Fundstrat CIO Tom Lee Sees Ethereum ‘Supercycle’ As BitMine ETH Holdings Hit 2M, ARK Invest Buys $4.4M BMNR

Fundstrat CIO Tom Lee said Ethereum is entering a “supercycle” as BitMine Immersion Technologies’ ETH holdings topped 2 million and Cathie Wood’s ARK Invest bought $4.4 million BMNR.

“Ethereum is one of the biggest macro trades over the next 10-15 years,” said Lee, who is also Bitmine’s chairman, in a press release. “Wall Street and AI moving onto the blockchain should lead to a greater transformation of today’s financial system. And the majority of this is taking place on Ethereum.”

BitMine shares jumped 4% on news that its ETH treasury stash had crossed 2 million ETH worth and that Cathie Wood’s ARK Invest had added to its BMNR holdings with another buy yesterday.

BMNR share price (Source: Google Finance)

BitMine Doubles Down On Ethereum Strategy

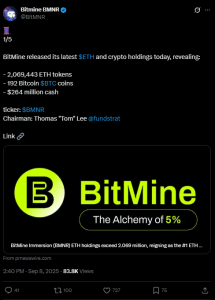

BitMine is currently the largest Ethereum treasury firm globally. In a Sept. 8 post on X, the company announced that its massive ETH stockpile reached 2,069,443 ETH.

BitMine’s latest holdings (Source: X)

That’s more than double the next biggest ETH treasury firm, SharpLink Gaming, which is chaired by Ethereum co-founder Joe Lubin. SharpLink currently holds around 837.23K ETH.

With ETH trading at $4,312.22 as of 1:00 a.m. EST, BitMine’s holdings are worth about $8.9 billion. This also makes BitMine the second-largest crypto treasury firm globally, trailing only behind the Michael Saylor-led Strategy with its holdings of 638,460 Bitcoin (BTC) valued at $71.54 billion, according to BiTBO data.

BitMine also said that it holds 192 BTC in its reserves, and still has $264 million in cash that it can use to purchase more crypto.

BitMine Makes $20M `Moonshot’ On Eightco

BitMine also announced that it made a $20 million “moonshot” investment in Eightco after that company pivoted to make Sam Altman’s Worldcoin (WLD) its primary treasury reserve asset.

The investment is part of BitMine’s “strategic roadmap,” according to the X thread.

After Eightco (OCTO) announced its Worldcoin treasury strategy and BitMine disclosed its investment in the company, the price of WLD skyrocketed.

WLD has soared over 39% in the past 24 hours while OCTO shares also went ballistic, skyrocketing over 3,000%.

OCTO share price (Source: Google Finance)

Year-to-date, OCTO shares are now up more than 1,958%.

ARK Invest Buys $4.4M BMNR

Amid BitMine’s increased ETH holdings, asset manager ARK Invest disclosed that it had bought 101,950 BitMine shares for about $4.4 million.

ARK Invest latest trade updates (Source: X)

Those purchases were spread across ARK Invest’s three ETFs (exchange-traded funds).

The ARK Innovation ETF (ARKK) bought 67,700 BitMine shares, the ARK Next Generation Internet ETF (ARKW) acquired 21,890 shares, and the ARK Fintech Innovation ETF (ARKF) purchased 12,360 BitMine stock.

Combined, those three ETFs currently hold 6.7 million shares in BitMine valued at about $284 million.

Wood’s firm has been increasing its holdings in BitMine ever since the company started accumulating ETH in April as part of its treasury strategy. BitMine was initially a Bitcoin mining company, but pivoted to an ETH treasury earlier this year. The company then launched its “alchemy of 5%” initiative with the goal to hold 5% of Ethereum’s total supply.

ARK Invest’s latest daily trading disclosure also shows the asset manager dumped 43,728 Robinhood (HOOD) shares valued at around $5.13 million. This was after the S&P committee announced that it will add HOOD to the coveted S&P 500 index.

You May Also Like

Wintermute CEO: Recent rumors of "institutional collapses" are extremely unreliable. The current crypto market is more orderly and the risks are controllable.

CME Group to Launch Solana and XRP Futures Options