ParaFi Capital: How did Ethena grow into a DeFi cornerstone in just one and a half years?

Author: ParaFi Capital

Compiled by: Felix, PANews

In less than 18 months, Ethena has become a cornerstone of DeFi and CeFi infrastructure.

Ethena’s USDe has become the fastest USD asset to reach 5 billion supply. As Ethena grows rapidly, this article will delve into the mechanics of the protocol. The main focus is on the following three aspects:

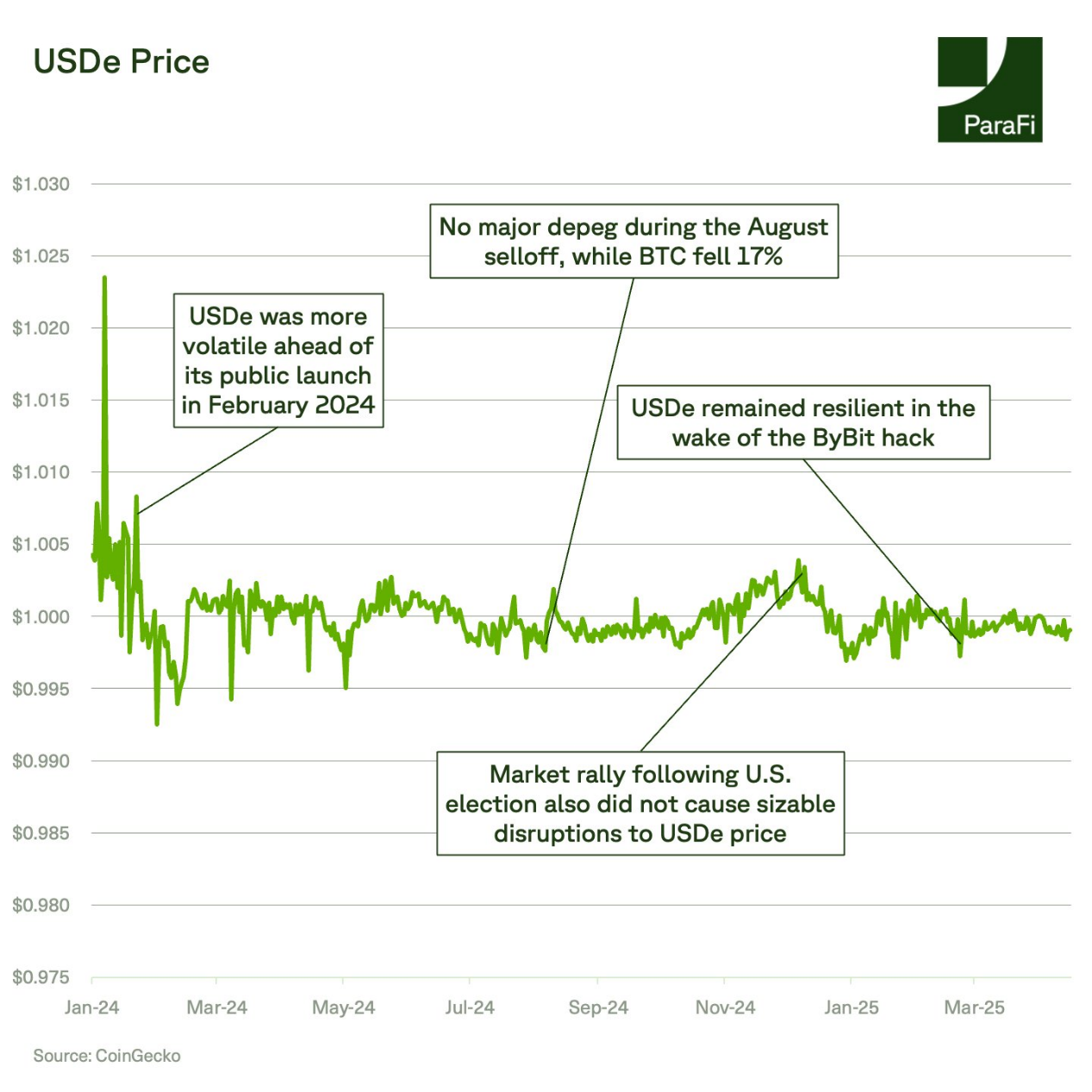

- Peg Resilience: To what extent has Ethena maintained its peg during significant market declines?

