CoinShares: Digital asset inflows surged $2.48b, here’s why

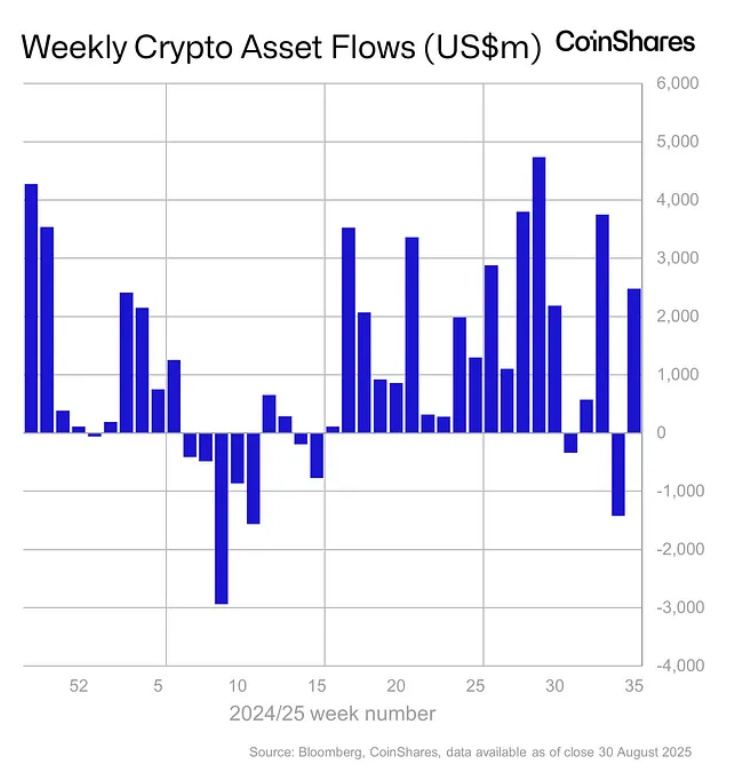

In CoinShares latest report net inflows for digital asset products reached $2.48 billion last week, more than doubling the monthly inflows for August.

- CoinShares’ recorded $2.48 billion of inflows last week, bringing the monthly total to $4.37 billion.

- Ethereum continues to outperform Bitcoin, accumulating inflows that have reached $1.4 billion last week.

According to the latest report by European investment firm CoinShares, last week’s net inflows reached as high as $2.48 billion. This boost in capital has raised August’s monthly net inflows to a total of $4.37 billion from just $1.89 billion.

In addition, the total year-to-date inflows have soared to around $35.5 billion.

It appears that digital asset investment products were able to recover from the large outpouring of capital from just a week prior. On the week of August 18, the firm recorded outflows of $1.43 billion; the largest it has seen since March.

Meanwhile, this month’s inflows signal strong investment sentiment, with positive signals all week except for Friday. This downturn was due to the release of the Core Personal Consumption Expenditures Price Index.

The Core PCE data measures inflation in the U.S. economy by tracking consumer prices for goods and services. According to CoinShares, the results from the data “failed to support expectations of a Federal Reserve rate cut in September, disappointing digital asset investors.”

The underwhelming Core PCE data combined with the recent negative price momentum led to a drop in the value of Assets Under Management by 10%, slipping from its recent peak of $219 billion.

In terms of region, the U.S. continues to dominate inflow shares; contributing $2.29 billion, followed by Switzerland, Germany, and Canada seeing inflows of $109.4 million, $69.9 million, and $41.1 million respectively.

CoinShares records more inflows from Ethereum than Bitcoin

The latest report also shows Ethereum (ETH) leading the charge with inflows totaling to $1.4 billion. This week’s boost in capital gave Ethereum the chance to further outpace Bitcoin (BTC), which only recorded $748 million in inflows last week. Throughout August 2025, Ethereum has accumulated as much as $3.95 billion.

Meanwhile, Bitcoin has seen mostly outflows; with its outflow amounting to $301 million.

On the other hand, other tokens like Solana (SOL) and XRP (XRP) remain on the uptrend along with Ethereum, attracting inflows of $177 million and $134 million respectively. According to Head of CoinShares research, James Butterfill, this optimism is fueled by potential U.S. ETF launches in the near future.

On August 29, Bloomberg Intelligence’s ETF analyst James Seyffart shared a list of 92 crypto exchange-traded products awaiting a decision from the US Securities and Exchange Commission. This list included eight Solana ETF applications, seven pending XRP ETF applications and other tokens.

You May Also Like

Valour launches bitcoin staking ETP on London Stock Exchange

USDT Transfer Stuns Market: $238 Million Whale Movement to Bitfinex Reveals Critical Patterns