Whales Circle Viral Bitcoin Hyper Presale As Layer-2 Sparks FOMO – Next Price Surge Under 48hrs Away

And when they find one, they don’t hesitate to go all in.

The latest crypto whale magnet is Bitcoin Hyper ($HYPER)–the upcoming layer-2 solution designed to enhance speed and programmability on the Bitcoin blockchain. The project expands Bitcoin’s reach to the broader Web3 market, including dApps, DeFi, NFTs, and even meme coins.

Having raised $15.2M already, the clock is ticking on the $HYPER presale.

So here is a closer look at what makes it one of the most promising altcoins this season.

$HYPER Mania: Why Bitcoin Hyper is Trending

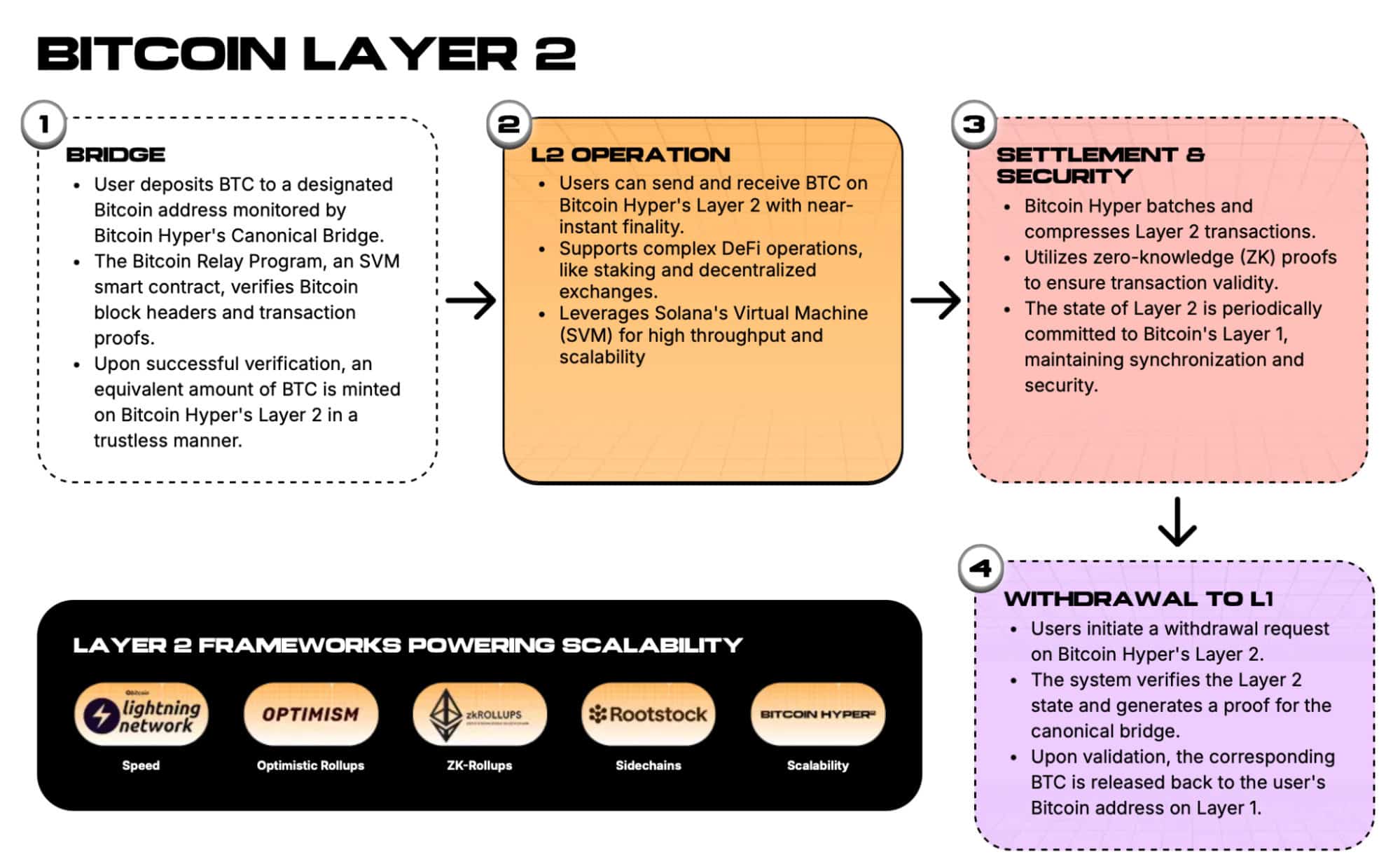

Bitcoin Hyper is building a Layer-2 solution for Bitcoin using the Solana Virtual Machine and a decentralized Canonical Bridge.

