Solana chops at $195: Whales ape Digitap presale ahead of tier-1 listing

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Solana struggles near $195 as whales shift focus to Digitap, a fast-rising fintech crypto presale.

- Solana stalls near $195 as whales pivot to Digitap, fueling a $1.2m presale surge ahead of tier-1 listings.

- Digitap’s crypto-fiat omni-bank bridges DeFi and TradFi, targeting the booming $33.5t global payments market.

- TAP token demand rises with 83.5m sold; 50% profit buybacks aim to boost long-term holder value post-presale.

Over the past couple of weeks, the Solana price action has become choppy as the broader market has turned cautious. Following a plunge to $177, SOL has been trading sideways below the $200 psychological level. As it battles bearish pressure near $195, SOL whales are liquidating their positions and entering the Digitap (TAP) presale.

Crypto whales know the best altcoins to buy when other investors get scared are emerging tokens that are slowly gaining mainstream demand. Digitap could be a perfect match for investors looking to get in early on such a high-potential, low-cap gem.

TAP’s presale is gaining momentum after surpassing $1.2 million in round two as whales rush to capture quick gains before the tier-1 listing price surge.

Solana price outlook: SOL loses steam near $195

Despite the recent launch of the Bitwise Solana Staking ETF (BSOL), the first spot exchange-traded product for SOL in the US, the Solana price remains in a sideways pattern. Following the October 10 crash, SOL entered a triangular consolidation, and the price action has gotten even narrower.

At the time of writing, it is hovering just above the lower trendline of the triangular pattern. Over the past 24 hours, the Solana price has declined 6.58%, currently trading at $186.52.

The momentum indicators are signaling a neutral outlook. The RSI is near 42, indicating stability after the correction, while the MACD is moving sideways.

A slip below the immediate trendline could lead to increased downward momentum, potentially bringing the Solana price to $160 or $145. On the other hand, a decisive breakout from the triangular structure could spark a considerable surge in demand, potentially fueling a rally to $235.

Digitap targets explosive growth in global payments

Digitap is the first of its kind, a crypto–fiat omni-bank designed to combine the speed and freedom of DeFi with the familiarity and reach of TradFi. It enables seamless transactions between crypto and fiat, accessible through a single, secure platform.

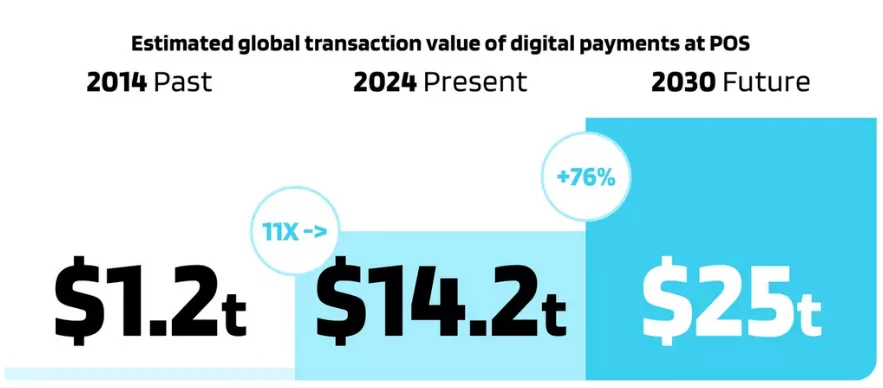

What makes Digitap stand out is that the project is capitalizing on the exponentially growing global payments market. According to Worldpay’s 10th global payments report, digital payment spending has grown nearly eleven-fold from “$1.7 trillion in 2014 to $18.7 trillion globally in 2024”.

They forecast the total value of digital payments to surpass $33.5 trillion by 2030, reflecting a 10% CAGR. The report added that cryptocurrency could define the future of the global payments landscape, as global crypto spending is expected to more than double from $16 billion in 2024 to $38 billion in 2030.”

Digitap offers its users the opportunity to grow along with it and capture this market opportunity through its live presale.

Why TAP tops the best altcoins to buy in 2025?

The native utility token of the Digitap ecosystem, TAP, is essential for almost all platform features, including payments and fees. The token’s value is expected to grow in parallel with the platform’s growth, providing long-term value to holders due to Digitap dedicating 50% of platform profits to buyback and burns.

TAP is currently available at $0.0268 in the second round of the presale. Over 83.5 million tokens have been sold to early investors, and the next round is expected to go live soon. Following the presale, TAP is scheduled for immediate listing on Uniswap and top-tier exchanges.

Why SOL whales are hoarding TAP ahead of tier-1 listing

The Solana price has entered a narrow, decisive range, and investors are closely monitoring its behavior for a potential breakdown or breakout. Due to the possibility of a deeper correction, many SOL whales are shifting capital to the TAP token presale, diversifying their portfolio with its high upside potential.

USE the code “SPOOKY50” for 50% off for first-time purchases.

With the increasing demand for crypto-fiat interoperability, Digitap is expected to grow at a rate faster than the projected 10% CAGR of the digital payments market. With the Digitap presale offering it at an 80.86% discounted price from the $0.14 listing value, TAP is potentially one of the best altcoins to buy in 2025.

To learn more about Digitap, visit its presale, website, and socials.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

You May Also Like

Solana Treasury Firm Forward Industries Launches $1 Billion Buyback, Files SEC Resale Prospectus

Best Cryptocurrency to Invest: With Noomez Presale Underway, Investors Eye Early Access