Bitcoin Hyper Presale Hits $16M As Whales Buy $64K, Is This the Next Crypto to Explode?

In a world of convenience and where the expectation of services is near instant, Bitcoin’s 7 transactions a second isn’t acceptable anymore.

What? Bitcoin isn’t perfect? It’s maybe something you’d hear from newbies, but for those in the know, it’s like the industry’s worst-kept secret.

Because of this, $BTC is seen as more of a store of value than day-to-day currency. But let’s face it, we all expect more from our investments these days.

Even with the Taproot upgrade in 2021, which aimed to help with privacy and scalability, $BTC is sadly still lagging.

Bitcoin Hyper ($HYPER) Is the Speed Force to Rejuvenate $BTC

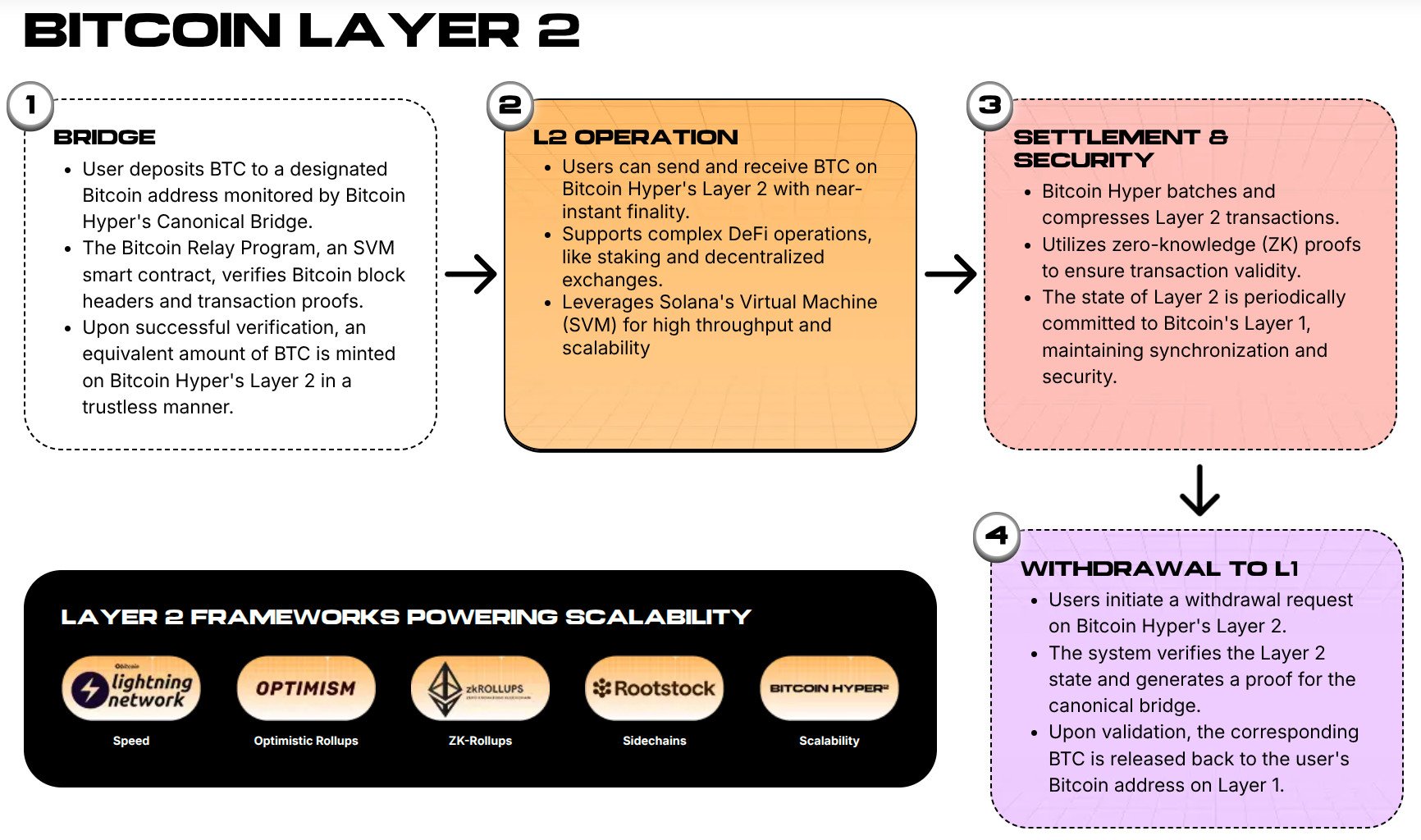

Bitcoin Hyper ($HYPER) is a new Layer-2 built on top of the Bitcoin network. The core idea is to bundle transactions off the main Bitcoin chain, process them at lightning speed, and then send a tiny, compressed summary of all that activity back to the main chain.

This rollup method cuts down on congestion and fees, and you’re getting a massive jump in speed and ability to handle significantly more transactions.

It’s a game-changer, simply put.

$HYPER’s Layer-2 isn’t just about speed, though. It’s also bringing smart contracts to $BTC by using Solana Virtual Machine (SVM) technology.

This will allow developers to create all kinds of cool things, think DeFi apps, NFTs, and even games, right on top of the most secure blockchain in the world.

This magical transformation is possible thanks to $HYPER’s Canonical Bridge. It’s a two-way, secure gateway. When you want to use your $BTC on the Hyper network, you send it to a special address.

The Canonical Bridge then securely locks that Bitcoin up and gives you a 1:1 wrapped version on the Hyper layer. This wrapped $BTC is what you use for the fast, cheap transactions and to interact with smart contracts.

It’s always fully redeemable, meaning you can burn your wrapped $BTC on the Hyper layer at any time to unlock your original $BTC.

The Financial Side: A Whale of a Presale

It’s clear the market is excited. Bitcoin Hyper ($HYPER) has already raised over $16M, and with offers of 71% staking rewards, it’s here to keep you for the long haul.

Investor confidence is buoyed further by some serious whale buys this weekend. We’re talking about purchases of $12.5K, $12.2K, $26.5K, and $13.1K for a total of over $64K.

When big players put that kind of money in, it’s a strong signal that they believe the project’s a big deal. They’re getting in on the ground floor, understanding that the utility could seriously increase the value of the $HYPER token.

It’s a mind-blowing thought. Bitcoin is already the biggest crypto by a country mile. But with a solution like Bitcoin Hyper ($HYPER), it could get even bigger by finally solving its speed and utility problems.

It’s a mind-blowing thought. Bitcoin is already the biggest crypto by a country mile. But with a solution like Bitcoin Hyper ($HYPER), it could get even bigger by finally solving its speed and utility problems.

You May Also Like

Fed Decides On Interest Rates Today—Here’s What To Watch For

Robinhood Chain Public Testnet Launch: A Strategic Pivot into Ethereum’s Layer 2 Ecosystem