iPhone Costs 50% Less When Bought with Bitcoin, Study Reveals

New research reveals that the iPhone 17 launch price has been reduced by 48.6 percent in terms of Bitcoin relative to the previous iPhone, a reflection of the emerging purchasing power of crypto.

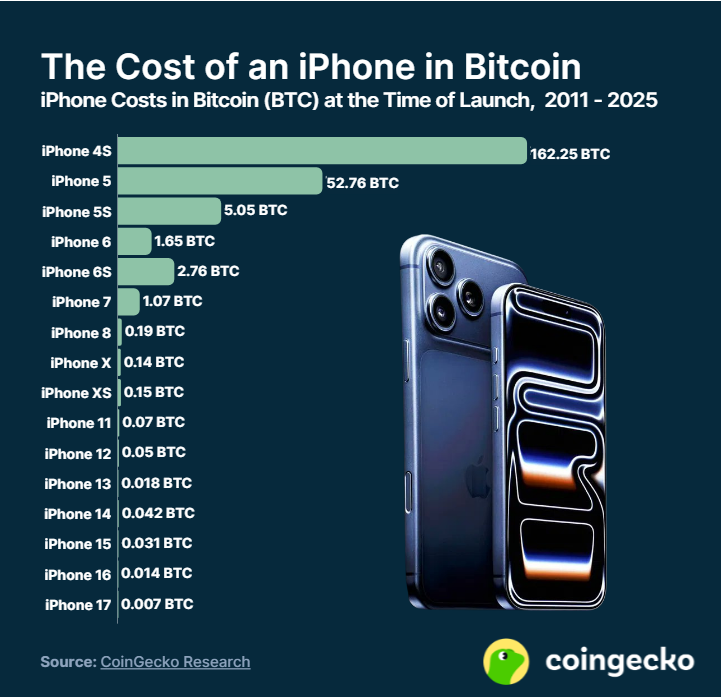

According to a recent CoinGecko analysis, the amount of Bitcoin required to purchase the latest iPhone 17 has dropped drastically.

Although Apple maintained the cost of the iPhone 17 launch at the same price, of 799 U.S. dollars, it is nearly half of the cost in Bitcoin relative to the iPhone 16 last year.

The CoinGecko study reveals that the iPhone 17 is 0.0072 bitcoins, or 48.6% cheaper than the iPhone 16 in 2024, which would have needed 0.0140 BTC.

This price change is amidst the fact that the value of Bitcoin almost doubled during this time frame, increasing by approximately 57,000 to above 111,000.

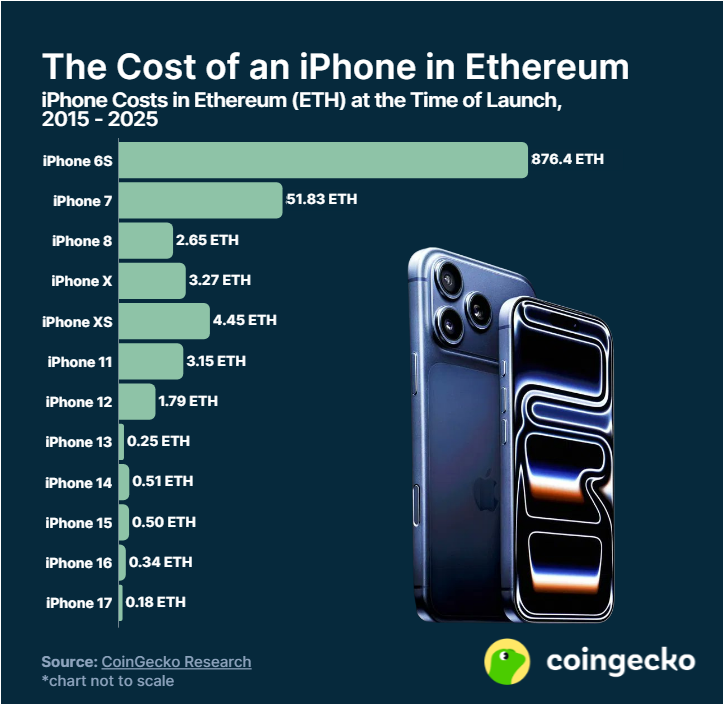

The research follows the iPhone price in Bitcoin and Ethereum in a ten-year period, to showcase how the increase of cryptocurrency repositions the purchasing power.

iPhone 17 leads sharp Bitcoin price drop

Source – Coingecko

The iPhone 17 is priced at only 0.0072 BTC as compared to 0.0140 BTC in iPhone 16, indicating a very high downward trend.

This fall indicates a tremendous increase in the value of Bitcoin since the dollar value of the phone did not vary. With the power of Bitcoin, people are virtually paying less crypto to acquire the latest gadget from Apple.

This is also evident in other models of the iPhone 17. The Air version, which is priced at $999, is priced at 0.0090 BTC.

The Pro and Pro Max models, which sell at 1,099 and 1,199 dollars respectively, would come at 0.0099 and 0.0108 BTC respectively. This decrease provides a new look at the value of assets in cryptocurrencies.

Ethereum’s buying power also climbs

Source – Coingecko

Ethereum is not an exception. iPhone 17 is priced below the iPhone 16 at 0.1866 ETH and 0.3386 ETH, respectively, which is a 44.9 percent drop. The ETH prices increased by 84 percent in approximately two years, between the prices of about 2,360 and 4,280.

The iPhone Air is being sold at 0.2333 ETH, and the Pro and Pro Max are sold at 0.2567 and 0.2800 ETH.

According to a study by CoinGecko, whose prices tracked the launch day of each iPhone generation, the prices of dollars versus the prices of BTC and ETH are tracked.

It demonstrates that early models, such as the iPhone 4S, cost 162.25 BTC in 2011, and now, the iPhone 17 will cost less than a hundredth of a Bitcoin.

Rising cryptocurrencies cut smartphone crypto costs drastically

The trend indicates that the purchasing power of cryptocurrency will increase with time. First-generation iPhones are worth astronomical Bitcoin and Ethereum prices, which were cheap at the time of their release.

Bitcoins are now seen to have surged upwards, reducing the amount of tokens required to procure the same commodity.

The analysis shows how iPhone prices in USD increased only 23 percent between 2011 and 2025, whereas the Bitcoin price required to purchase one had dropped by almost 100 percent.

The similar decline in Ethereum also approaches 100 percent, which emphasizes the possibility of real value maintenance and an increase in crypto.

You May Also Like

XRP Confirms Downtrend After $1.50 Breakdown, with $1.15 in Focus

Will Bitcoin Crash Again After Trump Insider Whale Dumps 6,599 BTC?