Automation In Finance Statistics 2026: Growth Facts

In today’s fast-paced financial landscape, automation has evolved from being a cutting-edge innovation to a necessary tool for efficiency. Imagine a world where tedious tasks like manual bookkeeping and data entry are things of the past.

Today, this vision is closer than ever, as automation transforms the financial sector by enhancing accuracy, reducing operational costs, and freeing professionals to focus on more strategic tasks. Whether it’s managing investment portfolios or automating tax compliance, automation is revolutionizing finance, and it’s only just beginning. Let’s explore the data behind this game-changing shift.

Editor’s Choice

- The global financial automation market is valued at $8.1 billion and is projected to reach $18.4 billion by 2030 at a 14.6% CAGR.

- The intelligent automation market is forecast to grow from $12.6 billion to $25.8 billion by 2033, with 35% of revenue coming from BFSI.

- Finance automation tools helped high-performing institutions cut KYC and loan processing time by 60–70% and operational costs by over 45% while achieving near-zero data entry errors.

- Over 54.2% of finance teams operate with only partial automation, while 61.6% say accuracy now outweighs speed as the top automation priority.

- The BFSI sector is expected to capture around 35% of global intelligent automation revenues as institutions invest to enhance fraud detection, compliance, and customer experience.

- Automation in finance has delivered 60–70% faster processing and reduced onboarding timelines from days to hours in leading RPA case studies.

Recent Developments

- Stripe AI’s foundation model increased card-testing attack detection by 64% for large businesses.

- JPMorgan Chase AI credit scoring projected to fuel $1.81 trillion in 2026 investment-grade bond issuance.

- SAP AI-powered financial closing achieved 621% ROI, 22% less closing time for customers.

- Visa AI fraud system prevented over $40 billion in fraud across 320 billion transactions analyzed.

- PayPal AI security engine blocked $500 million in fraud per quarter using 500+ data points.

- Mastercard Decision Intelligence Pro grew Value-Added Services revenue 22% YoY with an AI fraud boost.

- Deloitte PairD AI chatbot reached 75% adoption among UK audit staff, tripling from the prior year.

- Global AI fintech market valued at $36.61 billion, projected 22% CAGR to 2031.

CFO Workload as a Barrier to Data and Technology Value

- 70% of CFOs report that their team’s already-heavy workload is the biggest obstacle to extracting value from data and technology initiatives.

- The finding highlights that capacity constraints, rather than a lack of tools, are the primary barrier to digital transformation in finance functions.

- Overburdened finance teams struggle to allocate time for analytics, automation, and strategic projects, limiting the impact of technology investments.

- The statistic underscores the need for process automation and workload optimization to unlock greater value from financial data.

- Without reducing operational strain, organizations risk underutilizing advanced data capabilities despite increased spending on technology.

(Reference: Solvexia)

(Reference: Solvexia)

Financial Automation Market Size

- Cloud-based segment expected to surpass $12.8 billion by 2032 due to scalability and low costs.

- Asia-Pacific autonomous finance grows at 17.9% CAGR from 2026 to 2035, driven by digitalization.

- Europe RPA in financial services is valued at €6.41 billion in 2025, 16.2% CAGR to €15.78 billion by 2033.

- Tax automation segment to reach $6.9 billion by 2030 at 13.9% CAGR amid complex regulations.

- Accounting automation grows at 15.2% CAGR, streamlining reporting and compliance processes.

- 80% of fintechs implement AI for process automation, improving efficiency by 75%.

Market Trends in Financial Automation

- AI fintech market valued at $36.61 billion, projected 22% CAGR to $99.09 billion by 2031.

- AI spending in financial services exceeds $35 billion, up 24.5% from 2025.

- AI agents automate >30% manual processes like data processing and reporting.

- The blockchain finance market is valued at $26.8 billion with 34.1% CAGR to 2035.

- 80% enterprise finance teams use internal AI platforms for operations.

- NLP finance market grows at 15-20% CAGR through 2035 amid automation demand.

- 70% global payments are expected to be real-time by 2030, transforming digital transactions.

- Automation top-three cybersecurity budget priority, reducing manual compliance hours.

