Crypto Market News Today: XLM Rides RWA Momentum, AVAX Catches Smart-Money Longs, and DeepSnitch AI On Track for 1000x 2026 Launch

Bitcoin miners unloaded nearly 49,000 BTC, around $3.2 billion, from their wallets across just two days in early February, the largest such spike since November 2024. And this same week, the US National Credit Union Administration proposed its first licensing framework under the GENIUS Act, carving a path for credit union subsidiaries to become federally supervised stablecoin issuers.

Crypto market news today is all about a market in mid-metamorphosis, with miners reshuffling and regulators drafting frameworks. But ultimately, the daily crypto headlines are tilting from speculation toward infrastructure.

Amid all of it, DeepSnitch AI has raised above $1.58 million at $0.03985, a 163% gain from $0.01510, where it began. Launch is practically on the doorstep, along with an anticipated moonshot.

Miners unload billions as credit unions prepare for stablecoins

On February 5, miner outflows hit 28,605 BTC, or roughly $1.8 billion, followed by 20,169 BTC the next day. CryptoQuant notes these figures include internal wallet shuffles and custodian transfers, not just exchange sales.

Public filings tell a mixed story with CleanSpark having sold 158 BTC from 573 mined in January, Cango having offloaded 550 BTC plus another 4,451 to fund an AI pivot, and Canaan and LM Funding reporting zero sales and growing their treasuries.

And the NCUA’s proposed rule covers above 4,000 credit unions serving around 144 million members and roughly $2.38 trillion in assets. A 120-day approval clock means applications are deemed approved by default if the agency doesn’t act, and stablecoins issued on public blockchains can’t be rejected on that basis alone.

The infrastructure is being built for tomorrow, and the crypto market news today for retail is always where the asymmetry is right now.

AI presale momentum, institutional RWA confidence, and the only major that smart money is backing

1. DeepSnitch AI

Most presales rush to list, but DeepSnitch AI did the opposite. As the team postponed the token generation event, it also kept the platform live in a closed environment where only presale holders can access the tools, which have already shipped internally during presale.

Come launch, those five AI agents will do the work of DYOR, only better, spanning contract auditing, whale detection, social sentiment analysis, risk scoring, and conversational intelligence. Running real data for users right now, this is a community that’s already familiar with the system and already staking at dynamic, uncapped APR.

Take AuditSnitch as one example of the five in the suite. You paste a token’s contract address and get a plain verdict, CLEAN, CAUTION, or SKETCHY, after it checks ownership control, liquidity locks, hidden taxes, and known exploit patterns. That single tool alone solves a problem that costs retail billions every year.

The presale has raised above $1.58 million at $0.03985. And when launch arrives, which is very, very soon, the market will be pricing a platform that’s already battle-tested, not a whitepaper hope. That’s how 1000x trajectories begin: proven utility meets open-market discovery.

With crypto market news today in mind, there’s little doubt that DeepSnitch AI stands a strong chance of being the next moonshot token. The system is proven, its utility is abundantly clear, and the pricing hasn’t caught up yet, though the doors won’t stay this open much longer.

2. Stellar

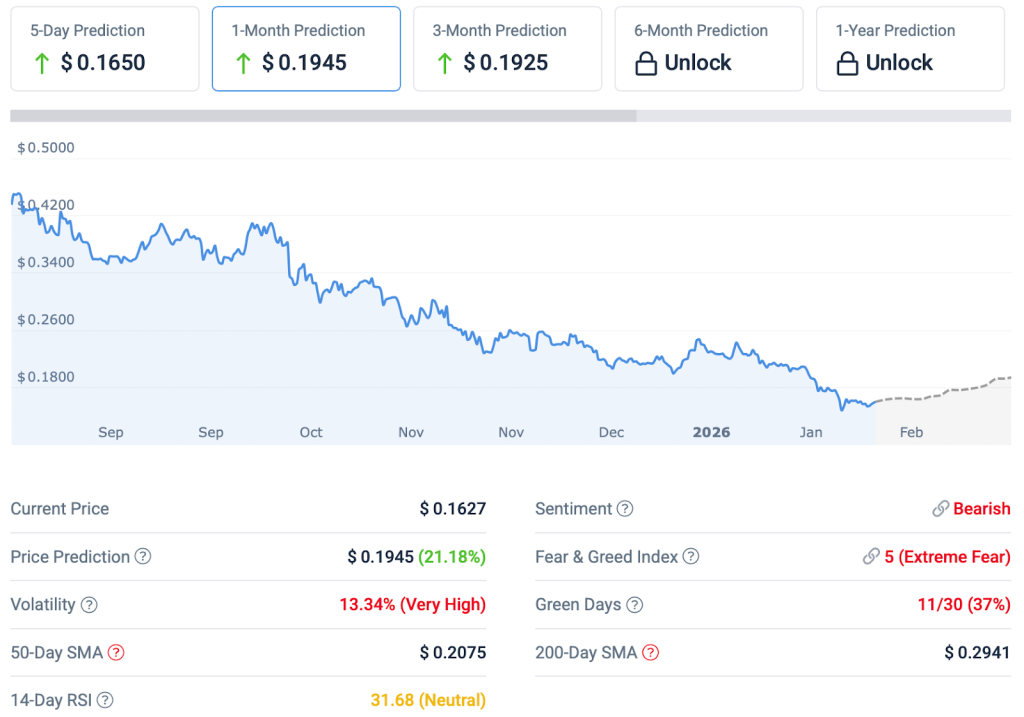

On February 12, Stellar climbed 3.27% to around $0.161 while Bitcoin barely budged, and the reason wasn’t hype.

