Bitcoin Price Tanks Below $109K After Whale Dump in Brutal Market Flush

Around $205 billion has exited crypto markets over the past 24 hours, sending total market capitalization plummeting back to $3.84 trillion.

It is the lowest level total cap has been since August 6, but it still remains within a six-week sideways channel despite the massive sell-off.

CoinGlass reported that around 205,000 traders were liquidated over the past day, with total liquidations coming in over $930 million as leveraged long Bitcoin positions got flushed. Other analysts were suggesting that exchanges were dumping crypto assets in order to liquidate the long positions.

Today’s painful, but not out of the ordinary, market slump has resulted in a 9% correction for overall crypto markets since their peak on August 14.

Bitcoin Dragging Markets Down

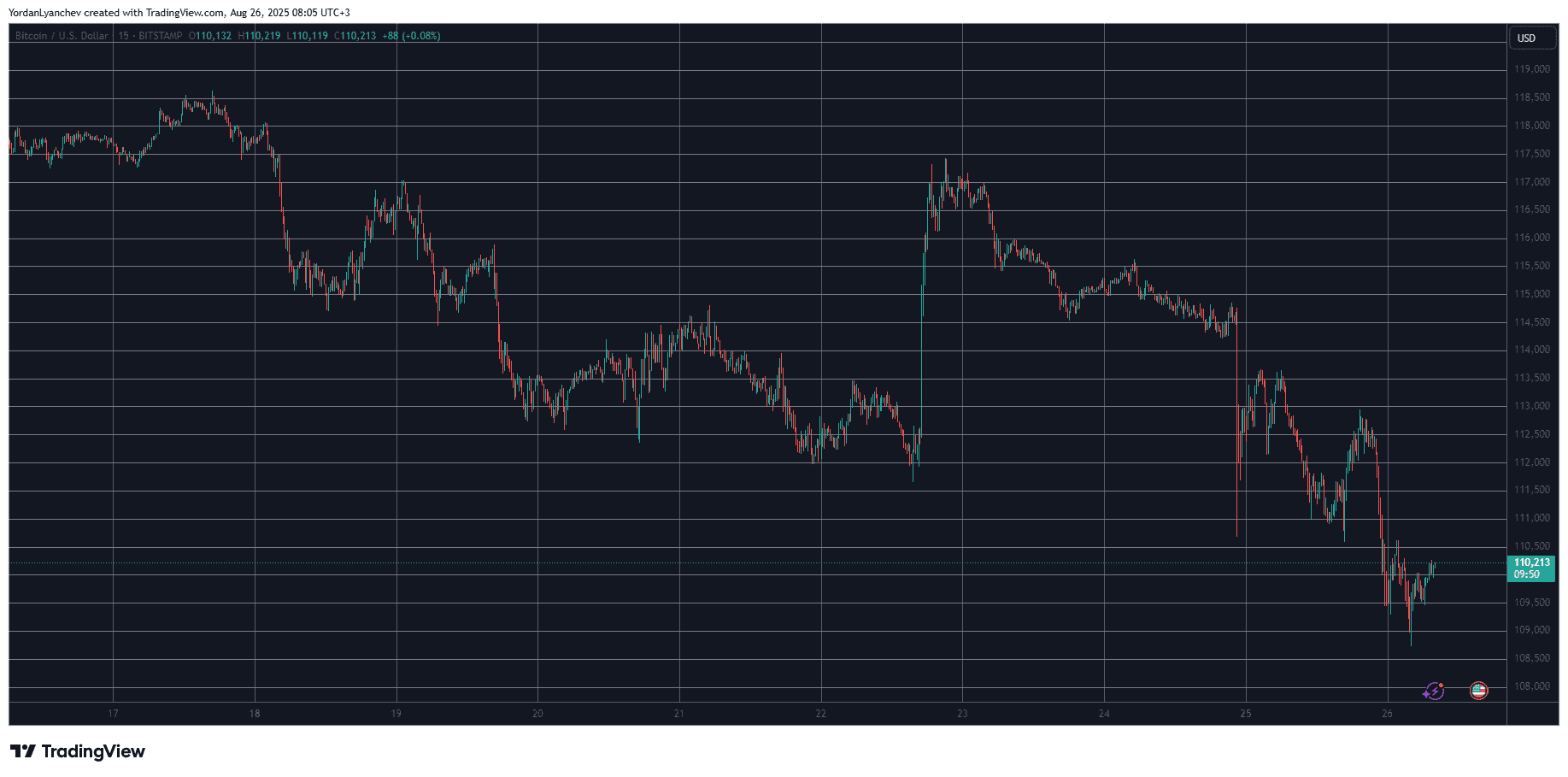

The big dump has been caused by Bitcoin, which crashed to a seven-week low of under $109,000 in early Asian trading on Tuesday morning on most exchanges.

BTCUSD. Source: TradingView

BTCUSD. Source: TradingView

This was caused by a Bitcoin whale selling an entire batch of 24,000 BTC worth over $2.7 billion, causing the asset to plummet $4,000 a few hours that followed.

According to Glassnode, Bitcoin has dropped below the average cost basis ($110,800) of one to three-month-old investors who accumulated during the May to July rally. “Historically, failure to hold above this level has often led to multi-month market weakness and potential deeper corrections,” it cautioned.

The total BTC correction now stands at 12%, which is still much shallower than the pullbacks in September 2017 and 2021, during the bull market years when the asset retreated by 36% and 24%, respectively.

A retreat between these two levels this September could see Bitcoin prices back at $87,000 before the bull market resumes.

Altcoins Bleed Out

As usual, the altcoins are suffering much more with major losses for Solana dumping over 11% to $186, Dogecoin dropping 10% in a fall to $0.21, Cardano sliding 9% to $0.83, and Chainlink tanking 11% to $23.30.

Other altcoins in pain include Hyperliquid, Sui, Avalanche, and Litecoin. Ethereum has lost 7% on the day, but it remains within its sideways channel and had already started to recover at the time of writing, trading above $4,400 again. However, ETH has lost over 11% since its all-time high just two days ago.

The post Bitcoin Price Tanks Below $109K After Whale Dump in Brutal Market Flush appeared first on CryptoPotato.

You May Also Like

Top Altcoins To Hold Before 2026 For Maximum ROI – One Is Under $1!

UBS CEO Targets Direct Crypto Access With “Fast Follower” Tokenization Strategy