Best Crypto to Buy as Congress Meets with Crypto Leaders

Today, they’re meeting with top crypto executives like Strategy’s Michael Saylor and Fundstrat’s Tom Lee to figure out how to make President Donald Trump’s vision a reality. The main goal? Push the BITCOIN Act through Congress.

This bill calls for the government to buy 1M Bitcoin over the next five years, creating a strategic reserve just like the nation’s gold holdings.

Finding a Taxpayer-Friendly Way to Pay for It

There is, however, a catch to the plan – the purchases must be budget-neutral, meaning no new taxes to pay for them. The meeting, hosted by advocacy groups like The Digital Chamber, brings together leaders from Bitcoin mining, venture capital, and traditional finance.

Source: X/@TheDigitalChamber

So, how do you buy a million $BTC without hitting taxpayers? The industry leaders are pitching ideas like reevaluating the value of the Treasury’s gold certificates or using tariff revenue to finance the purchases.

By understanding these roadblocks, they can work to build a stronger coalition and refine the legislation to get it across the finish line. The partnership between the government and private sector shows the US is considering Bitcoin as a strategic national asset.

Whilst the government ponders its options, it’s time to consider which are the best crypto to buy. Projects like Bitcoin Hyper ($HYPER), offering enhancements, Snorter Token ($SNORT), giving you a trading edge, and SpacePay ($SPY), allowing us to pay with our crypto, are some of the hottest tickets to consider adding to your asset portfolio.

Bitcoin Hyper ($HYPER): Unleashing Bitcoin’s Hidden Power

Bitcoin is king, no one is questioning that. But it’s not exactly a king that’s spritely, as it’s failed to keep up with modern-day demands. That’s where Bitcoin Hyper ($HYPER) steps in. It’s basically a turbocharger for the Bitcoin network.

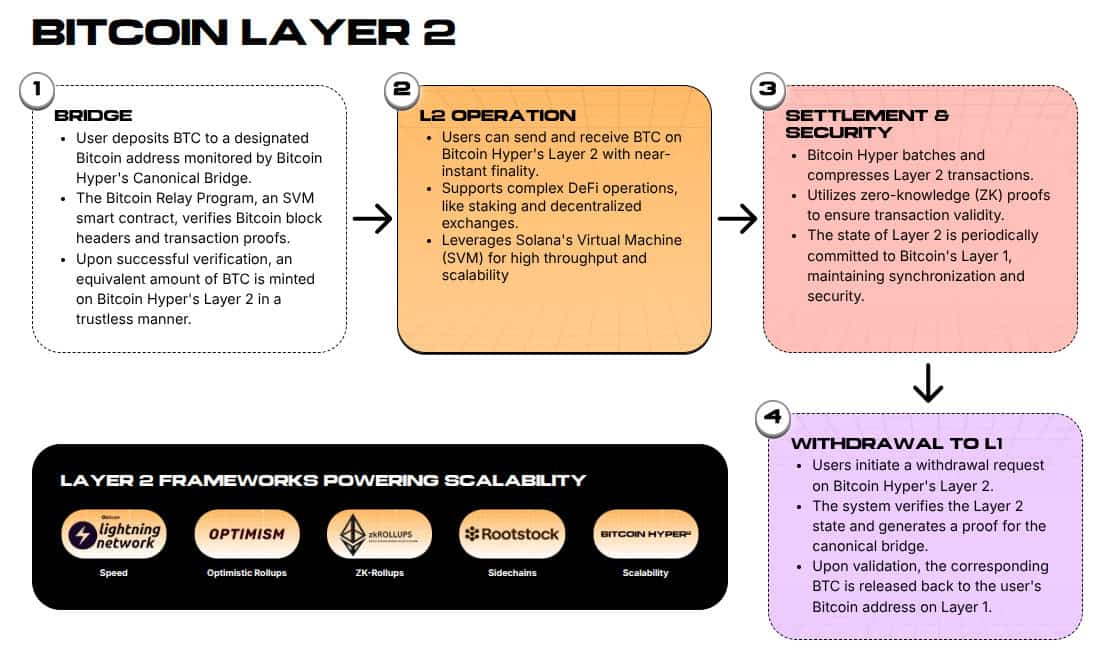

It’s a game-changing Layer-2 upgrade built right on top of Bitcoin. Using the Solana Virtual Machine, Bitcoin Hyper makes Bitcoin transactions lightning-fast and super cheap.

