From Lithuania to Poland: The UTORG Group’s Regulatory Migration and the Rise of ChainValley!

As European regulators tighten the noose on Virtual Asset Service Providers (VASPs) ahead of MiCA implementation, the UTORG Group—a key payment facilitator for offshore casinos via SoftSwiss—has executed a strategic jurisdictional shift. Following the suspension of its Lithuanian operations, evidence points to a migration toward Poland via Chain Valley Sp. z o.o., signaling a “whack-a-mole” approach to maintaining high-risk payment rails.

Key Findings

- Executive Smoking Gun: Ilie Cernişev, identified in regulatory filings as the CEO of Utorg OÜ (Estonia), is currently the Chairman/CEO of Chain Valley Sp. z o.o. (Poland).

- Operational Successor: Chain Valley has replaced the suspended Lithuanian entity UAB Utrg (utPay) as the primary crypto-to-fiat processor for the FinteqHub (SoftSwiss) casino ecosystem.

- The “wrapper” Technique: The group utilizes a “Crypto Purchase” wrapper (operating via the

chain-valley.prodomain) to process credit card and Open Banking payments for unlicensed offshore casinos, appearing on player bank statements as a neutral IT service rather than gambling. - Holding Structure: The group is ultimately controlled by UTORG LABS HOLDING LTD in Abu Dhabi, which owns the branding, intellectual property, and global domains (

utorg.com,utorg.pro). UTORG discloses a holding / ownership layer tied to the UTORG website/app stack. - UTORG’s own Terms of Use link “Buy Crypto” directly to

app.chainvalley.pro. - Regulatory Arbitrage: The move to Poland (VASP Registration RDWW-765) exploits a transitional period in Polish AML oversight compared to the now-strict Lithuanian and Estonian regimes.

Compliance Analysis

While no public registry or filing yet confirms a direct ownership or group‑company link between UTORG LABS HOLDING LTD / UAB Utrg and Chain Valley sp. z o.o., the temporal substitution of utPay by Chain Valley in identical casino integrations, the close mirroring of product and infrastructure, and the documented movement of a former Utorg CEO into the top role at Chain Valley together form a relational signature that makes an operational connection highly probable and the hypothesis of pure coincidence remote.”

The connection between UTORG and Chain Valley is highly probable based on a “preponderance of evidence” rather than a single smoking gun. In compliance terms, this is often referred to as a “Relational Signature”—where technical, corporate, and temporal data points align so perfectly that the likelihood of coincidence is negligible.

1. The “Whack-a-Mole” Temporal Alignment

The most compelling evidence is the timing. As UAB Utrg (utPay) faced regulatory pressure and eventual suspension in Lithuania, Chain Valley Sp. z o.o. simultaneously appeared as the primary crypto-processing alternative for the exact same merchant network (SoftSwiss/FinteqHub).