- Cloud financial tools 59-67% adopted by SMBs, cutting manual tasks 39%.

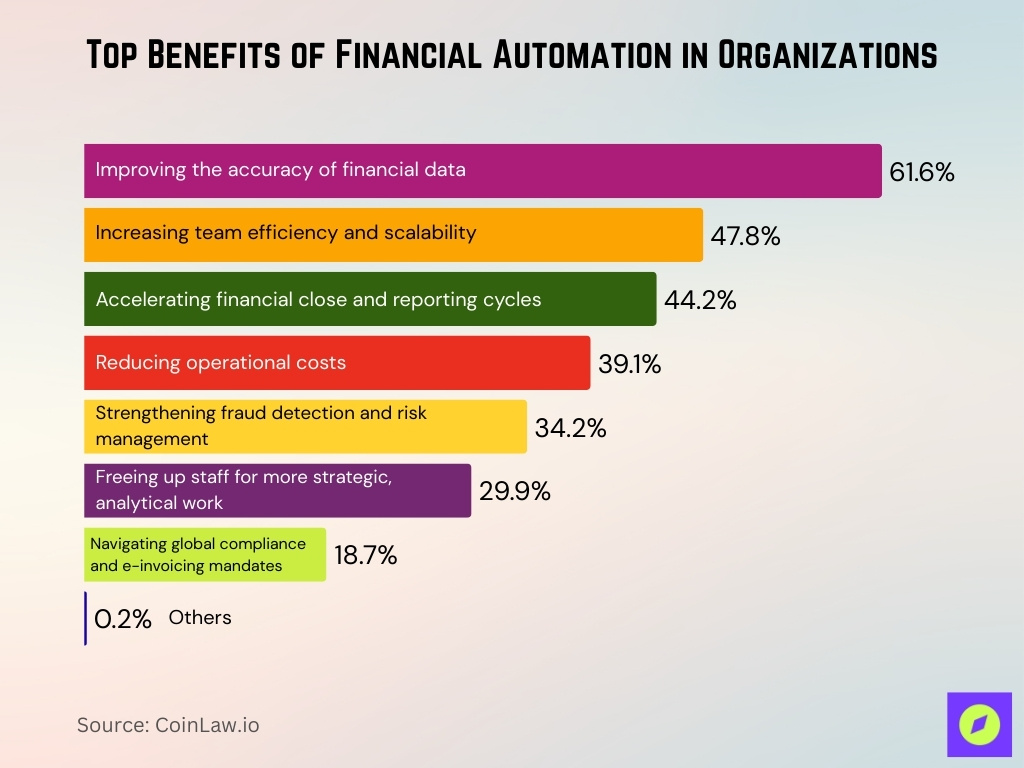

Top Benefits of Financial Automation in Organizations

- 61.6% of organizations report improving the accuracy of financial data as the most significant benefit of automation.

- 47.8% highlight increased team efficiency and scalability, enabling finance departments to handle higher workloads without proportional staff growth.

- 44.2% say automation helps accelerate financial close and reporting cycles, improving the speed of decision-making.

- 39.1% note substantial gains in reducing operational costs through streamlined processes and fewer manual tasks.

- 34.2% emphasize stronger fraud detection and risk management capabilities enabled by automated controls and monitoring.

- 29.9% indicate automation is freeing up staff for more strategic and analytical work, shifting focus from routine tasks to value-added activities.

- 18.7% report benefits in navigating global compliance and e-invoicing mandates, particularly in regulated markets.

- Only 0.2% selected other benefits, suggesting most organizations experience similar core advantages from financial automation.

(Reference: Rossum)

(Reference: Rossum)

Robotic Process Automation (RPA) Impact on Financial Processes

- Global RPA finance market grows from $12.23 billion in 2025 to $15.28 billion at 24.9% CAGR.

- RPA cuts operational costs 30-50%, boosts employee productivity 50% in banking.

- 90%+ reduction in data-entry errors, 90% faster compliance reporting with RPA.

- RPA achieves 99.8% data entry accuracy and reduces errors up to 95% in six months.

- BFSI sector generated 36.52% RPA revenue share in 2025 for banking automation.

