Grayscale Files Registration Forms for Polkadot and Cardano ETFs

The asset manager filed S-1 forms on August 29, 2025, seeking approval for ETFs that would track Polkadot (DOT) and Cardano (ADA).

These filings mark the next step in a process that began in February 2025. Back then, Nasdaq and NYSE Arca submitted initial 19b-4 forms on behalf of Grayscale. Bloomberg analyst James Seyffart clarified that these recent submissions “aren’t brand new filings” but rather continuations of earlier regulatory efforts.

ETF Structure and Trading Details

The proposed Polkadot ETF would trade on Nasdaq under the ticker “DOT.” It would track the CoinDesk DOT CCIXber Reference Rate to mirror Polkadot’s price movements. Meanwhile, the Cardano ETF would list on NYSE Arca with the ticker “GADA” and follow the CoinDesk Cardano Price Index.

Both funds would hold their respective cryptocurrencies directly through Coinbase custody services. Neither ETF would use leverage or derivatives, making them straightforward investment vehicles for institutional and retail investors.

The Polkadot trust includes plans to stake up to 85% of its holdings. However, this feature depends on meeting certain “Staking Conditions” that remain undefined. The fund would also face 28-day unbonding periods that could limit liquidity during market stress.

Regulatory Timeline and Challenges

The SEC has set October 26, 2025, as the decision deadline for the Cardano ETF application. This date represents the final deadline under the 19b-4 regulatory framework, where the SEC must either approve or reject the proposal.

Both trust entities were incorporated as Delaware Statutory Trusts on August 12, 2025. This follows Grayscale’s standard approach of establishing Delaware registrations before SEC submissions.

The Cardano filing includes a warning about potential regulatory risks. The document states that if the SEC classifies ADA as a security, it could trigger “material adverse impacts” on the token’s value and potentially force the trust to shut down.

