BTC & ETH Divergence: How Glassnode Signals Market Shift

The evolving dynamics between Bitcoin and Ethereum highlight a significant shift in the cryptocurrency landscape. As both assets diverge further in their functions and behavior, institutional investors are increasingly shifting their holdings into secure, long-term stores of value while Ethereum gains momentum as a vital platform for DeFi, staking, and blockchain-based applications. This divergence underscores the contrasting roles these leading cryptocurrencies now play within the broader blockchain ecosystem.

- Bitcoin’s dormant supply profile now closely resembles that of gold, indicating its shift toward a digital store of value.

- Ethereum’s long-term holders are actively mobilizing coins three times faster than Bitcoin holders, reflecting utility-driven activity.

- Both Bitcoin and Ether are experiencing outflows from exchanges, flowing into ETFs, institutional custody, and staking platforms, signaling increased institutional adoption.

- Analysts warn of structural risks in Ethereum’s high activity levels, suggesting potential vulnerabilities amid Bitcoin’s growing dominance.

Bitcoin Locks Up, Ether Speeds Up

Recent analyses show that 61% of Bitcoin has remained inactive for over a year, with daily turnover at just 0.61% of free floating supply — one of the lowest velocity profiles among major assets. The report emphasizes that Bitcoin now behaves more like gold, serving primarily as a long-term store of value rather than a medium of exchange.

Active supply age bands for BTC, ETH. Source: GlassnodeConversely, Ethereum’s activity pattern is markedly different. ETH long-term holders are actively moving dormant coins three times faster than Bitcoin investors—an indication that utility, such as staking, DeFi, and institutional wrappers, fuels ETH’s on-chain activity. Its turnover rate hovers around 1.3% daily, more than double Bitcoin’s, and about 25% of ETH is now locked in staking or ETFs, creating a robust productive ecosystem.

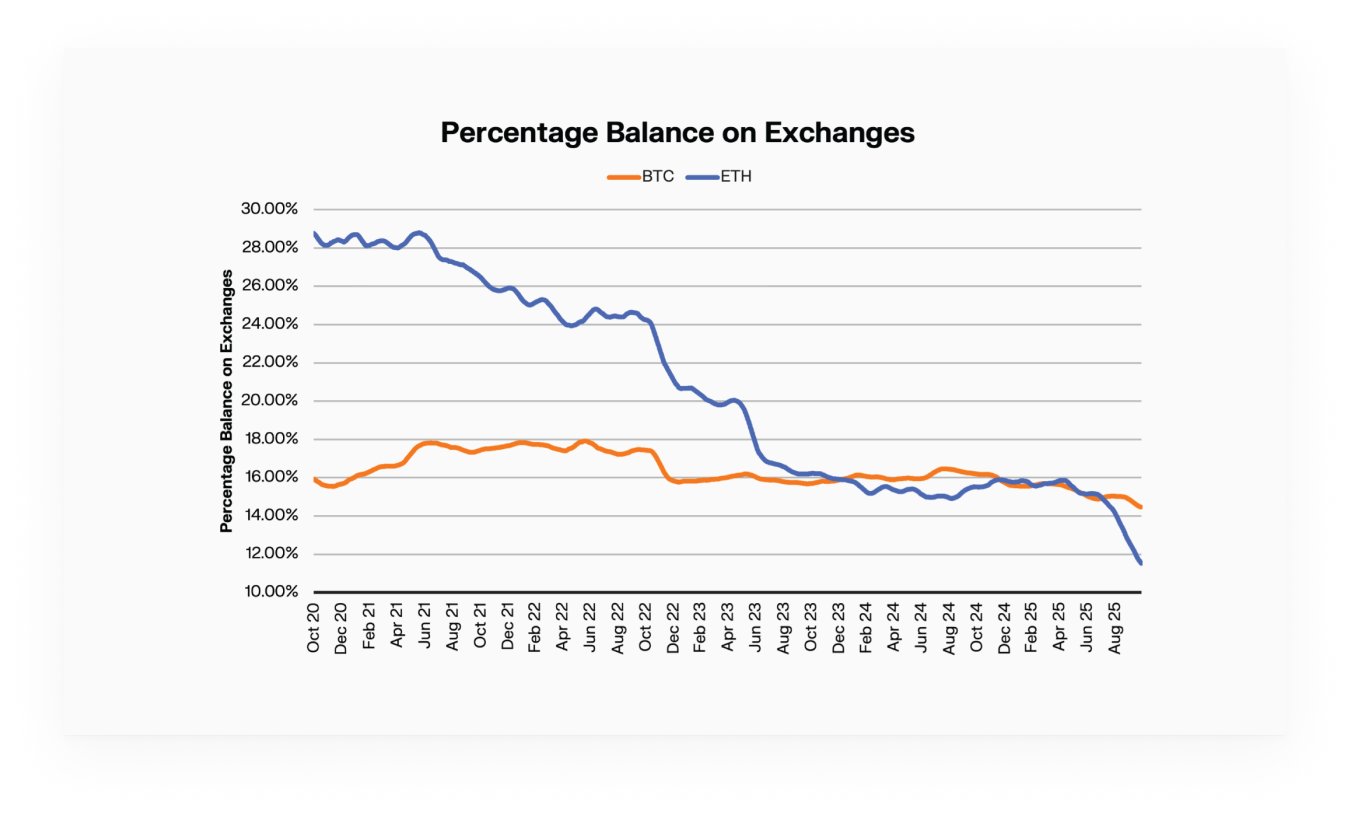

Simultaneously, exchange balances for both assets are decreasing—Bitcoin holdings on exchanges have fallen by 1.5%, while Ethereum’s balances have dropped nearly 18%. This shift signifies growing confidence among investors in custody mechanisms like ETFs and institutional wallets, marking a major structural transition: Bitcoin is evolving into a digital savings bond, whereas Ether is cementing its place as the operational backbone for onchain activity.

