Silver Price Time Bomb: Bank Shorts Are Now Bigger Than Global Supply

A viral post from analyst Alex Mason on X is making the rounds in the metals world, and it’s easy to see why. His claim is simple but explosive: the paper silver market has grown so large that bank short exposure now dwarfs the amount of physical silver the world can actually produce.

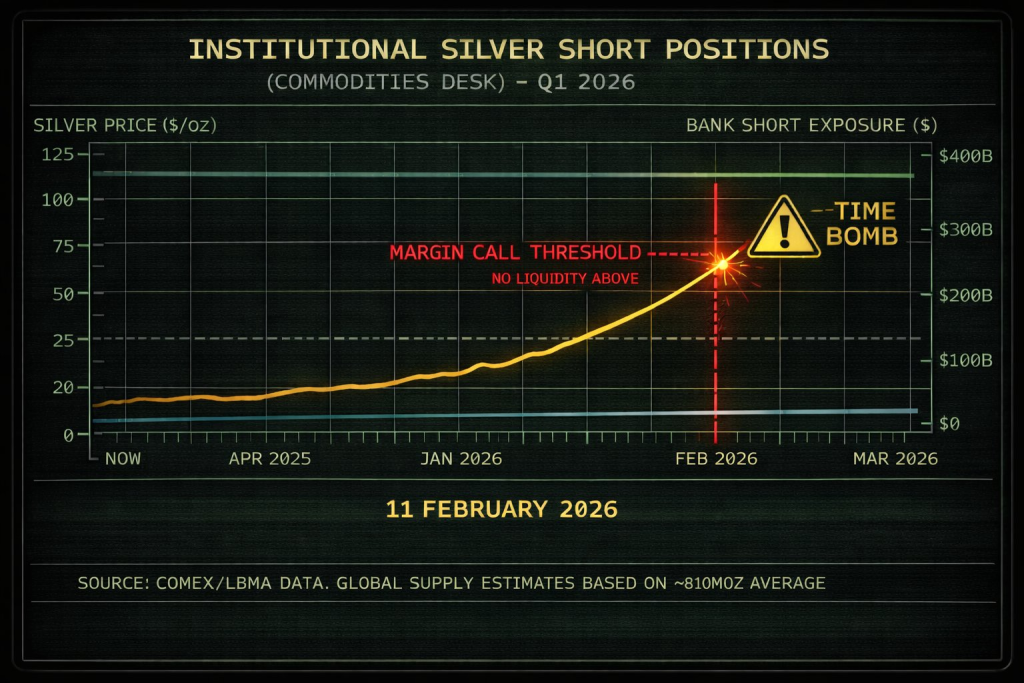

The chart he shared frames the situation as a potential “margin call threshold” event, where silver’s price approaching the $90–$100 zone could create stress across institutional short positions. Whether someone agrees with his conclusion or not, the setup highlights how unstable silver trading can become when leverage dominates the market.

The Core Claim: Paper Silver vs. Physical Reality

Mason points to a staggering imbalance: global silver production is roughly 800 million ounces per year, while bank short exposure is presented as 4.4 billion ounces. That’s multiple years of mining supply tied up in synthetic claims, which immediately raises questions about how “real” the pricing mechanism actually is.

This is the heart of the argument metals bulls always come back to. The silver price is being traded as a massive financial derivative product, where exposure can multiply far beyond what exists in vaults.

One of the most dramatic parts of Mason’s thread is the big drop from the low $90s into the mid-$60s in a very short window. He interprets that volatility not as normal price discovery, but as a forced reset designed to prevent silver from breaking into a zone where short positions become dangerous.

To be clear, silver is historically one of the most volatile major commodities, and sudden moves are not unusual. But Mason’s point is that these moves often happen exactly where liquidity is thinnest, which fuels suspicions about how heavily managed the paper market really is.

The “Margin Call Threshold” Narrative

In the image, the $90+ region is marked as a critical stress zone, implying that a sustained push higher could trigger cascading margin calls for large institutional shorts. If enough leveraged players are positioned the wrong way, silver doesn’t need a slow grind upward. It can gap violently once pressure builds.

Source: X/@AlexMasonCrypto

Source: X/@AlexMasonCrypto

That’s why silver rallies often feel discontinuous. The market can spend months doing nothing, then explode in weeks because positioning, not fundamentals, becomes the catalyst.

Mason also leans into the idea that physical silver demand is diverging from futures pricing. He mentions rising lease rates, delivery delays, and a scramble for immediate supply, suggesting that buyers increasingly want metal now, not contracts later.

This is a real theme worth watching, even without the apocalyptic framing. When physical tightness shows up, silver tends to react sharply because inventories are smaller and industrial demand is less flexible than people assume.

Read also: The Silver Price Chart Isn’t Lying – The $200 Math Is Starting to Show

My Take on the Silver Price “Time Bomb”

The broader message is directionally valid: silver is heavily financialized, and paper exposure absolutely amplifies volatility. Silver is not a clean supply-and-demand market like many retail investors imagine, and leverage plays a huge role in both rallies and crashes.

However, the most extreme conclusions (“banks will collapse” or “force majeure is next”) should be taken cautiously. The derivatives market is complex, and many short positions are hedges rather than naked bets, so the headline numbers alone don’t guarantee an imminent blow-up.

Still, Mason’s post captures something important: silver is sitting at the intersection of industrial necessity, monetary speculation, and extreme paper leverage. That combination is exactly why the next major silver move, whenever it comes, will probably not be quiet.

Read also: The Silver Price Doesn’t Look Real – And This Video Explains Why

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

The post Silver Price Time Bomb: Bank Shorts Are Now Bigger Than Global Supply appeared first on CaptainAltcoin.

You May Also Like

What Is an Uncontested Divorce and How Does It Work?

Google's AP2 protocol has been released. Does encrypted AI still have a chance?