- Yield Profile and System Support: How has the protocol’s asset composition and yield drivers changed year-to-date?

- Capacity Limits: Is Ethena Approaching DeFi TVL or Open Interest Limits?

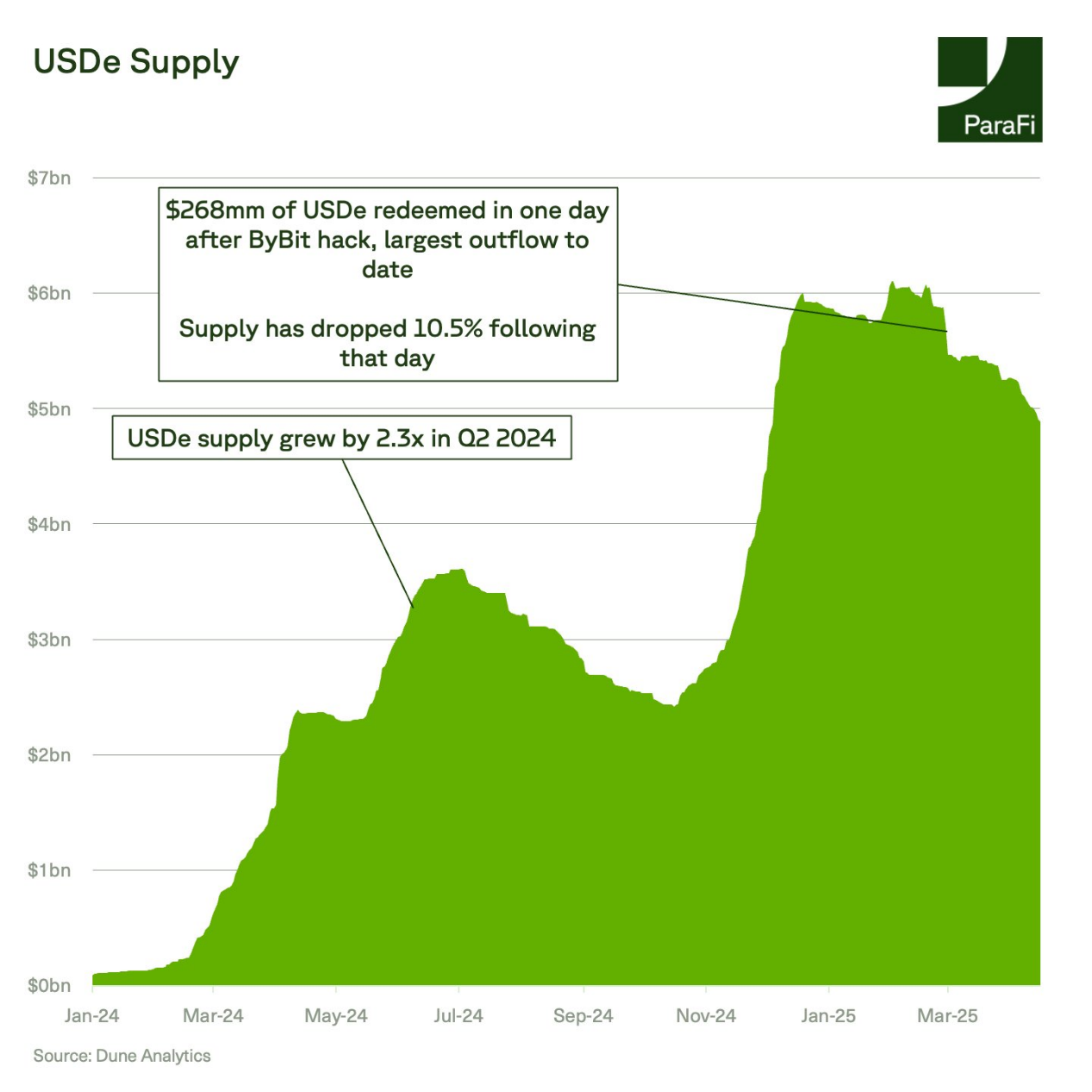

USDe has experienced extreme market volatility, including eight Bitcoin declines of more than 10%, and the largest crypto hack in history. Since its launch, the protocol has processed $3.3 billion in redemptions, but USDe has not deviated from its dollar peg by more than 0.5% over the past year. Since Liberation Day, the protocol has experienced $409 million in redemptions.

