Sharplink Executives Push Ether as Institutional Tool as Prices Fall

TLDR

- Sharplink adopts ether treasury strategy focusing on staking and yield.

- Executives see Ethereum as infrastructure for tokenization and stablecoins.

- Sharplink emphasizes long-term locked capital to earn risk-adjusted returns.

- Ether staking provides about 3% yield while holding permanent capital.

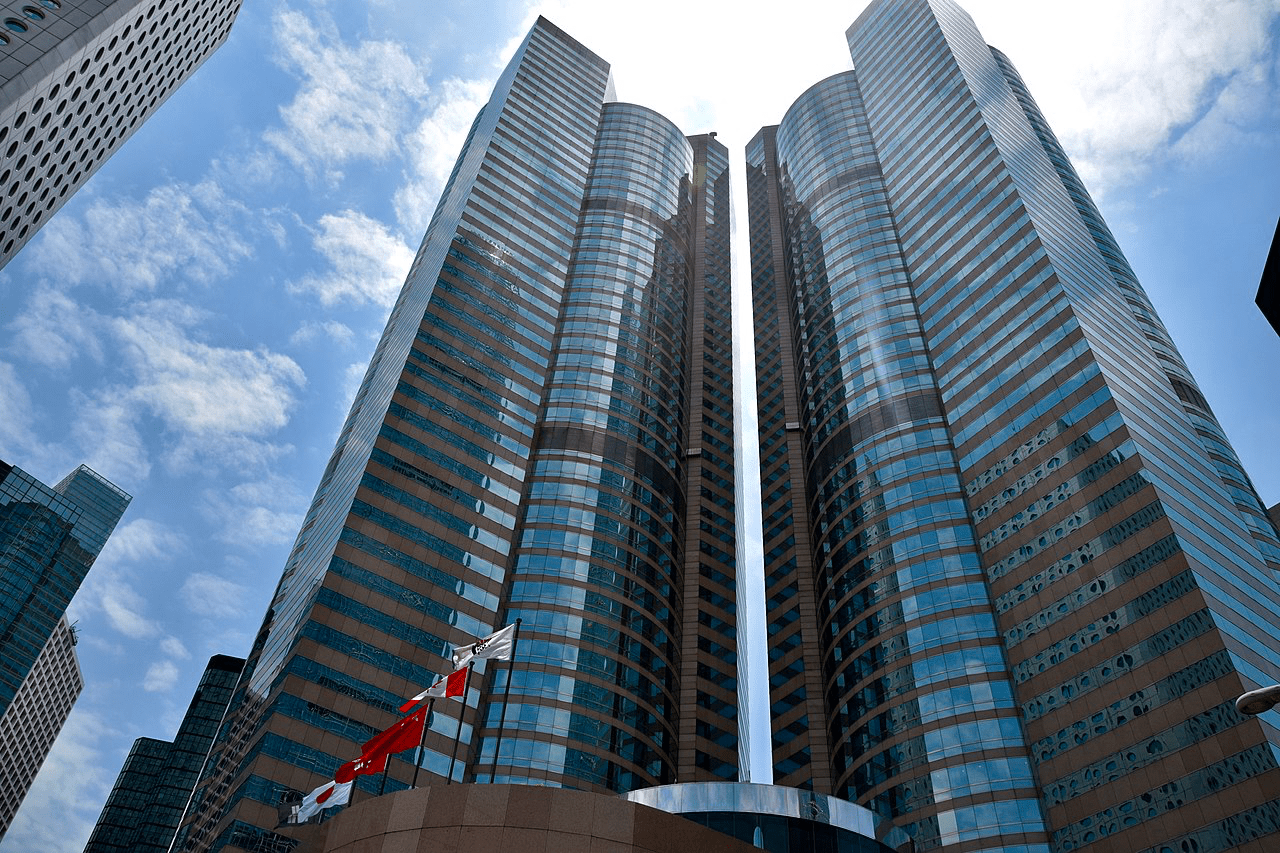

At Consensus Hong Kong 2026, Sharplink Gaming executives highlighted a new approach to ether. Chairman Joe Lubin and CEO Joseph Chalom presented digital asset treasuries (DATs) as more than investments, describing them as productive financial infrastructure.

The discussion comes as ether prices and digital asset treasury stocks face volatility. Sharplink’s share price soared last May after adopting an ether treasury strategy but has since fallen along with similar firms.

Ether as Productive Capital

Chalom described a shift in institutional strategy. “I’ve never seen more of a moment of differentiation where the actual macro tailwinds for Ethereum have never been better in its 10-and-a-half-year history,” he said. He pointed to the growth of stablecoins and tokenization, noting that over 65% of BlackRock’s $14 trillion projected tokenization is on Ethereum.

Lubin emphasized ether’s yield potential. “Ether would be a much better asset… because it is a productive asset. It yields. It has a risk-free rate,” he said. Sharplink has staked nearly all its holdings, earning roughly 3% from staking, and plans to continue accumulating ether.

The executives argued that deploying permanent capital differs from passive instruments like ETFs, which require liquidity. “We own permanent capital,” Chalom said. “The third stage is making your ETH productive.”

Institutional DeFi and Risk-Adjusted Returns

Sharplink outlined what it calls “good institutional DeFi,” using long-term locked capital to generate returns without chasing high-risk ventures. Chalom stated, “We’re not looking for convex VC 10x outcomes — we’re looking for the best risk-adjusted yield for our investors.”

The approach aims to provide steady, risk-managed returns while supporting Ethereum’s ecosystem. By holding ether in a productive capacity, Sharplink seeks to combine treasury management with broader blockchain adoption.

Ether’s Role in Corporate Strategy

Lubin compared the current stage of blockchain adoption to the early internet era. “A long time ago…there were internet companies. Now every company is an internet company. Soon, every company is going to be a blockchain company,” he said.

The executives predict firms will increasingly hold tokens on balance sheets, requiring advanced onchain treasury tools. Ether is positioned not only as a financial asset but as a platform for institutional growth and infrastructure.

Sharplink’s strategy reflects the belief that despite market volatility, ether remains a productive asset capable of generating yield and supporting tokenized finance.

The post Sharplink Executives Push Ether as Institutional Tool as Prices Fall appeared first on CoinCentral.

You May Also Like

Spot ETH ETFs Losses Outpace Bitcoin As Monthly Netflows Remain Negative

The Hithium Disclosure Risk Highlights Regulatory Enforcement Challenges of the Stationary Battery Industry