Sui Price Struggles at $3.4, Is a 10% Correction Coming?

The post Sui Price Struggles at $3.4, Is a 10% Correction Coming? appeared first on Coinpedia Fintech News

Sui price is facing pressure after a sharp pullback, with a value of $3.40, down 3.91% in the past 24 hours. Its market cap stands at $11.94 billion, while 24-hour trading volume has fallen 10.5% to $1.62 billion. The token is now more than 36% below its ATH of $5.35, as traders weigh weakening technical momentum and softening ecosystem data.

What Does the On-chain Say?

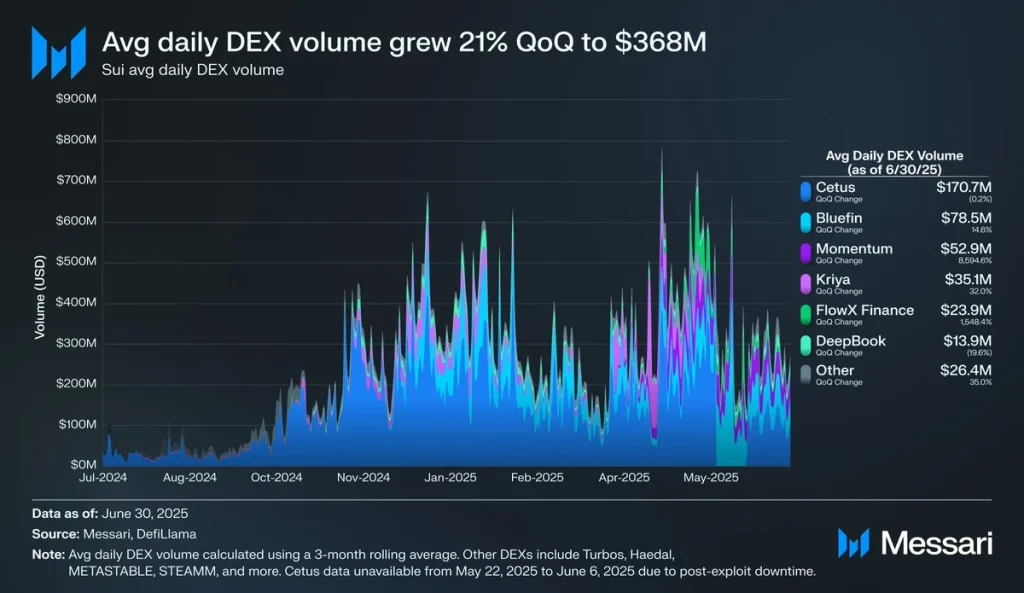

Sui’s on-chain performance has cooled in recent weeks. According to Messari, average daily DEX volume on Sui grew 21% quarter-on-quarter to $368M, but growth was uneven. While platforms like Momentum is up 8,594% and FlowX Finance is up 1,548%. Cetus, the largest DEX was flat at $170.7M, signaling consolidation at the top.

Meanwhile, the TVL dropped 11% to $3.4B in the past week, reflecting reduced user engagement. On the derivatives side, SUI futures open interest plunged 31% from $2.66B in late July to $1.84B. And long liquidations totaled $5.64M on August 20, hinting at shaken trader confidence.

Sui Price Analysis:

Technically speaking, SUI is under pressure after breaking below its 50-day moving average at $3.69 and pivot point at $3.46. Moreover, the MACD histogram at -0.0293 confirms persistent bearish momentum.

Successively, the immediate support for the Sui price sits near $3.32, with a more crucial level at $3.27. A daily close below $3.27 could open the door to a further 10–15% decline, targeting the $2.90–$3.00 range.

On the upside, resistance lies at $3.52, followed by $3.69 and $4.07. The RSI near 41 suggests SUI is approaching oversold territory, but buyers are yet to stage a convincing defense.

FAQs

SUI slipped below key technical levels amid falling TVL, reduced futures open interest, and heavy long liquidations.

Support is at $3.32 and $3.27. Resistance sits at $3.52, then $3.69 and $4.07.

While RSI shows oversold conditions, a rebound needs a sustained close above $3.52 to confirm strength.

You May Also Like

Top Altcoins To Hold Before 2026 For Maximum ROI – One Is Under $1!

UBS CEO Targets Direct Crypto Access With “Fast Follower” Tokenization Strategy