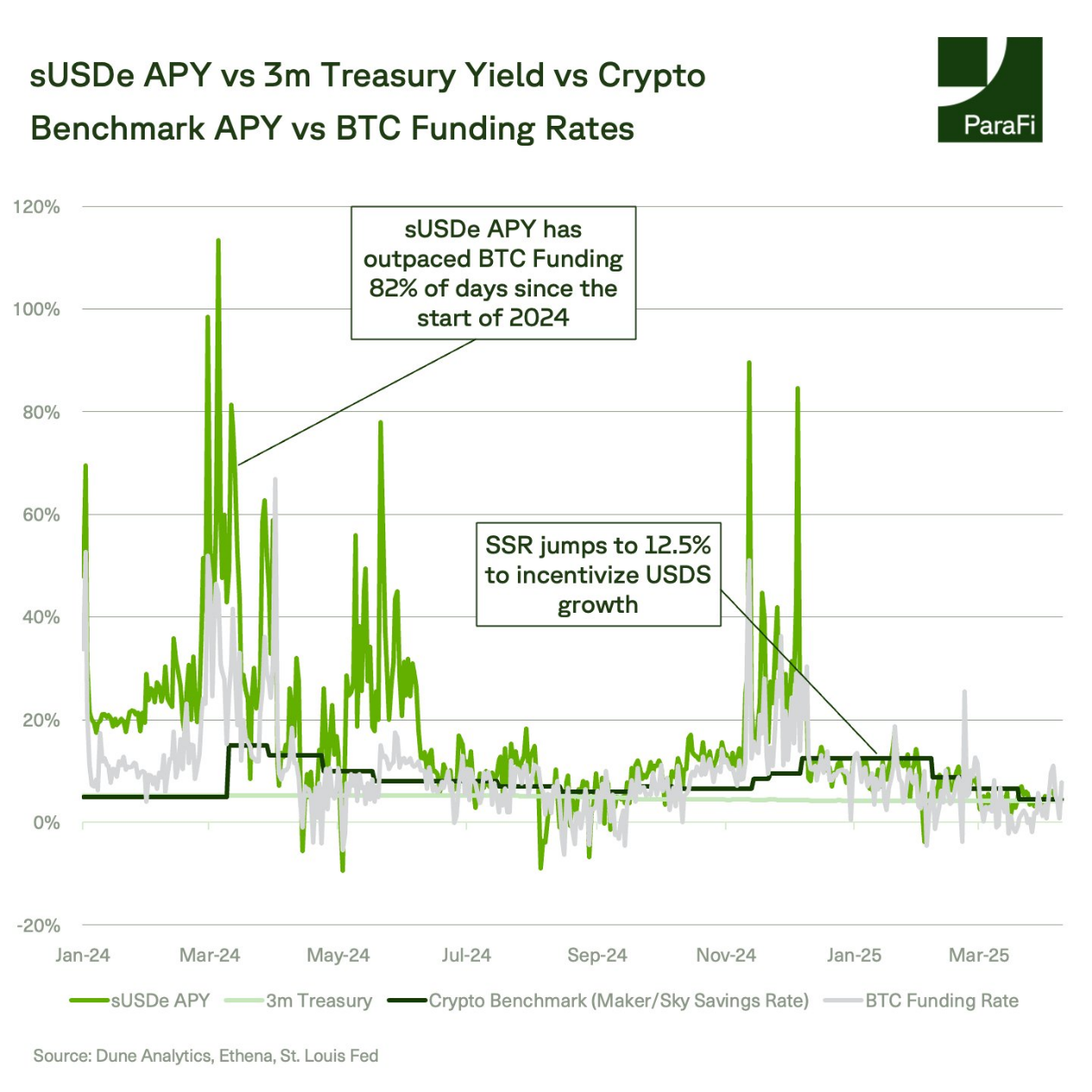

sUSDe has become a yield benchmark for DeFi — a metric that institutional investors in traditional finance (TradFi) may increasingly look to to gauge risk appetite and market sentiment.

Ethena’s revenue mechanism is rooted in its structural advantages.

A large portion of the sUSDe APY comes from funding rates used in basis trades to hedge spot exposure. Historically, these funding rates have been positive. For reference, 93% of the days in the past year were positive.

sUSDe can often provide a yield that exceeds BTC’s funding rate, thanks to two key factors:

- Not all USDe is staked, which means that returns are concentrated in a smaller group of supply;

- Ethena's custody framework supports cross-margin and optimizes capital efficiency. Currently only 43% of USDe is pledged, the lowest proportion since August.

Over the past six months, sUSDe’s average yield was 12.3%, far exceeding the Maker/Sky savings rate of 8.8% and the BTC funding rate of 9.2%.

It is worth noting that Ethena only operates in a high interest rate environment where the current federal funds rate is above 4%. Given that the sUSDe yield should be negatively correlated with the real interest rate, a decline in the real interest rate may increase the demand for leveraged crypto assets, thereby pushing up the funding rate and, in turn, the sUSDe yield.