Although Bitcoin is the world’s largest crypto, the Bitcoin blockchain is outdated. It doesn’t stand a chance against blockchains like Ethereum and Solana that support smart contracts.

Bitcoin Hyper addresses Bitcoin’s issues, making it faster, cheaper, and scalable without sacrificing security.

The Layer-2 architecture is simple, yet sophisticated, as shown below:

Basically, you send your $BTC to a specific wallet address monitored by the Canonical Bridge. Once confirmed, it will be minted on Layer-2 as wrapped $BTC, ready for DeFi, staking, and nearly anything else in Web3.

Thanks to the SVM, transactions are extremely fast and inexpensive. In fact, it can sometimes be faster than Solana itself.

The best part is, you can withdraw your $BTC back to Bitcoin’s native Layer-1 whenever you want.

It’s Not Just a Promise; Tech Progress Inspires Confidence

The crypto market is crowded with early-stage coins that promise everything under the sky, only to keep investors waiting for months after the TGE for a product update, if there is any.

Bitcoin Hyper is one of the rare exceptions. Here, the community is regularly updated about the product and the roadmap.

As per the latest product update, the team has already completed:

- Core research on rollup settlement models compatible with Bitcoin L1.

- Early prototypes validating SVM execution inside the rollup.

- Exploratory designs for developer-facing infrastructure: explorer, console, and dev tooling.

- Alignment with ecosystem teams who want to build on Hyper once devnet access broadens.

Here’s what the community can expect next:

- Better rollup sequencing models, refined for anchoring to Bitcoin’s base layer.

- Stronger dev workflows for SVM-compatible contracts, from deployment to monitoring.

- Lightweight infra services (RPC, indexers, explorers) to help developers interact with Hyper efficiently.

- Pathway for early builders to test contracts and infra components before the mainnet launch.

That explains why Bitcoin Hyper ($HYPER) has become a favorite among whales this season.

$HYPER is Winning Over Whales

Crypto whales are crowding the Bitcoin Hyper presale, as the project’s layer-2 solution sparks FOMO. Here are four whale purchases from the last few hours:

- $16.9K (at 07:16:47 PM UTC, Sep-11-2025)

- $11.1K (at 05:08:47 PM UTC, Sep-11-2025)

- $10.1K (at 06:48:11 PM UTC, Sep-11-2025)

- $10.1K (at 05:22:23 AM UTC, Sep-12-2025).

With another altcoin season likely around the corner, they are rushing to secure the native crypto $HYPER before it hits exchanges. In a recent post, Crypto Rand makes a strong case for an alt season with the BTC-ETH dynamics shifting.

Why alt season is close, source: CryptoRand on CoinMarketCap

The broader market environment only reinforces this optimism, as macroeconomic shifts point toward a Fed rate cut and the SEC Chair declares that crypto’s time has come.

SEC Chairman Paul Atkins proposes pro-crypto initiatives, source: X

But crypto giants have rarely been able to give exponential gains to latecomers.

While $BTC and $ETH are a favorite among institutional adopters–because they can afford to spend a fortune to make a fortune–retail whales play a completely different game.

So it’s not surprising that investors are circling Bitcoin Hyper now. It is one of the few early-stage crypto projects that show real dev progress.

The token has also undergone two smart contract audits by Coinsult and SolidProof, clearing any concerns investors may have around early-stage investments, as vulnerabilities and rug pulls are a valid risk in the crypto space.

Based on our price prediction, $HYPER has the potential to rally up to 1,441% before year-end if it follows through on its development milestones.

$15.2M Raised: Clock is Ticking on the $HYPER Presale

$HYPER is currently on presale, with prices steadily increasing. It is accompanied by a passive income program, where investors can lock their presale tokens to earn attractive staking APY.

But it won’t last long.

So, to grab the best prices and staking deals in the presale, visit the official Bitcoin Hyper website before it’s too late.

You May Also Like

CEO Sandeep Nailwal Shared Highlights About RWA on Polygon

SHIB Price Analysis for February 8