Best Crypto to Buy Now as Truth Social Partners with Crypto.com for Web3 Expansion

President Trump’s Truth Social, one of the leading new-age right-wing social media platforms, has pushed its entire weight into crypto by partnering with Crypto.com. With hopes that the prediction market will be disrupted in a major way, eyes are now on whether this could influence people’s decisions when deciding the best crypto to buy now.

This collaboration was made possible through a Crypto.com affiliate and will now allow Truth Social users to bet on the outcomes of multiple real-world events.

Trump’s Unpredictable Move to Tap into the Prediction Market

To say that Trump’s second term as president has been tumultuous and eventful till now would be underplaying the scenario. Trump’s views and news shift within a day, especially during the current geopolitical climate in which the US President is more than happy to weigh in on every political matter.

Due to this, Truth Social’s partnership with Crypto.com now makes sense. However, what is surprising is that the prediction is not about crypto prices specifically but on matters and events that may or may not influence the cryptocurrency market.

For users, this could be an opportunity to keep tabs on the geopolitical background that influences the cryptocurrency market, and it could very well be the first of many efforts by the current government to “democratize information and empower everyday Americans.”

However, this could also be considered an insidious move by the current ruling party to tap into the thought process of people to make investment decisions that could go against them.

This skepticism is legitimate, especially since the shorting event before the Bitcoin price almost broke into the 5-digit zone after the US President imposed tariffs on China.

What Impact Can This Partnership Have on the Market?

While, in hindsight, the partnership looks like another move by Trump-led media to push into the crypto narrative, considering that the endgame is to let every user bet on political, sports, and market events, the impact is far-reaching.

People can bet on whether a particular political party wins or whether a particular bill gets passed. That decision may or may not influence the cryptocurrency market directly. Indirect impact, however, will likely be felt across every corner of the crypto front.

The impact, for now, is not evident since the news has just broken out. Bitcoin is currently trading above the $112K level, and there has been little to no change in the price since yesterday. In the long term, however, it would benefit investors to keep an eye on the markets that appear on Truth Social since that can lead them to the best crypto to buy now.

Best Crypto to Buy Now

Considering that the prediction game could change with the Truth Social and Crypto.com partnership, investors wanting to stay in the green should focus on assets that are currently available on presale. The following picks are optimal.

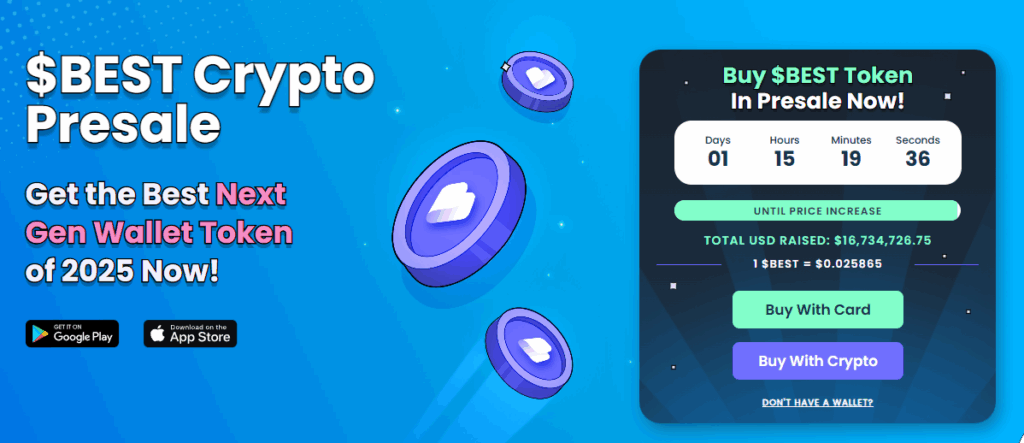

Best Wallet Token

Best Wallet, powered by Best Wallet Token, is fast becoming one of the most advanced ecosystems in the crypto space. The platform is reportedly working toward offering market insight and analytical tools that could rival the prediction market formed through the partnership between Truth Social and Crypto.com. These new additions could help investors identify smarter opportunities and make better trading decisions.

Best Wallet already functions as a decentralized hub that allows users to trade, stake, and participate in early-stage crypto projects through its Token Launchpad. The launchpad gives investors a first-mover advantage by granting access to promising projects before they reach major exchanges. Alongside this, the platform provides staking for passive rewards, seamless token swaps, and decentralized governance options that ensure users remain actively involved in its evolution.

At the center of it all lies the Best Wallet Token, which powers every major feature within the ecosystem. It offers benefits such as reduced fees, boosted staking yields, exclusive project access, and community governance rights that shape future updates. Its utility makes it essential to the functioning of the entire Best Wallet framework.

Currently in its ICO phase, Best Wallet Token has already raised over 16.7 million dollars. With innovative features and upcoming analytical tools designed to help users navigate the market more intelligently, Best Wallet Token provides a strong alternative for those looking to circumvent the speculative side of crypto investing.