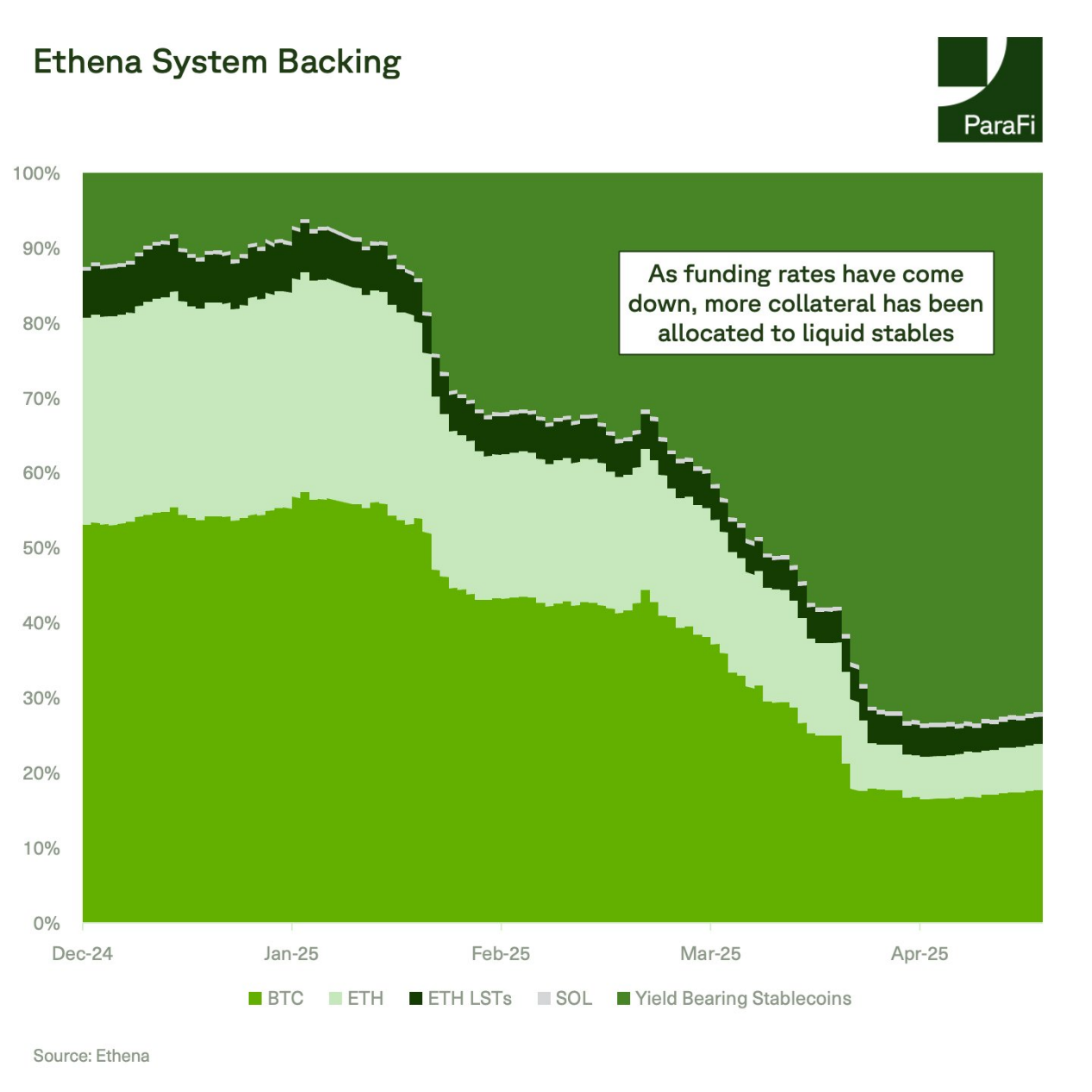

Ethena achieves its yield goals by dynamically managing collateral. Depending on the yield environment, Ethena will strategically switch between funding rate arbitrage, stablecoins, and treasury yields.

In December 2024, Ethena launched USDtb, a stablecoin backed by BlackRock’s BUIDL product, with a supply of over $1.4 billion.

Currently, 72% of Ethena’s collateral is allocated to liquid stablecoins, a significant change from 53% of collateral allocated to BTC and 28% to ETH at the end of 2024. This shift reflects the decline in funding rates relative to Sky and Treasury yields.

In the early days of going online, capacity limitation was the main problem.