How exactly? It creates a 1:1 wrapped version of your Bitcoin and transfers it to the Layer-2 via a Canonical Bridge to process multiple smaller transactions, freeing up the original layer for the larger, bulkier purchases.

This unlocks a whole new world for Bitcoin, from crazy-fast payments to cool new decentralized apps and NFTs. The power and speed will give developers the chance to make Bitcoin shine and be the true powerhouse it can be.

The presale has also attracted considerable whale attention. Last month alone saw two standout whale buys in particular – $161.3K and $100.6K.

After analyzing this project in detail, we reckon it has great potential. Take a look at our Bitcoin Hyper ($HYPER) Price Prediction to find out why we believe $HYPER could scale to the dizzying heights of $0.20 by the end of 2025, which would net you an impressive 1447% ROI if you invested today.

Ready to join what is gearing up to be one of the best presales of the year? Buy your Bitcoin Hyper ($HYPER) today.

Snorter Token ($SNORT): Your Secret Weapon in the Meme Coin Jungle

Ever felt like you’re a step behind the meme coin craze? Snorter Token ($SNORT) is your solution. It’s the key to the impressively powerful Snorter Bot, a powerful crypto trading bot you can use right on Telegram.

This bot is your personal scout, helping you find hot new projects and sniping them as soon as they go on presale, giving you an edge over the competition. More importantly, it also helps you avoid scams. It can detect honeypots and rug pulls before they happen, giving you peace of mind in the crazy crypto world.

As a token holder, you also get access to copy trading, meaning you can learn from the best and potentially see better returns. Another perk is the reduced trading fees (just 0.85%, compared to the standard 1.5%).

Snorter Token is currently on the Solana network but it has big plans to expand to Ethereum and beyond. This would open the door to a larger user base, and it taps into the increased liquidity and security on offer from other blockchains. It also gives you a seamless way to trade across blockchains from one convenient place.

$SNORT is also currently on presale and, as it nears the $4M milestone, it’s seeing significant investor interest. You can buy Snorter Token today for $0.1045 and earn passive rewards by staking it for 118% APY.

$SNORT is an ideal blend of meme culture and real-world utility, and it’s that utility that makes us believe $SNORT has the potential to reach $1.07 by the end of 2025. If you locked in today, that’s a return of 923%.

Remember, though, presale prices goes up in stages, whilst the APY decreases as more investors stake their $SNORT. So we suggest that you buy your $SNORT today before tomorrow’s price increase.

SpacePay ($SPY): Simplifying Crypto Payments

Crypto is exciting, the buzz around it is real, and major players are seeing its value as an asset. Yet it can still be a pain if you want to use it to buy something. SpacePay ($SPY) plans to fix that.

It’s not a futuristic dream; it’s a working solution that enables businesses accept crypto payments using the same card machines they already have.

This means no new equipment or training costs. The best part is that the company gets paid instantly in their local currency, so they don’t have to worry about the volatility of crypto prices.

And by holding $SPY, you get to vote in the project’s future, earn monthly rewards, and even get a piece of the platform’s revenue.

The SpacePay presale has raised $1.3M so far, and 1 $SPY currently costs $0.003181. As always, be sure to do your own research and check out the SpacePay ($SPY) whitepaper before you buy $SPY through its presale website.

You May Also Like

Aave V4 roadmap signals end of multichain sprawl

Wormhole Token Surges After Tokenomics Reset and W Reserve Launch