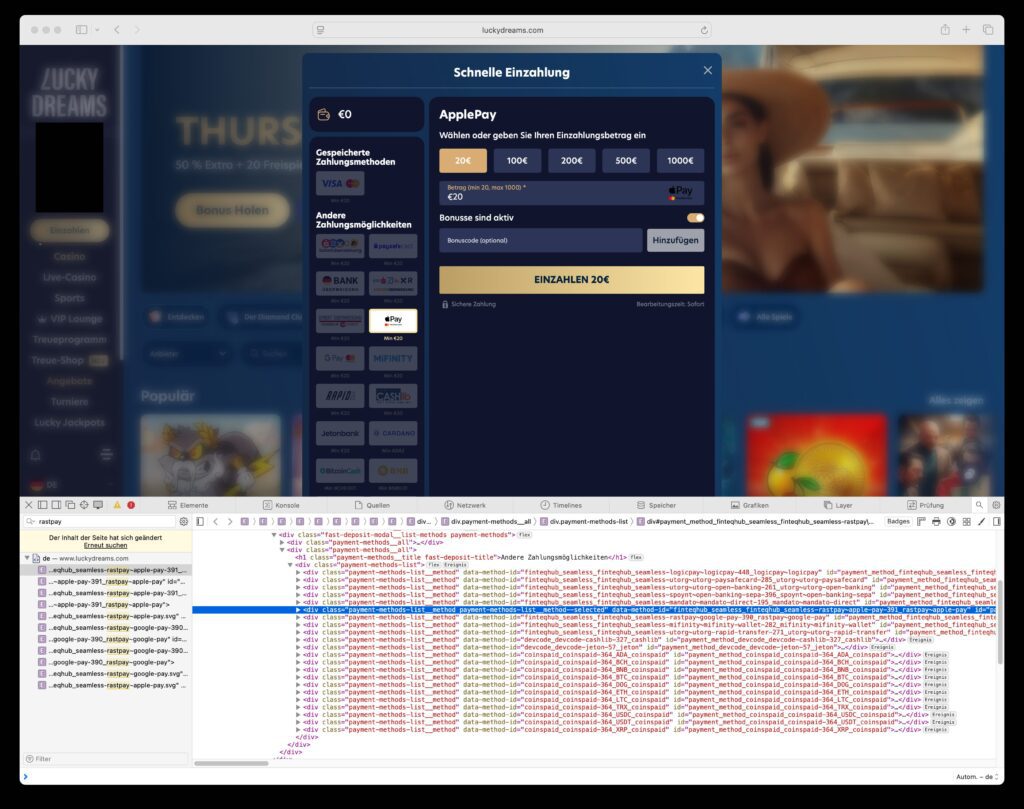

The Switch: In the source code of platforms like LuckyDreams, the data-method-id attributes shifted from referencing utorg or utpay endpoints to chain-valley or rastpay (a brand associated with the Polish migration) while maintaining the exact same UI layout for the user.

1. Structural Evolution and Executive Continuity

The investigation into the UTORG Group reveals a highly agile corporate structure designed to navigate the tightening EU regulatory landscape. The group’s journey from Estonia (Utorg OÜ) to Lithuania (UAB Utrg) and now Poland (Chain Valley Sp. z o.o.) is not a series of independent failures, but a strategic “license migration.”

The most definitive link is the role of Ilie Cernişev (LinkedIn). Corporate records from 2022 confirm him as the CEO of the Estonian branch during its peak expansion. His reappearance as the head of Chain Valley in Poland (KRS 0001036419) as of August 2023 provides irrefutable evidence that Chain Valley is the current operational arm of the UTORG ecosystem.

2. The FinteqHub / SoftSwiss Nexus

Source code of Lucky Dreams payment page showing payment rail FinteqHub -> utorg

Source code of Lucky Dreams payment page showing payment rail FinteqHub -> utorg

The group’s primary revenue driver is its partnership with SoftSwiss, specifically through its payment aggregator FinteqHub. Historically, “utPay” was the preferred method for “Crypto via Card” transactions on casino sites like LuckyDreams and Rooli. The screenshot on the left shows the payment rail in the code of the Lucky Dreams payment page, with a direct connection between SoftSwiss FinteqHub and UTORG.

When Lithuania’s FCIS tightened requirements, “utPay” was phased out. Real-time transaction monitoring and source code analysis of the LuckyDreams payment page (see uploaded image) show that Chain Valley now occupies the exact technical slot previously held by utPay, using identical API structures and user interface elements.

A digital “DNA” test of the two services reveals nearly identical technical fingerprints:

- API Architecture: The way Chain Valley’s payment widget interacts with the FinteqHub aggregator mirrors the legacy utPay integration.

- Customer Support & Documentation: Internal support documents for merchants transitioning from utPay to Chain Valley used similar language, and in some cases, shared the same technical support channels or desk-level contact points.

3. The Abu Dhabi Command Center

While the EU entities change, the core remains stable in the UAE. UTORG LABS HOLDING LTD (Abu Dhabi Global Market) acts as the intellectual and legal “mother ship.” It manages:

- Mikhail Zhuchkov (Chairman) and Eugene Petrakov (CEO) as the group’s strategic leaders.

- The centralized development of the “fiat-to-crypto” technology stack.

- The legal ownership of the group’s brand and domains.

4. AML/CFT Risk & “Merchant of Record” Masking

For financial institutions, Chain Valley presents a significant Transaction Laundering risk. By acting as a “Virtual Asset Service Provider,” the company allows banks to see a “crypto purchase” rather than a “casino deposit.” Under PSD2 and upcoming MiCA rules, this “masking” is a high-risk typology for circumventing national gambling bans.

