Coinbase Plans Native Token for Base L2, Similar to Bitcoin Hyper

At BaseCamp 2025, Base creator Jesse Pollak announced a reversal of Coinbase’s earlier stance against launching a native token. As Base enters its next phase, the token could become a key tool in aligning creator and developer growth.

The news has fueled a buying frenzy around the Bitcoin Hyper ($HYPER) presale, a new crypto project with a similar concept. It has already crossed $16M and counting.

Like the new Base token would fuel the Base layer-2 (L2), $HYPER fuels the Bitcoin Hyper network, the upcoming L2 solution for Bitcoin.

Base’s Native Token U-Turn Explained

Coinbase’s Ethereum L2 network, Base, is known for its creator-first energy.

For a long time, the project didn’t explore the idea of a native token, and understandably so, as tokens could take attention away from building infrastructure in a hurry to absorb value. And this value is often rooted in speculation more than any utility.

But the time has come for Base to launch a new token, as it has achieved sub-second, sub-cent transactions already. This will mark a crucial step in Base’s transition from a Stage-1 to a Stage-2 rollup, and from partial to complete decentralization.

How, exactly? Token rewards are a smart way to bring in more creators and developers around a common goal, encouraging long-term participation.

Jesse Pollak reveals plans for a Base native token at BaseCamp 2025; Source: X

The details of the token launch have yet to be finalized, however. As always, Base will tune into community feedback before making any decisions.

Since Base doesn’t have a native token yet, the news has turned attention to another project delivering on a similar front – Bitcoin Hyper.

The viral project is building an L2 solution for Bitcoin, using Solana’s Virtual Machine to make the L1 faster and fully programmable. The best part is, early backers can get in on the action right now with Bitcoin Hyper’s native crypto $HYPER.

$16M Raised: Why Bitcoin Hyper is the Latest Crypto Sensation

Blue-chip cryptos like Bitcoin and Ethereum are must-haves in a crypto portfolio. But if you hope to make exponential returns from them any time soon, you are bound to be disappointed.

While top cryptos have plenty of potential left, they’re past the rapid growth you see in early-stage projects.

This explains the growing traffic to the Bitcoin Hyper ($HYPER) token presale, which builds on Bitcoin’s brand value by bringing more speed and activity to the network.

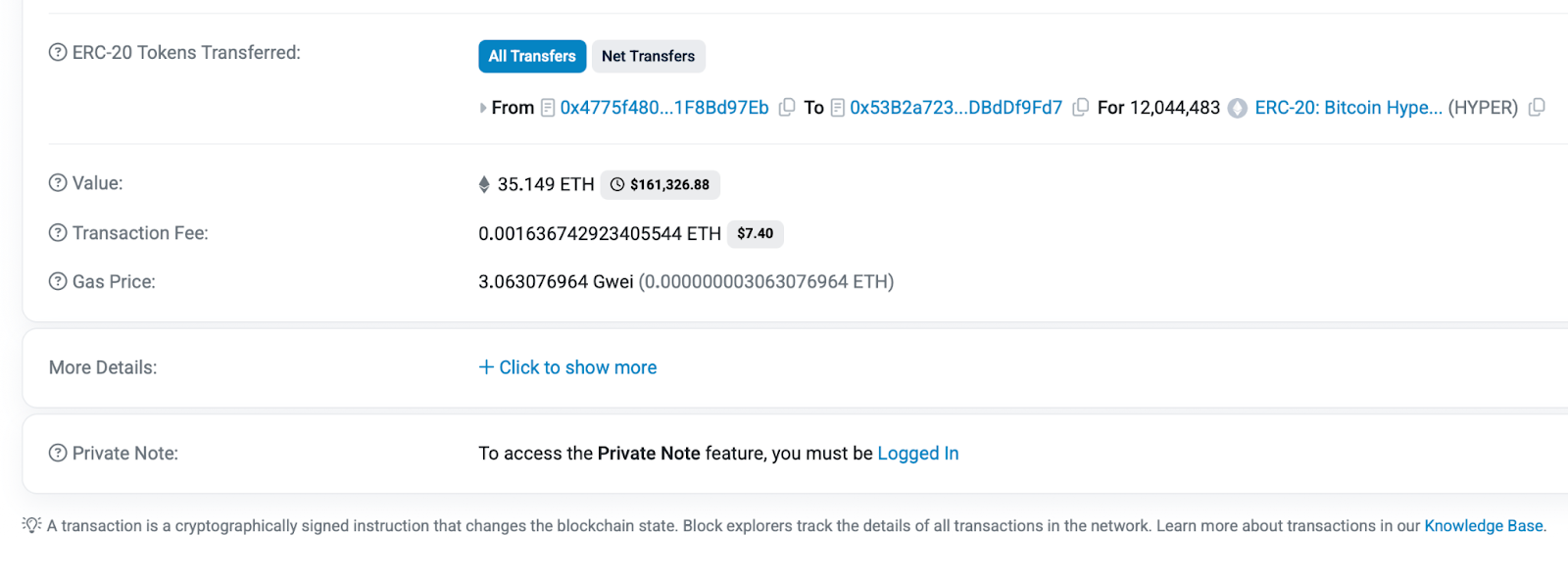

With promising utility, ongoing retail support, and the rapid price spike potential only low cap projects can give, this presale has gone on to attract even whale buyers looking for an upside. The biggest purchase to date was a whopping $161K+.

