arxiv under CC BY 4.0 DEED license.

:::

\

You May Also Like

Antalpha: Gold RWA is the best paradigm for the digital reconstruction of real-world assets.

Microsoft Corp. $MSFT blue box area offers a buying opportunity