Percentage Balance on Exchanges for BTC, ETH. Source: Glassnode

Percentage Balance on Exchanges for BTC, ETH. Source: Glassnode

Analysts Express Caution Over ETH’s Structural Risks

Despite these contrasts, some analysts interpret Ethereum’s heightened activity differently. 10x Research argues that the surge in onchain activity could signal underlying structural fragility rather than strength, especially as Bitcoin continues to dominate the institutional treasury flows.

A recent 10x report suggests that shorting ETH might serve as a hedge against Bitcoin’s increasing institutional momentum. The firm notes that many Ethereum treasury strategies, like those employed by companies such as BitMine, may be nearing saturation. These structures often allow institutions to purchase ETH at low cost and later sell at a premium, a cycle that appears to be breaking down amid shifting market conditions.

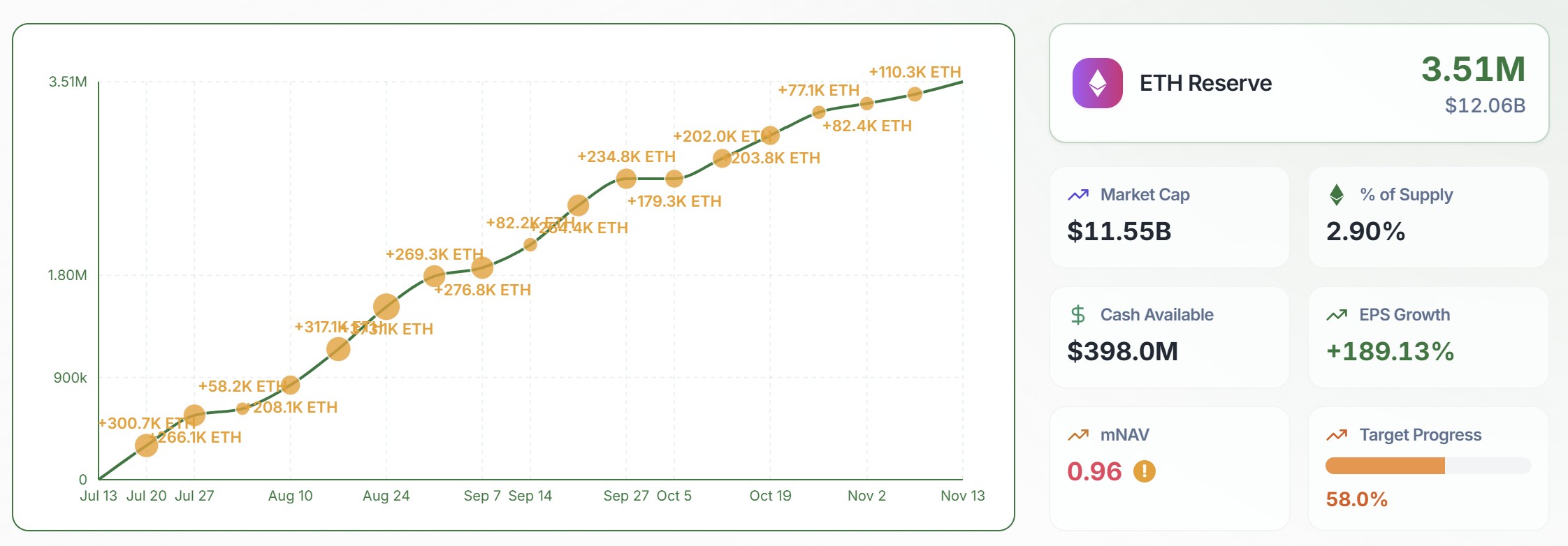

While institutional inflows into ETH reserves have recently stagnated—growing 124% in Q3 but only marginally in Q4—BitMine has continued to add significant ETH holdings, boosting their total to over 3.5 million ETH as of November 10.

Bitmine’s ETH Reserve data. Source: strategicethreserve.xyz

Bitmine’s ETH Reserve data. Source: strategicethreserve.xyz

This divergence in asset behavior emphasizes the ongoing transformation within the crypto markets. Bitcoin maintains its reputation as a low-volatility digital asset, while Ethereum continues to position itself as the operational core of blockchain innovation. Yet, analysts advise caution, suggesting that market fragility and evolving institutional dynamics could influence future trends in these critical crypto assets.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

This article was originally published as BTC & ETH Divergence: How Glassnode Signals Market Shift on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

Experts Debate The Best Beginer Crypto Investment Strategies

As XRP and ETH soar, investors are turning to MSP Miner for $9,250 in daily gains.