- RPA automates 42% financial tasks like reconciliation and payment processing.

- Banks see 30% operational speed increase 25% repetitive task cost reduction.

- RPA finance market valued at $2 billion, 9.7% CAGR to 2033 amid compliance needs.

- 61.6% prioritize RPA for financial data accuracy improvement over efficiency.

AI and Machine Learning Integration in Financial Services

- AI fintech market is valued at $36.61 billion with 22.04% CAGR to $99.09 billion by 2031.

- Deepfake scams targeting financial institutions surged 2000% over the past three years.

- Predictive models boost corporate forecasting accuracy from 80% to 90%.

- AI in risk assessment improves early-warning systems by 40% for loan defaults.

- 55% reduction in suspicious activity report backlog via AI AML compliance.

- AI chatbots handle 90% customer queries, enhancing 24/7 service efficiency.

- 60% credit risk teams use ML for dynamic risk threshold adjustments.

- AI cybersecurity reduces breaches by 37% in multinational banks.

- KYC review times slashed 50% with AI-assisted due diligence tools.

Top Industries Using Machine Learning

- IT and Telecommunications leads with 19% machine learning usage across the sector.

- Banking, Financial Services, and Insurance follows at 18%, focusing on risk and fraud.

- Automotive and Transport accounts for 14%, mainly autonomous systems.

- Healthcare and Retail each contribute 12%, diagnostics, and personalization.

- Manufacturing uses 10% for quality control and predictive maintenance.

- Advertising and Media represent 9%, targeting and content optimization.

- Healthcare leads AI adoption at 78% rate with 36.8% CAGR.

- Financial Services at 71% adoption, 19.6% CAGR for fraud detection.

- 81% Fortune 500 companies use ML for core functions like cybersecurity.

Which Financial Processes Are Most Commonly Automated?

- 54% U.S. finance leaders rank AP automation as the top digital priority.

- 52% companies achieve touchless invoice processing, up from 29% two years ago.

- 78% CFOs plan increased AP automation investment through 2026.

- 81% adoption rate for risk management automation in finance teams.

- 74% adoption for financial reporting automation workflows.

- 54.2% finance teams are partially automated, relying on OCR and manual intervention.

- 70-85% reduction in manual invoice touchpoints via AI capture.

- 50-60% touchless processing rate, exception rates down to 5-12%.

- 88% organizations report significant RPA benefits in finance processes.

- 64% teams are significantly or partially automated, only 8% fully.

Challenges and Barriers to Financial Automation Adoption

- Budget constraints top barrier at 29% for midsize finance teams.

- Integration challenges with legacy systems were cited by 28%.

- Resistance to change affects 14% of automation efforts.

- Lack of technical skills hinders 15% of finance teams.

- Data security concerns worry 11% handling sensitive info.

- Cost primary obstacle for 32% implementing document automation.

- Regulatory hurdles are a barrier for 50% scaling of AI investments.

- Talent gap reported by 50% U.S. financial executives.

- 38% wary of people issues in automation adoption.

Frequently Asked Questions (FAQs)

87% of CEOs reported optimism about attracting and retaining AI talent this year.

61.6% of finance teams state accuracy matters more than speed in automation priorities.

About 40% of financial services firms are predicted to deploy AI agents by late 2026.

60% of financial services CEOs expect AI investments to maintain or boost current staffing levels this year.

Conclusion

As financial services continue to embrace automation, the future looks increasingly efficient and streamlined. Automation technologies, including AI, RPA, and cloud-based solutions, are not only transforming how financial institutions operate but also how they make decisions, protect against fraud, and engage with customers.

While challenges such as security concerns and implementation costs persist, the benefits of automation, greater accuracy, speed, and cost-efficiency, are undeniable. Financial automation will likely become an essential tool for any competitive business, reshaping the financial landscape as we know it.

The post Automation In Finance Statistics 2026: Growth Facts appeared first on CoinLaw.

You May Also Like

Crucial Fed Rate Cut: October Probability Surges to 94%

Hedera (HBAR) Price Today, Chart & Market Cap | Live HBAR to USD Converter