Crowded Market for Crypto ETFs

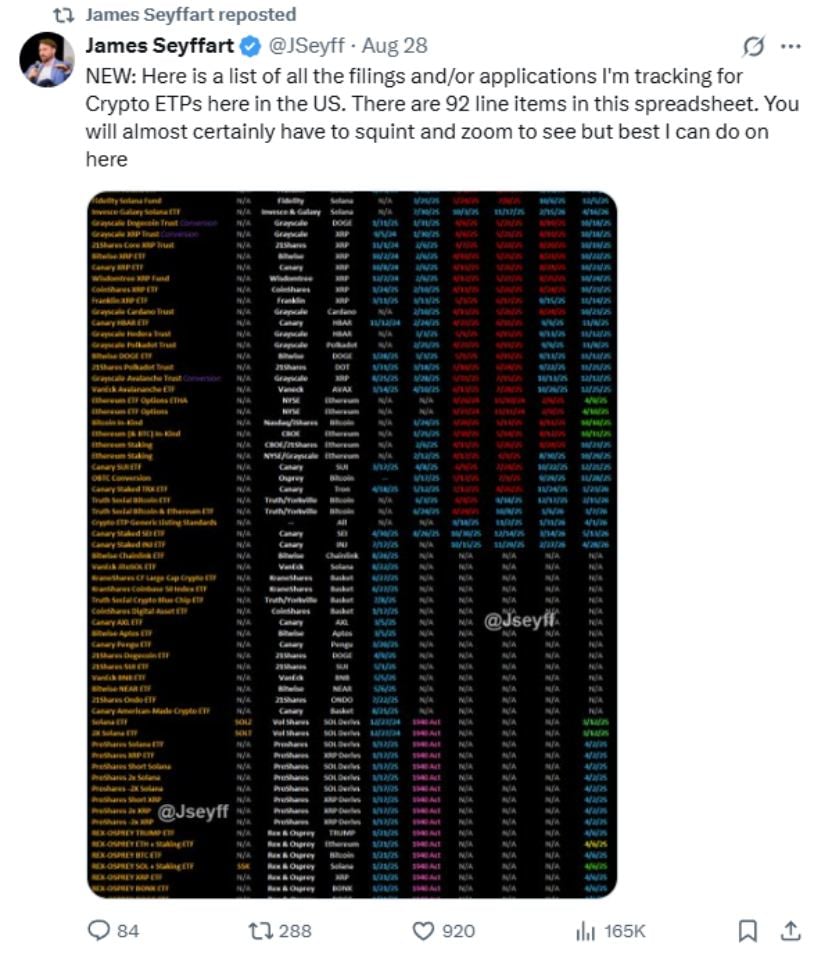

Grayscale’s applications join a packed field of pending cryptocurrency investment products. Currently, 92 crypto ETPs await SEC approval, with most facing final deadlines by October 2025.

Source: @JSeyff

Solana leads the pack with eight pending ETF applications, followed by XRP with seven applications. Other major cryptocurrencies like Litecoin, Dogecoin, and various altcoins also have multiple ETF proposals under review.

Recent prediction markets show strong optimism for altcoin ETF approvals. As of August 2025, Solana maintains 99% approval odds on Polymarket (up from 72% in May), while XRP holds 87% probability (up from 64% in August). Even Dogecoin commands 82% approval odds, nearly doubling from 44% in June.

Market Response and Price Impact

The ETF filings have generated notable market reactions. When Grayscale initially filed the 19b-4 forms in February 2025, Cardano’s price jumped 10% within 24 hours, outperforming Bitcoin and Ethereum during that period. However, recent regulatory delays have created some volatility.

Industry experts believe ETF approvals could significantly boost institutional adoption. ETFs offer regulated exposure to cryptocurrencies without the technical challenges of direct ownership, custody, and security management.

The funds would operate through cash-only creation and redemption mechanisms, processing shares in 10,000-unit baskets. Direct token deposits remain unavailable pending “In-Kind Regulatory Approval” that may never materialize.

Broader Regulatory Environment

The current regulatory climate appears more favorable for crypto ETFs than in previous years. The SEC has already approved Bitcoin and Ethereum ETFs, creating precedent for digital asset investment products.

Recent developments include the approval of in-kind redemption mechanisms for existing crypto ETFs, which has expanded compliance options for asset managers. The Project Crypto collaboration between the SEC and CFTC aims to provide clearer guidelines for digital asset classifications.

However, significant challenges remain. The SEC has previously indicated that assets like Cardano, XRP, and Solana might qualify as unregistered securities based on lawsuits against major exchanges. This classification could complicate ETF approval processes.

What This Means for Investors

These ETF filings represent Grayscale’s systematic expansion beyond Bitcoin and Ethereum products. The company already manages successful Bitcoin and Ethereum ETFs, giving it regulatory experience and market credibility.

If approved, these ETFs would provide mainstream investors with regulated access to Polkadot and Cardano through traditional brokerage accounts. This could eliminate barriers that currently prevent many institutional investors from gaining cryptocurrency exposure.

The October 2025 deadline creates a clear timeline for regulatory decisions. Industry watchers expect the SEC’s approach to these applications will signal its broader stance on altcoin ETFs.

Grayscale’s aggressive expansion strategy includes converting existing trusts for Litecoin, Solana, Dogecoin, XRP, and Avalanche into ETF structures. This comprehensive approach suggests confidence in eventual regulatory approval across multiple cryptocurrency categories.

The Path Forward

The crypto ETF landscape continues evolving rapidly. Asset managers including VanEck, Bitwise, 21Shares, and others have filed similar applications, creating competitive pressure for quick approvals.

Success for Grayscale’s applications could open doors for broader cryptocurrency ETF adoption. Conversely, rejections might signal continued regulatory caution around altcoin investment products.

With 92 applications pending and most facing October 2025 deadlines, the coming months will prove crucial for the future of regulated cryptocurrency investing in the United States.

You May Also Like

XAU/USD picks up, nears $4,900 in risk-off markets

Sonic Holders Accumulate Millions as Price Tests Key Levels