DOGE Crypto Enters ‘Maximum Opportunity’ Zone

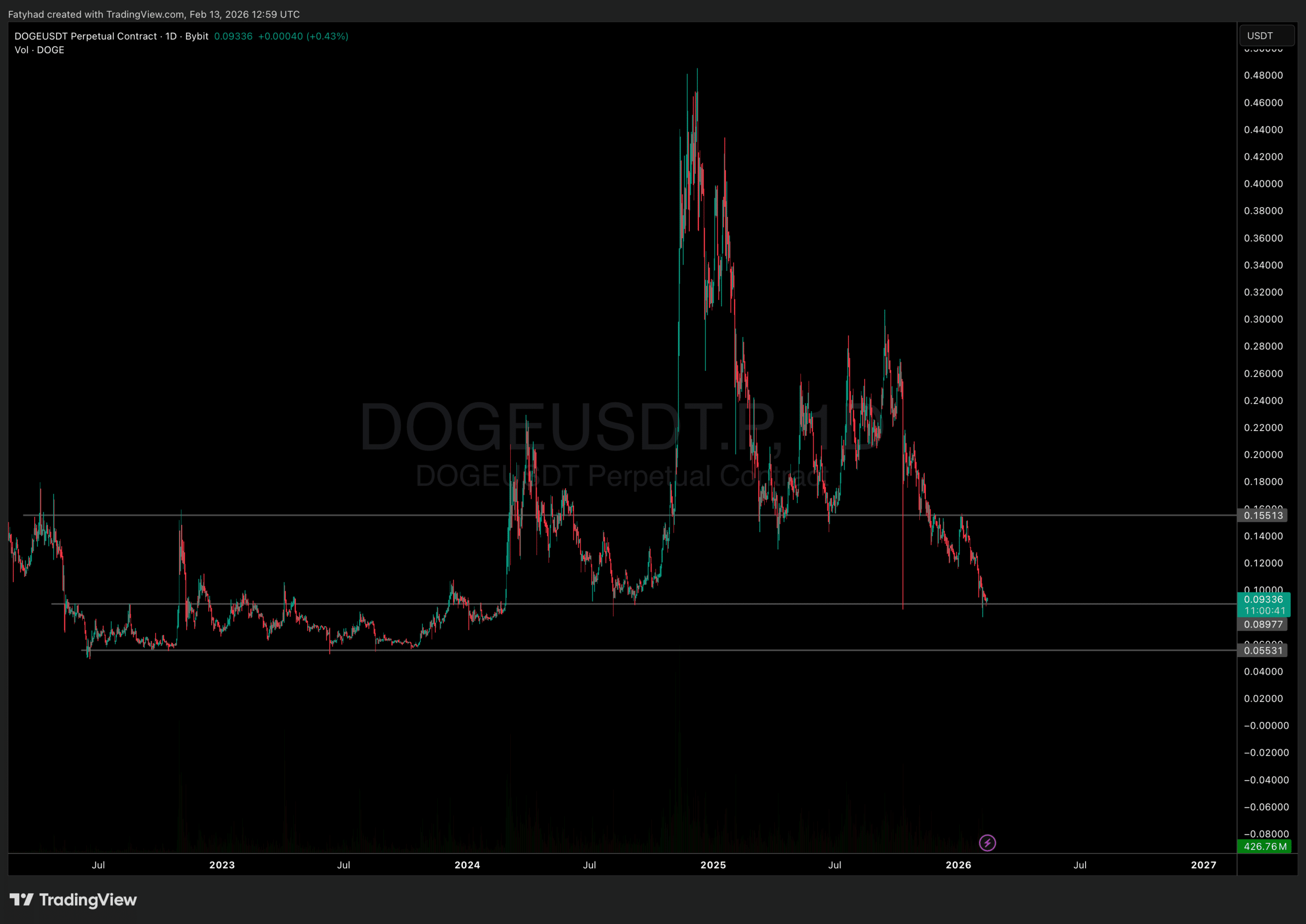

DOGE ( DOGE $0.0966 24h volatility: 5.0% Market cap: $16.30 B Vol. 24h: $914.11 M ) is currently testing a critical support level near $0.09 as the whole crypto sector is weighted down by extreme fear and weak technical setups.

While DOGE faces immediate downside pressure, market analysts suggest the token has entered a rare “maximum opportunity” zone, characterised by technical indicators that have historically preceded meaningful cyclical bottoms.

EXPLORE: What is the Next Crypto to Explode in 2026?

Is the Crypto Market Signaling a Cyclical Reset?

The recent price action has positioned the largest of the meme coins at an important juncture. Crypto analyst Cryptollica identified this specific accumulation zone using a long-horizon chart of DOGE against the US Dollar Index (DXY).

His theory is that the current correction has returned price action to a historic “Launchpad”: a level that served as breakout resistance in early 2021 before flipping into a macro support fortress during the bear markets of 2022 and 2023. This retest occurs as the broader crypto market navigates complex signals regarding Bitcoin’s next move, which often dictates the beta response for altcoins like DOGE.

The theory posits that prior resistance, once breached, acts as a memory point for institutional positioning. When the market revisits these levels after a full boom-bust loop, they often provide favorable risk-reward ratios for entry.

DISCOVER: Best Solana Meme Coins By Market Cap 2026

DOGE Crypto Technical Analysis: RSI and Key Levels

Central to this technical analysis is the 10-day Relative Strength Index (RSI), which is currently hovering near 34. In previous market cycles, specifically 2015, the March 2020 crash, and mid-2022, visits to this “red line” zone marked capitulation points followed by sustained rallies.

While earlier reports examined if Dogecoin price was preparing for aggressive upside similar to past cycles, the current reality demands DOGE first defend the $0.089 floor.

DOGE Price Analysis Source

Conversely, a weekly close below $0.09 would likely invalidate the bullish “Launchpad” thesis. Such a breakdown could trigger a deeper slide toward the $0.080 liquidity cluster, extending the correction that began in January.

EXPLORE: 10 New Upcoming Binance Listings to Watch in February 2026

Maxi Doge Presale Accelerates as DOGE Crypto Tests Critical Support

As Dogecoin tests the crucial $0.09 support level, the meme coin market is entering a decisive phase. DOGE currently trades around $0.0935, with analysts warning that a weekly close below $0.09 could open the door toward $0.080. For bulls, defending this level is essential to confirm the “Launchpad” accumulation thesis.

While DOGE fights to stabilize, Maxi Doge (MAXI) is moving ahead with its ongoing presale. The project has already raised over $4.5 million, with tokens currently priced at $0.0002803.

Maxi Doge leans into pure meme culture but pairs it with structured incentives for early buyers. Its staking model distributes rewards daily through a smart contract-powered pool.

The project also runs ROI-based community contests and is preparing partner events tied to futures platform integrations and gamified tournaments.

If DOGE successfully reclaims momentum from this support zone, capital rotation into smaller meme assets could follow. Maxi Doge positions itself early in that cycle, offering presale exposure while the wider meme sector searches for direction.

Visit Maxi Doge Here

nextThe post DOGE Crypto Enters ‘Maximum Opportunity’ Zone appeared first on Coinspeaker.

You May Also Like

Fed rate decision September 2025

Glenn Hughes Scores His Greatest Chart Debut On His Own