Compliance & Regulatory Implications

1) “VASP registration” is not a fiat payments licence

ChainValley’s RDWW listing is a virtual-currency activities registration, not a PSD2 payment institution licence.

If the same entity (or stack) effectively initiates/receives/aggregates fiat flows for merchant purposes (e.g., casino deposits masked as “crypto purchases”), regulators will ask: who is the authorised payment service provider in the chain, and where is the safeguarded client money?

2) Terms banning “illegal gambling” are meaningless without controls

ChainValley explicitly bans use for “illegal gambling operations.” If offshore casinos are a major source of inbound traffic and conversion flow (as FinTelegram’s Rail Atlas work repeatedly indicates), then either:

- compliance is not implemented,

- compliance is deliberately bypassed, or

- the model relies on formal “terms” for regulators while the commercial reality is different.

3) MiCA transition creates “migration incentives” (Lithuania → Poland)

ESMA’s published overview shows different national transitional windows for MiCA across Member States (e.g., Lithuania vs Poland). That matters because high-risk payment layers tend to re-platform to the jurisdiction where onboarding friction is lowest—without changing the underlying customer base (Germany-first, in your observed casino rails).

4) Historic Estonia → Lithuania shift is a known pattern

Utorg OÜ’s licence invalidation in Estonia is a notable marker in the “move the entity, keep the business” playbook. Lithuania’s register confirms UAB Utrg’s declared VASP activities, which fits the observed “regulatory transition” narrative.

Summary Table: Connected Entities & Brands

| Entity / Brand | Jurisdiction | Domains observed | Regulatory posture (public) | Role in rail hypothesis |

|---|---|---|---|---|

| UTORG LABS HOLDING LTD | UAE (Abu Dhabi) | utorg.com stack | Disclosed as ownership layer for UTORG app/site stack | Brand/ownership layer |

| Utorg OÜ | Estonia | utorg.pro (site owner references) | Estonia FIU lists licence invalidated (historic) | Prior EU operating layer / legacy |

| UAB Utrg | Lithuania | utpay.io | Declared as VASP activities in LT register bulletin | EU operating layer (crypto services) |

| Chain Valley Sp. z o.o. (ChainValley) | Poland | chainvalley.pro / app.chainvalley.pro | KRS 0000984860 (Chain Valley); Listed in Poland RDWW (VASP register) | Conversion backend; “crypto purchase / fake-FIAT” node |

Export to Sheets

Whistleblower Call to Action

Are you an insider? We are seeking further information regarding the internal transfer of merchant contracts from UAB Utrg to Chain Valley and the specific roles of the Abu Dhabi holding company in managing EU fiat flows. Report anonymously via Whistle42. Your identity is protected by end-to-end encryption.

Sources & Links

- FinTelegram Reports: Chain Valley & Utorg Coverage

- Lithuanian Register of Legal Entities: UAB Utrg Status

- Polish VASP Register: Chain Valley Sp. z o.o. Registration

- Corporate Records: KRS 0000984860 (Chain Valley)

- UTORG Legal Pages: About UTORG Group

You May Also Like

WLFI Expands Into Forex With World Swap Launch

BUZZ HPC Closes Acquisition of 7.2 MW Toronto Site to Build Data Centre for Sovereign AI Infrastructure

BitGo wins BaFIN nod to offer regulated crypto trading in Europe

BitGo’s move creates further competition in a burgeoning European crypto market that is expected to generate $26 billion revenue this year, according to one estimate. BitGo, a digital asset infrastructure company with more than $100 billion in assets under custody, has received an extension of its license from Germany’s Federal Financial Supervisory Authority (BaFin), enabling it to offer crypto services to European investors. The company said its local subsidiary, BitGo Europe, can now provide custody, staking, transfer, and trading services. Institutional clients will also have access to an over-the-counter (OTC) trading desk and multiple liquidity venues.The extension builds on BitGo’s previous Markets-in-Crypto-Assets (MiCA) license, also issued by BaFIN, and adds trading to the existing custody, transfer and staking services. BitGo acquired its initial MiCA license in May 2025, which allowed it to offer certain services to traditional institutions and crypto native companies in the European Union.Read more