Source: Etherscan

Two core technologies form the backbone of the project:

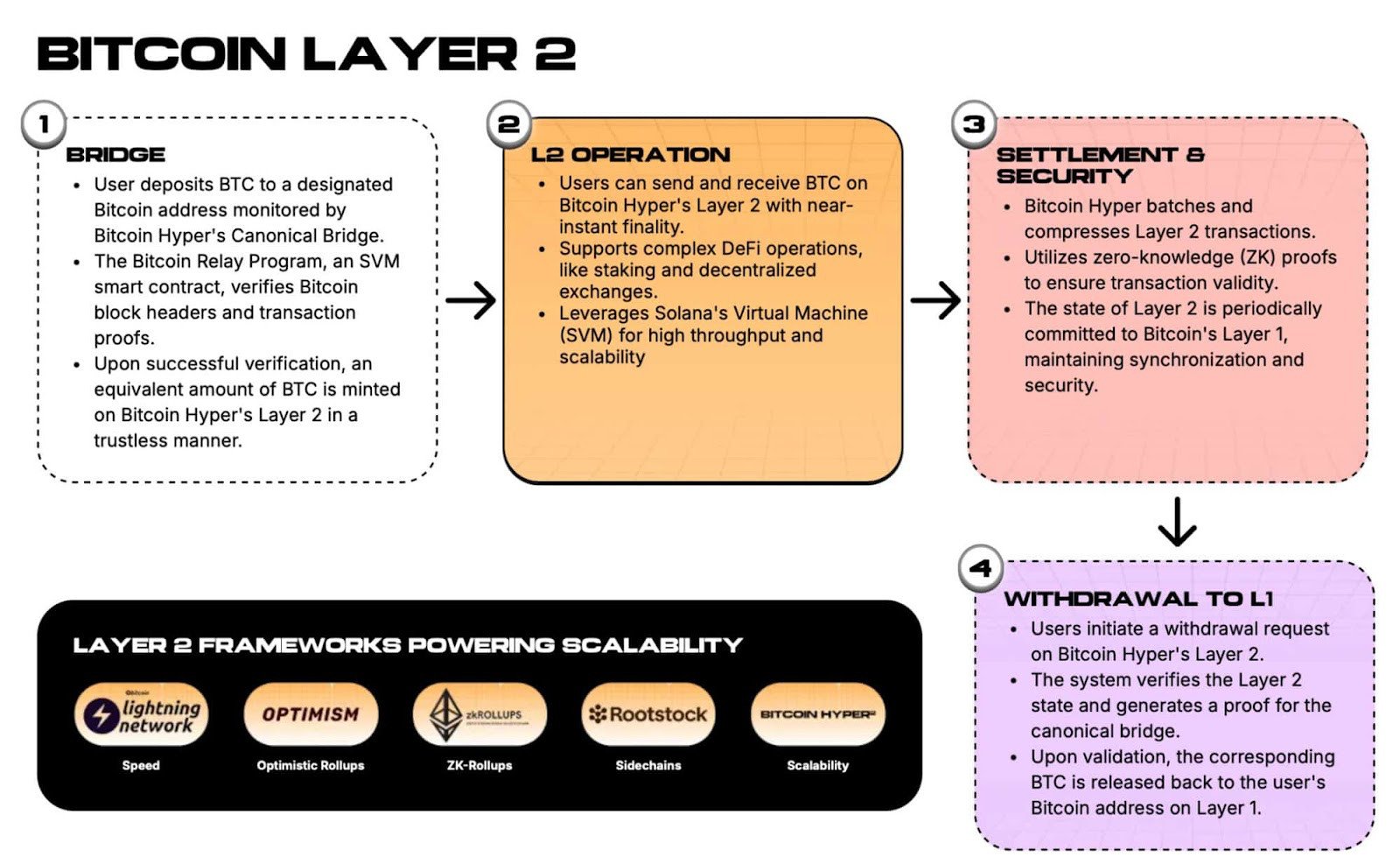

The first is the decentralized, noncustodial Canonical Bridge, which connects Bitcoin’s L1 with the Hyper L2. Through it, users can lock $BTC on the primary layer in exchange for an equal amount of wrapped $BTC on the new network.

Unlike the original $BTC, the wrapped version is compatible with Web3 apps, DeFi, games, and NFTs. And, it can be withdrawn at any time and converted back into native $BTC on the Bitcoin chain.

The second is the SVM. It brings Solana-level performance to Bitcoin and helps build a programmable layer for it – all while preserving the L1’s security.

Developers who are already familiar with the Solana framework will find it easy to build apps on Bitcoin Hyper’s network. This ease of use opens up the Bitcoin blockchain for Web3 innovation.

Join the $HYPER presale for $0.012925 before the listing.

Tech Progress Instill Confidence in Early Backers – Presale Frenzy Continues

Bitcoin Hyper’s regular product updates prove it’s not another crypto project making grand promises only to disappoint after the TGE.

The project is steadily advancing along its roadmap. For example, the latest update confirms that the team has completed:

- Core research into rollup settlement models compatible with Bitcoin L1.

- Early prototypes validating SVM execution inside the rollup.

- Exploratory designs for developer-facing infrastructure: explorer, console, and dev tooling.

- Alignment with ecosystem teams interested in building on Hyper once devnet access broadens.

Bitcoin Hyper has also undergone extensive smart contract audits by Coinsult and SolidProof, further reassuring early backers.

But to buy $HYPER cheaply and unlock 70% APY, investors need to hurry. The staking rewards drops as more investors lock their tokens, and the next price surge is only hours away.

You May Also Like

Aave V4 roadmap signals end of multichain sprawl

Wormhole Token Surges After Tokenomics Reset and W Reserve Launch