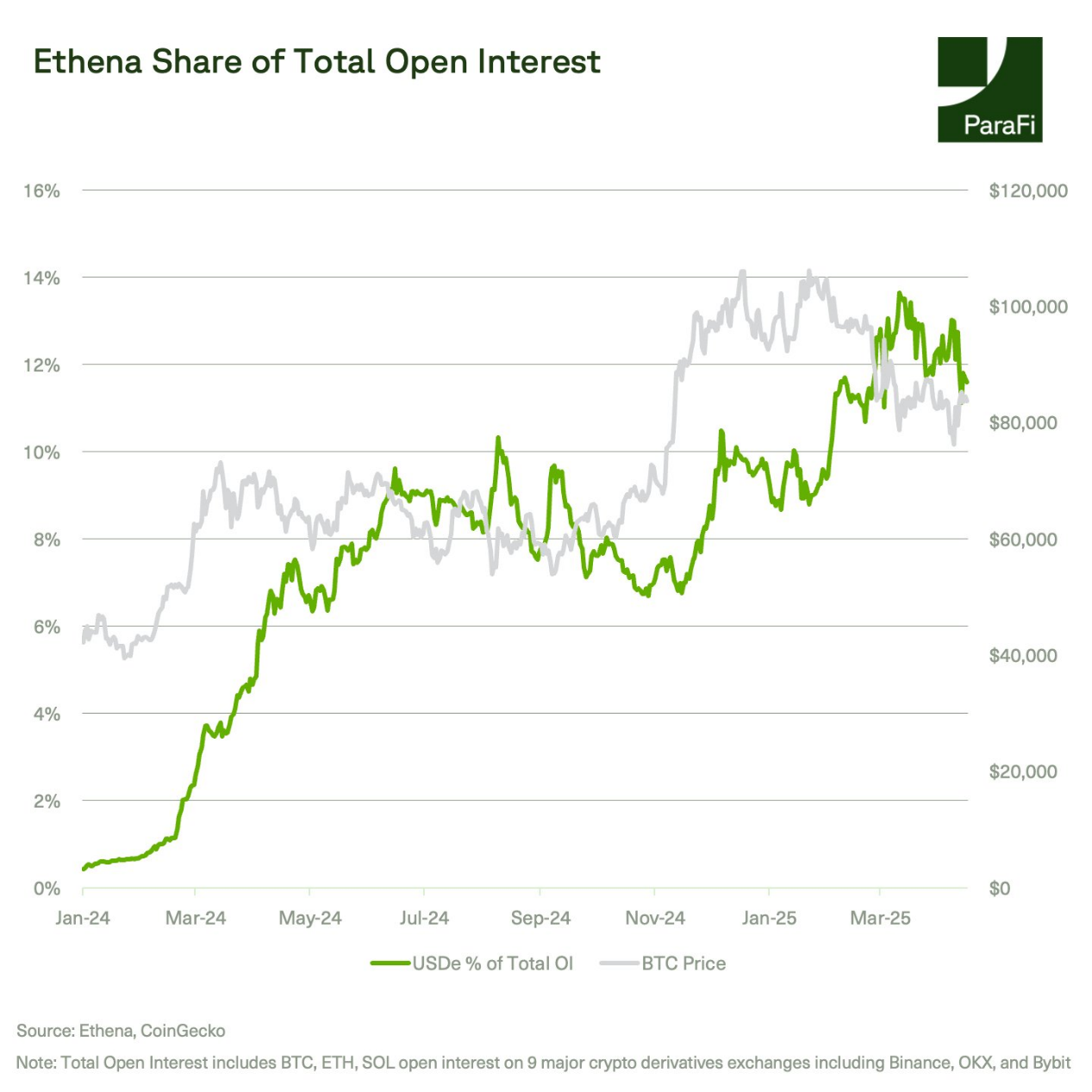

Currently, Ethena’s supply is around 5 billion, and its total TVL accounts for only 12% of the open interest of Bitcoin, Ethereum, and Solana futures. This is a relatively conservative measure because not all of Ethena’s collateral is pegged to perpetual contracts.

In a period of explosive growth in open interest, such as late 2024, even if Ethena's supply reaches $6 billion, its supply will only account for 14% of the market share.

Ethena has solidified its position as the cornerstone of DeFi, with USDe and sUSDe deeply integrated into the entire ecosystem.

