Crypto News: Bitwise CEO Says Four-Year Crypto Cycle Is Dead

Bitwise CEO Hunter Horsley declares the four-year crypto cycle dead, replaced by a mature market structure driven by Bitcoin ETFs and regulatory shifts.

The crypto market’s long-term fundamentals look promising. This is in spite of the shakeup in October and November. This period left asset prices down. Investor sentiment also crashed. This is according to Hunter Horsley. He is CEO of an investment firm called Bitwise. He is optimistic for the future.

New Market Structure Replaces Bygone Crypto Era

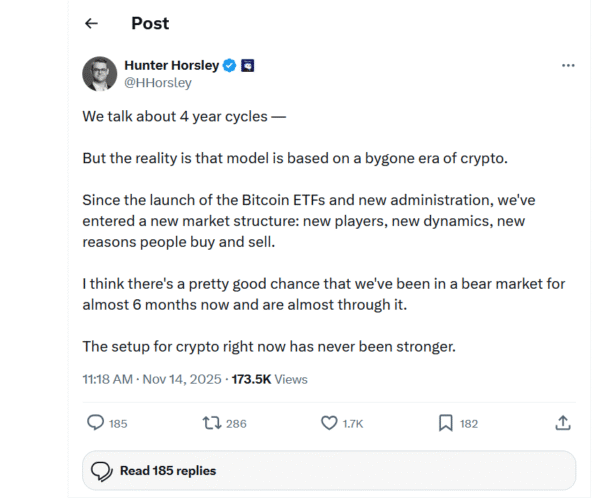

Horsley said the four-year market cycle is dead. It has given way to a more mature market structure more recently. Changed dynamics are due to a pro-crypto regulatory pivot. This pivot is taking place in the US. He wrote about his views in a Friday X post.

“Since the introduction of the Bitcoin ETFs and new administration, we’ve seen a new market structure,” Horsley wrote. He added, “new players, new dynamics, new reasons people buy and sell.” This represents a fundamental change.

Related Reading: BTC News: Harvard Boosts Bitcoin ETF Position by 257% in Latest 13F | Live Bitcoin News

“We talk about 4 year cycles – But the reality is that model is based on a bygone era of crypto.” He stressed the fact that the market has evolved. “Since the launch of the Bitcoin ETFs and new admin, we’ve got a new market structure, new players, new dynamics, new reasons people buy and sell.” He believes that a bear market is ending. “I think there’s a pretty good chance that we’ve been in a bear market for almost 6 months now and are almost through it.” “The set up for crypto right now has never been better.” The Bitcoin price was recently at $94K.

Investor and financial educator, Robert Kiyosaki, attributed the downturn of the crypto market to low liquidity levels. He provided his own viewpoint. Kiyosaki said that the prices of crypto and precious metals will rise. This will occur after the government resorts to printing more money. This money would be used to finance budget deficits.

The four-year cycle was based on a “bygone era of cryptocurrency.” This is according to Horsley. New dynamics, such as the introduction of Bitcoin ETFs, have fundamentally changed the market.

Institutional Adoption and Regulatory Tailwinds Drive New Dynamics

A major new driver is institutional adoption. Growing institutional involvement is now an important aspect. Regulatory clarity is also an important factor. These new players bring with them differences in patterns. Their capital flows are important. This is in contrast to past cycles. Those were driven largely by retail investors.

Source: X

Source: X

The regulatory environment for crypto has changed. According to Horsley, it went from a headwind to a tailwind. This constructive stance is being adopted by regulators. White House and lawmakers also contribute. This makes it easier for investors to get involved. They are now allowed to interact more freely with the asset class. This positive regulatory climate is a game-changer.

Horsley’s thinking points to a more stabilised and predictable market. This is compared to the past. The influence of institutional capital provides a new basis. This renders the crypto market less prone to extreme volatility. It is also less dependent on the vagaries of retail sentiment. This maturity bodes well for long-term growth. It attracts a larger array of investors. This strategic move in the market structure could result in a sustained expansion.

The post Crypto News: Bitwise CEO Says Four-Year Crypto Cycle Is Dead appeared first on Live Bitcoin News.

You May Also Like

Pepeto vs Blockdag Vs Layer Brett Vs Remittix and Little Pepe

'Rich Dad Poor Dad' Author Robert Kiyosaki Says He's Not Offloading Bitcoin Despite Recent Crash: 'Real Reason I'm Not Selling Is…'