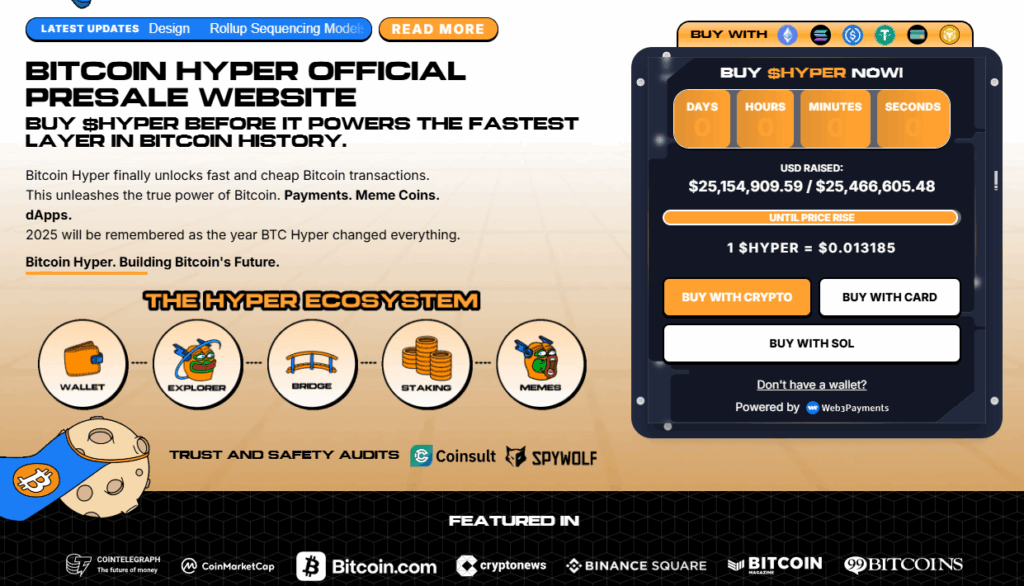

Bitcoin Hyper

Bitcoin Hyper has raised over $25.1 million so far, making it one of the most successful presale projects currently available. Its rapid growth reflects how strongly investors believe in its mission to transform the Bitcoin narrative from that of a purely speculative asset to one built around practical utility and real-world functionality.

The project focuses on building a fully operational Layer 2 ecosystem that enhances Bitcoin’s scalability, efficiency, and usability. It supports decentralized applications, cross-chain payments, staking, and bridging between major networks, all while maintaining Bitcoin’s security and decentralization principles. These use cases aim to unlock the next evolution of Bitcoin, one that goes beyond holding and trading to real utility across multiple sectors.

From a technological standpoint, Bitcoin Hyper incorporates a sophisticated execution layer and modular architecture designed to optimize developer workflow and improve transaction throughput. This framework allows developers to create high-performance dApps that integrate seamlessly with existing blockchains, positioning Bitcoin Hyper as a foundation for innovation.

Visually, the project blends traditional Bitcoin symbolism with modern meme-inspired design, giving it strong appeal among degen traders who thrive on projects with both purpose and personality. This dynamic imagery not only differentiates Bitcoin Hyper from other Layer 2 ventures but also gives it short-term upside by attracting a wider, more diverse audience.

Analysts have praised Bitcoin Hyper for its dual identity: a project inspired by Bitcoin’s core philosophy but not marketed as a direct alternative. Instead, it builds upon the foundation laid by the original while evolving it for a more functional, community-driven future.

Pepenode

Pepenode has raised close to $2 million so far, and with more than 10K being added on average, this milestone is expected to be surpassed very soon. The project takes a refreshing approach to mining, turning it into a gamified experience that removes the need for expensive hardware and technical knowledge.

Through Pepenode, users can create and upgrade virtual mining rigs using Meme Nodes purchased with PEPENODE tokens. These rigs simulate mining activity for meme coins such as Pepe and Fartcoin, combining gaming mechanics with a lighthearted take on DeFi. This approach keeps mining engaging, accessible, and profitable in a way that traditional setups no longer can.

One of Pepenode’s unique features is its airdrop system, which transforms its virtual mining process into an airdrop engine. As users “mine” within the simulation, they can earn bonuses in the form of different meme coins, adding extra excitement and tangible value to gameplay.

Presale investors are also given added incentives. Those who buy early can upgrade their virtual mining facilities to generate higher returns, and those who invest now receive a 20 percent bonus in Pepe tokens. These mechanics help drive both short-term engagement and long-term participation.

By building a multi–meme coin ecosystem with interconnected rewards, Pepenode offers something rare in the current market, an entertaining yet functional platform. Once it goes live, its success could be heavily influenced by prediction market activity, making it a suitable choice for degen investors seeking creative, high-potential assets.

Conclusion

The best crypto to buy now, at this instant, may not be found among high-cap cryptos but low-cap ICOs. This is important since the arrival of a new form of prediction market on Truth Social has altered the game in the long term. Expect the market to be more volatile, which means ICOs could be considered a safer bet at the moment.

This article has been provided by one of our commercial partners and does not reflect Cryptonomist’s opinion. Please be aware our commercial partners may use affiliate programs to generate revenues through the links on this article.

You May Also Like

‘Great Progress’: Cardano Founder Shares Update After CLARITY Act Roundtable

Read the full article at coingape.com.

Going For Huma Finance Vanguard On Solana