Altcoins Continue to Bleed Out as Bitcoin Fights to Maintain $110K: Market Watch

Bitcoin’s price nosedived once again in the past 24 hours to a new multi-week low of under $109,000 before it recovered a small portion of the recent losses.

The altcoins are in no better shape, with ETH dumping by over $550 since its latest all-time high and many others dropping by 5-6% daily again.

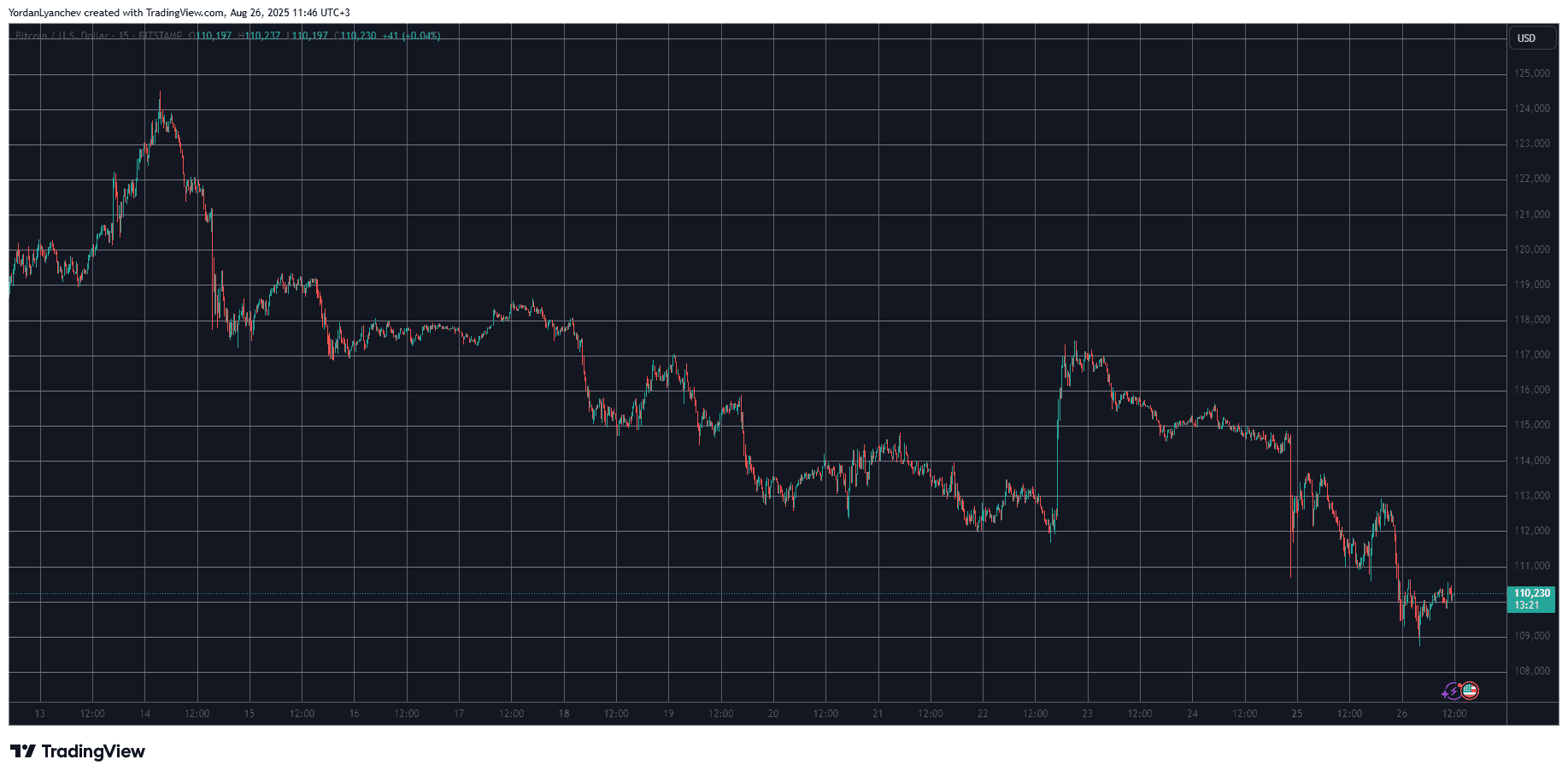

BTC’s New Local Low

The past several days have been quite volatile for the primary cryptocurrency. Its price was gradually declining for most of the previous week, and bottomed (at the time) at just under $112,000 on Friday before Jerome Powell’s speech.

As the Fed Chair took the main stage, though, the asset’s trajectory reversed immediately and skyrocketed to over $117,000 following his somewhat promising comments about the upcoming FOMC meeting. That rally, though, was short-lived, and BTC quickly returned to $115,000 during the weekend.

The landscape worsened on Sunday evening when bitcoin dumped by several grand to under $111,000, leaving over $300 million in liquidations within a single hour. After a minor recovery attempt on Monday, the bears took control once again later during the day and on early Tuesday morning and pushed BTC to its lowest position in almost seven weeks of just under $109,000.

