Apertum Coin ($APTM) Rockets Into CoinMarketCap’s Top 3 Trending Cryptos — Crypto of the Day

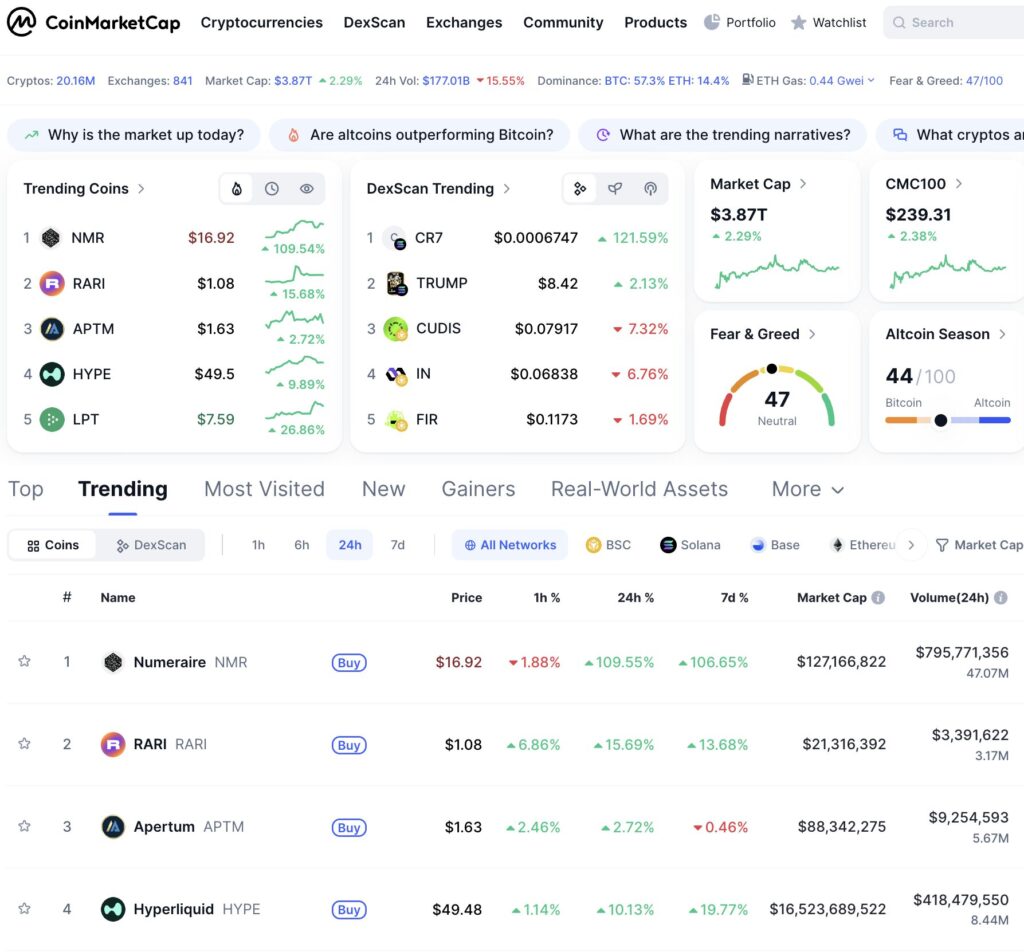

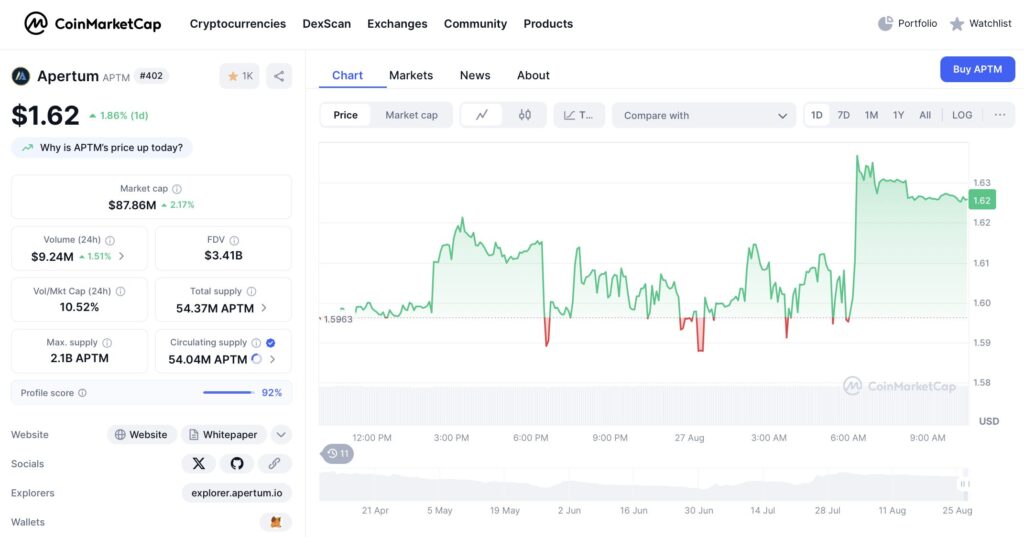

On August 27, Apertum Coin ($APTM) was recognized as Crypto of the Day on CoinMarketCap and secured the #3 position among trending cryptocurrencies worldwide. This milestone coincided with an important DAO Community strategic call, where Apertum’s leadership and community members discussed the future of the Apertum Ecosystem.

Apertum Coin ($aptm) Rockets Into Coinmarketcap’s Top 3 Trending Cryptos — Crypto Of The Day

Apertum Coin ($aptm) Rockets Into Coinmarketcap’s Top 3 Trending Cryptos — Crypto Of The Day

CoinMarketCap, the leading global crypto data platform with over 340 million monthly visitors and thousands of coins, highlighted Apertum. Just yesterday, $APTM experienced a remarkable leap in the global rankings, moving from #840 to #400, reaching a market capitalization of over $88 million. The very next day, it rose to the Top 3 Trending Coins, showcasing the growing momentum around the project.

Apertum Coin ($aptm) Rockets Into Coinmarketcap’s Top 3 Trending Cryptos — Crypto Of The Day

Apertum Coin ($aptm) Rockets Into Coinmarketcap’s Top 3 Trending Cryptos — Crypto Of The Day

Apertum is a leading Layer-1 blockchain in the Avalanche ecosystem, designed for scalability, operational efficiency, and full EVM compatibility, supporting thousands of transactions per second with rapid finality. With DAO-based governance, deflationary tokenomics, and seamless smart contract integration, Apertum is positioning itself as a driving force in the decentralized economy.

The project’s impressive growth strategy is only the beginning. With new partnerships, market expansions, and ecosystem developments on the horizon, Apertum is rapidly emerging as one of the most promising blockchain projects to watch in 2025

This article was originally published as Apertum Coin ($APTM) Rockets Into CoinMarketCap’s Top 3 Trending Cryptos — Crypto of the Day on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

Crypto Market Cap Edges Up 2% as Bitcoin Approaches $118K After Fed Rate Trim

The address "1011short" deposited 20 million USDC into HyperLiquid to continue its long position in BTC and ETH.