Why Ethereum and Solana Holders Are Eyeing Avalon X’s Real Estate-Backed RWA

The post Why Ethereum and Solana Holders Are Eyeing Avalon X’s Real Estate-Backed RWA appeared first on Coinpedia Fintech News

Ethereum and Solana are some of the biggest names in crypto, leading the way in decentralized finance, NFTs, and scalability. However, 2025 is shaping up to be the year of real-world assets (RWA) crypto presales. At a time when investors are calling for more than speculation, Avalon X (AVLX) is setting itself up to be a contender for the next big crypto 2025.

Its new strategy for bridging blockchain and luxury real estate is making both ETH and SOL investors question if it’s time to invest in real estate backed cryptocurrency for the long term.

The question here is a large one: are Ethereum and Solana able to keep up the pace, or will projects like Avalon X redefine what tokenized property crypto wealth actually entails?

Ethereum Price Current Outlook

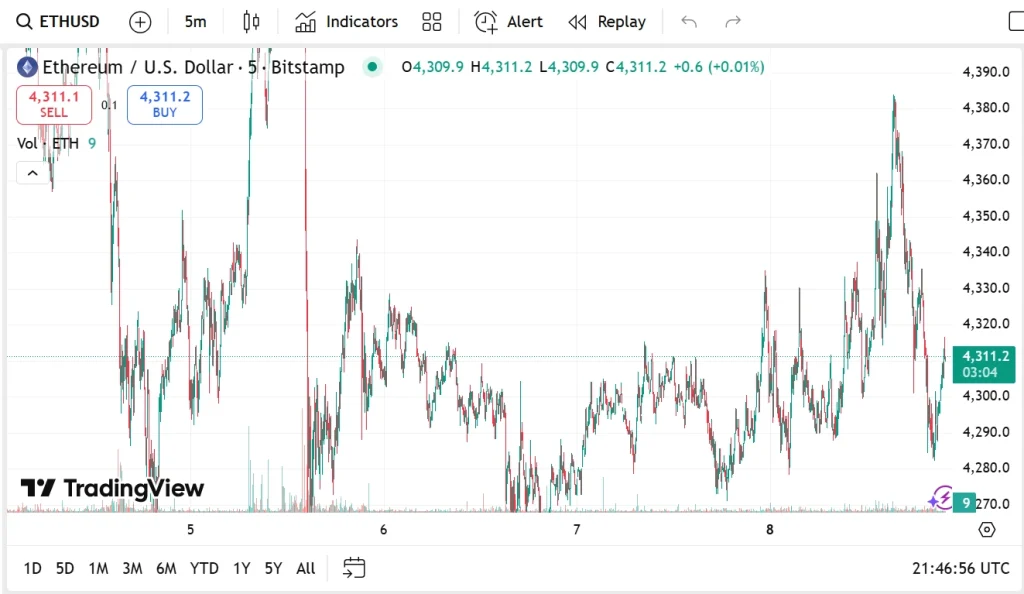

Ethereum still sits at the center of DeFi; you can’t really talk about the space without it. Right now, Ethereum price is around $4,311, up a little over 1% in the past day, with a market cap just shy of $523 billion.

Latest Ethereum news shows that trading activity has spiked too, jumping more than 70% to about $30.5 billion, which says a lot about Ethereum price prediction as the backbone of decentralized finance.

Source: Tradingview.com

And yet, the same old question keeps circling: beyond DeFi, what can Ethereum actually do for the real world? That’s where the conversation gets interesting. Some investors have started holding it up against real estate blockchain projects 2025 like Avalon X which ties crypto value to property, something you can actually step inside of or rent out.

Regardless, some analysts, including Peter Maliar, believe Ethereum’s current structure looks ready for a powerful move.

For most, the comparison raises the question of whether DeFi infrastructure on its own can hold its own against tokens that enable you to invest in real estate crypto.

Solana Price Prediction: SOL’s Growing Momentum

Solana has become synonymous with speed and efficiency. Solana price stands at $215.60, appreciating 7.08% over the past 24 hours with a market cap of $117.19 billion and trading volume of $9.79 billion, up by 205.51%. The rise in Solana price shows that investors consider scalability and performance as central to Web3 adoption.

Yet the story is shifting. As Solana price garners attention for appreciation, more investors are looking at real-world use cases like Avalon X. The narrative is no longer merely speed or gas fees but whether tokens like SOL can stand up to projects that enable users to invest in real estate crypto, with utility outside of digital speculation.

Avalon X: Utility Meets Real Estate

Unlike giants like Solana and Ethereum, Avalon X real estate crypto is going in the opposite direction by bridging blockchain with actual, income-generating property. Underpinned by Grupo Avalon’s nearly $1 billion pipeline of Dominican Republic luxury projects, Avalon X converts the speculation concept into direct exposure to the property market.

This isn’t a question of hype, this is a matter of giving investors the ability to invest in crypto backed by real world assets that can be quantified for value.

By fractionalizing luxury developments, Avalon X unlocks the $379 trillion global real estate market, an asset class once exclusive to wealthy institutions. For everyday investors, Avalon X is dangling a kind of ownership that, honestly, wasn’t even on the table until recently.

Instead of chasing meme coins or tokens that live entirely in the digital ether, they’re tying value to something people can actually touch property. That shift changes the equation: appreciation isn’t just about hype cycles or Twitter trends, it’s pulled along by real-world demand.

Security That Inspires Investor Confidence

Avalon X has won trust by securing a CertiK audit, widely seen as the gold standard of blockchain security. This third-party assurance allows investors to trust that its smart contracts are secure and transparent. Security is of the utmost importance for a real estate crypto backed by nearly $1 billion of luxury property.

The audit adds a much-needed trust layer, and this is what distinguishes Avalon X in the competitive presale landscape, making it arguably the best crypto to buy 2025. It’s a project designed for stability, growth, and protection for investors in the long run.

A Million Reasons to Get in Early

Avalon X has grabbed attention with its $1 million giveaway and townhouse up for grabs in the gated Eco Valley development, but it’s not just a flashy headline. Early supporters are being rewarded with AVLX tokens and perks tied directly to real property, which is a different kind of incentive than the usual short-term hype plays.

Eco Avalon Townhouse Giveaway

The approach does two things at once: it builds a community that feels invested from day one, and it connects rewards to assets that might actually hold value over time. For presale investors, it is a bonus on top of Avalon X’s inherent value, as it gradually becomes the best crypto presales 2025

Beyond Hype: Generating Wealth Through Real Assets

The moral of the story is straightforward: Ethereum will continue to dominate DeFi, and Ethereum news will always be meaningful. Likewise, Solana price action will always garner interest for scalability.

But projects like Avalon X show investors that the future lies in being able to invest in real estate crypto. This model provides a utility-based story that meme coins and even standard DeFi cannot compete with.

To any person in search of long-term growth, Avalon X property crypto is not just one more presale. It’s a chance to underpin wealth with actual property so that blockchain is based on the actual economy and one of the best altcoins to invest in 2025.

Join the Community

- Website: https://avalonx.io

- $1M Giveaway: https://avalonx.io/giveaway

- Telegram: https://t.me/avlxofficial

- X: https://x.com/AvalonXOfficial

You May Also Like

USD Weakness Reveals Surprising Relief: Dollar’s Decline Lowers Global Risk Scores, Says DBS Analysis

Franklin Templeton CEO Dismisses 50bps Rate Cut Ahead FOMC