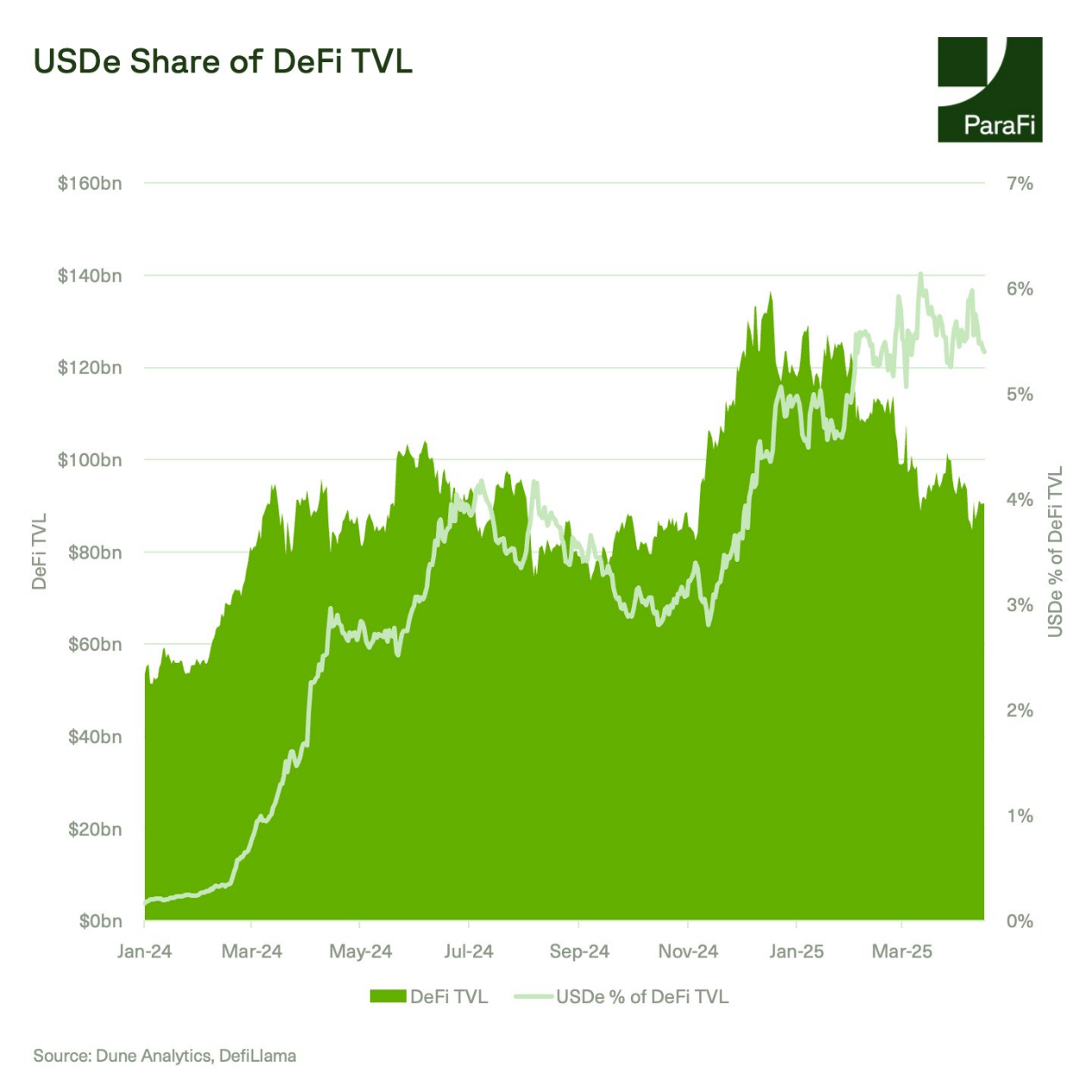

USDe alone contributes about 60% of Pendle’s TVL and about 12% of Morpho’s TVL. Ethena’s share of DeFi TVL has been growing since its launch, reaching about 6% in March this year.

While DeFi TVL has fallen 23% year to date, in sync with recent price action and the ByBit hack in February, USDe’s TVL has only fallen 17%.

What opportunities and risks will you focus on in the future?

- USDe supply in a negative funding rate environment

- Exchange Operation Risks

- USDtb Supply Growth and Integration

- iUSDe Institutional Adoption

- Ethena's Converge is now live

- USDe Payment Use Cases

Related reading: A comprehensive interpretation of Ethena: the next generation of the cryptocurrency federation

You May Also Like

The Giants Are Stumbling: Why BlockDAG’s 20-Exchange Launch is the Market’s New Safe Haven

IP Hits $11.75, HYPE Climbs to $55, BlockDAG Surpasses Both with $407M Presale Surge!