Japan’s SBI Trade VC introduced a new lending utility for XLM holders, offering a passive-income avenue that signals institutional faith in Stellar’s real-world-asset rails. RSI sits at 31.68, neutral after weeks of oversold readings, with support around $0.151 and resistance near $0.163.

The 50-day SMA is projected to be around $0.179 by mid-March, and the 200-day SMA above $0.257 shows how far the price has drifted from its longer-term trend. A recovery to that level alone would mean roughly 60% upside.

3. Avalanche

Nansen data flagged AVAX as the only major cryptocurrency where smart-money traders held a net long position ($10.5 million) while being short virtually everything else. And AVAX was up around 2% to roughly $8.93 on February 12, riding a modest rotation into altcoins as the Altcoin Season Index ticked higher.

Above $8.50, resistance near $9.20 is the next test. Below, $8.00 becomes the floor. But the broader question is whether Bitcoin holds above $68,000 long enough to sustain those altcoin flows.

Smart money being selectively long is meaningful, but it’s worth remembering that even a well-positioned large-cap has a ceiling on its multiples.

Last look

Miners are reshuffling billions as credit unions are lining up for stablecoin licences. Smart money is long on exactly one major. And that’s all worth knowing across the market, but then, there’s DeepSnitch AI, priced at $0.03985 with live tools, uncapped staking, and a launch date that’s practically here.

The token offers something unseen among crypto market news today, with a 1000x launch on the horizon. And for a brief time ahead of that launch, bonus codes are available to add extra tokens to committed purchases, so you can compound your position even more.

Explore the official website before this stage closes, and follow X and Telegram for more updates from the team.

FAQs

What is the biggest crypto market news today in February 2026?

Bitcoin miner outflows of nearly 49,000 BTC and the NCUA’s proposed stablecoin licensing rules are the top market movers, while DeepSnitch AI’s approaching 1000x launch is among breaking crypto news today.

Based on crypto market news today, is Stellar a good investment right now?

XLM benefits from new institutional lending utility and solid RWA momentum, but for 100x-scale upside, DeepSnitch AI’s presale pricing and live platform offer a magnitude of return potential that Stellar’s market cap can’t contend with.

What is the key crypto market news today for presale investors?

DeepSnitch AI has crossed $1.58 million raised with three live AI tools, dynamic staking, and launch closing in, making it the most compelling crypto market news today story for anyone scouting the next crypto to 100x, or even 1000x in this case, among presale opportunities.

DISCLAIMER: CAPTAINALTCOIN DOES NOT ENDORSE INVESTING IN ANY PROJECT MENTIONED IN SPONSORED ARTICLES. EXERCISE CAUTION AND DO THOROUGH RESEARCH BEFORE INVESTING YOUR MONEY. CaptainAltcoin takes no responsibility for its accuracy or quality. This content was not written by CaptainAltcoin’s team. We strongly advise readers to do their own thorough research before interacting with any featured companies. The information provided is not financial or legal advice. Neither CaptainAltcoin nor any third party recommends buying or selling any financial products. Investing in crypto assets is high-risk; consider the potential for loss. Any investment decisions made based on this content are at the sole risk of the readCaptainAltcoin is not liable for any damages or losses from using or relying on this content.

The post Crypto Market News Today: XLM Rides RWA Momentum, AVAX Catches Smart-Money Longs, and DeepSnitch AI On Track for 1000x 2026 Launch appeared first on CaptainAltcoin.

You May Also Like

WLFI Expands Into Forex With World Swap Launch

BUZZ HPC Closes Acquisition of 7.2 MW Toronto Site to Build Data Centre for Sovereign AI Infrastructure

BitGo wins BaFIN nod to offer regulated crypto trading in Europe

BitGo’s move creates further competition in a burgeoning European crypto market that is expected to generate $26 billion revenue this year, according to one estimate. BitGo, a digital asset infrastructure company with more than $100 billion in assets under custody, has received an extension of its license from Germany’s Federal Financial Supervisory Authority (BaFin), enabling it to offer crypto services to European investors. The company said its local subsidiary, BitGo Europe, can now provide custody, staking, transfer, and trading services. Institutional clients will also have access to an over-the-counter (OTC) trading desk and multiple liquidity venues.The extension builds on BitGo’s previous Markets-in-Crypto-Assets (MiCA) license, also issued by BaFIN, and adds trading to the existing custody, transfer and staking services. BitGo acquired its initial MiCA license in May 2025, which allowed it to offer certain services to traditional institutions and crypto native companies in the European Union.Read more