Despite bouncing off to just over $110,000 as of press time, bitcoin is still over 1% down daily. Its market cap has tumbled below $2.2 trillion, while its dominance over the alts has rebounded slightly to 56.6% on CG.

BTCUSD. Source: TradingView

BTCUSD. Source: TradingView

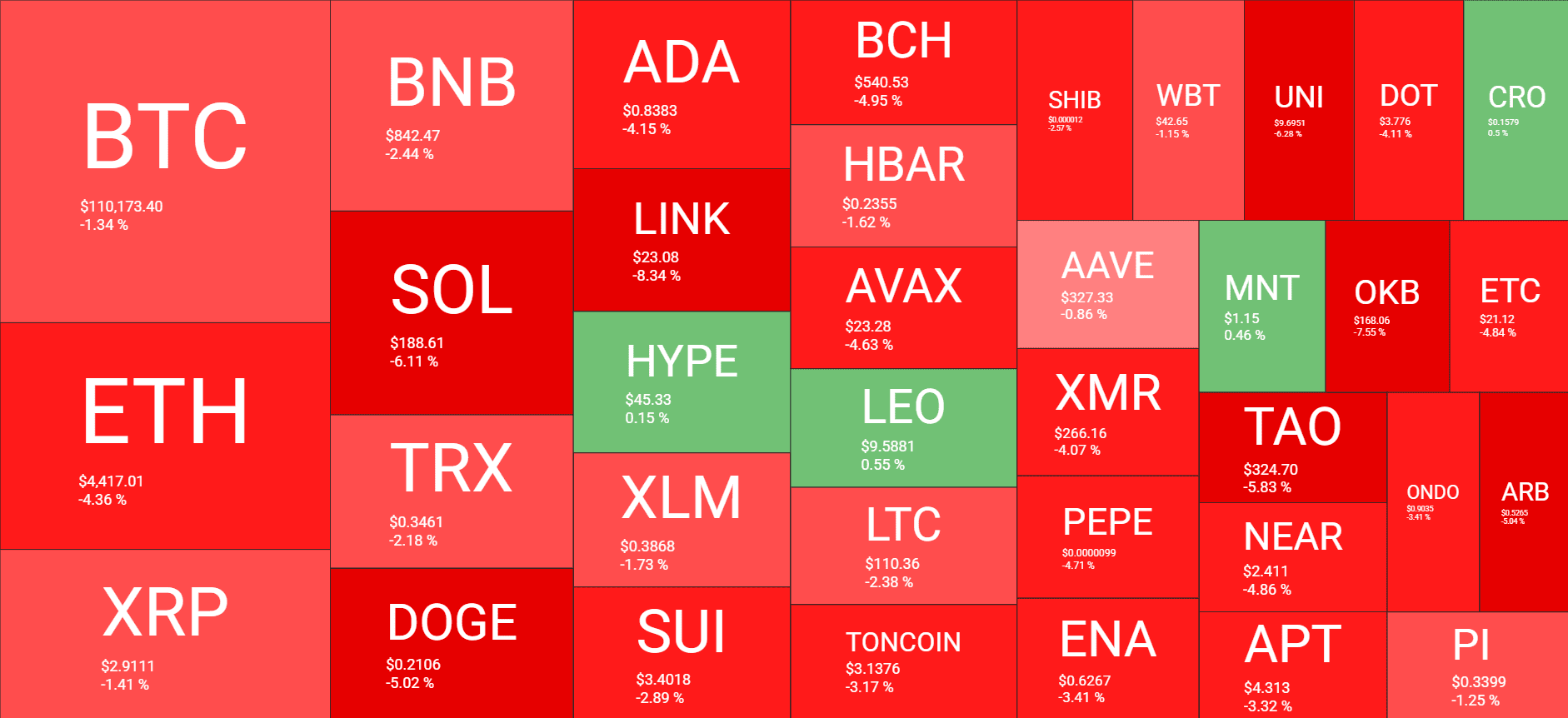

Alts in Freefall State

Most altcoins have marked even more substantial losses over the past day, including ETH, which took yesterday’s correction rather well but then dumped by roughly $600 since its latest ATH to around $4,300. It now trades inches above $4,400, but it’s still over 4% down on the day.

Even more painful declines come from SOL, DOGE, and LINK. Chainlink’s token has plunged by over 8% daily to $23. XRP, TRX, BNB, XLM, BCH, AVAX, and TON are also in the red.

The landscape with the mid-cap alts is similar, which is why the overall crypto market cap has seen another $60 billion disappear overnight and is down to $3.870 trillion on CG.

Cryptocurrency Market Overview. Source: QuantifyCrypto

Cryptocurrency Market Overview. Source: QuantifyCrypto

The post Altcoins Continue to Bleed Out as Bitcoin Fights to Maintain $110K: Market Watch appeared first on CryptoPotato.

You May Also Like

Top Altcoins To Hold Before 2026 For Maximum ROI – One Is Under $1!

UBS CEO Targets Direct Crypto Access With “Fast Follower” Tokenization Strategy