Beyond Bitcoin: Why Crypto Infrastructure Will Survive the Next Crash

While Bitcoin crashes have historically triggered market-wide sell-offs, the underlying blockchain infrastructure has consistently proven resilient. Networks continue operating, enterprises keep building, and the ecosystem is now far more diversified and institutionally supported than in previous downturns.

Even if Bitcoin were to crash 70% tomorrow, core crypto infrastructure would keep running: Ethereum would continue processing transactions, DeFi protocols would facilitate billions in loans and trades, enterprise blockchain networks would maintain supply chain operations, and cross-border payment systems would function as designed. The fear that crypto infrastructure depends entirely on Bitcoin’s price, while understandable, does not reflect the technical and economic realities of today’s blockchain systems.

Infrastructure That Already Survived

History offers the clearest evidence of blockchain resilience. During the severe 2018 crypto crash, when cryptocurrencies lost approximately 80% of their value from January highs, surpassing the dot-com bubble’s 78% decline, the underlying networks never stopped functioning.

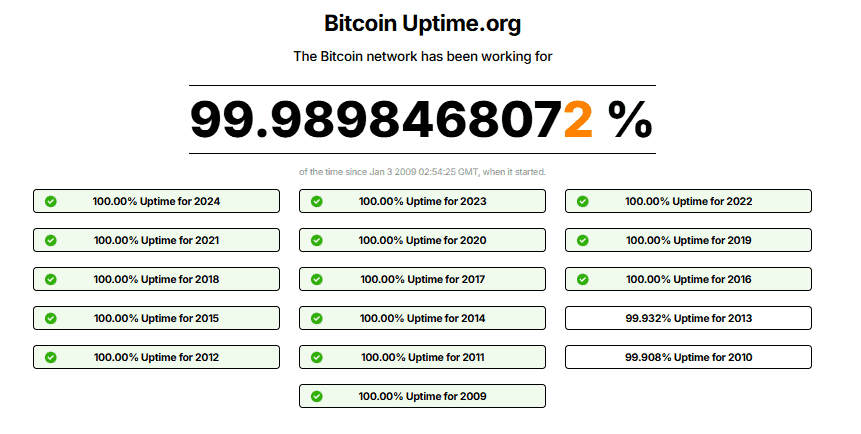

Bitcoin’s reliability is striking: the network has maintained 99.98% uptime since inception, with 100% uptime each year from 2014 through 2024.

Source: Bitcoin Uptime.org

During the 2018 downturn, Bitcoin fell from nearly $17,000 to around $3,200, yet transaction processing continued uninterrupted. The same pattern persisted during the 2022 decline, when Bitcoin lost roughly 75% of its value.

Ethereum provides another powerful example. Its transition to proof-of-stake in September 2022, a fundamental overhaul of the network’s operation, succeeded despite massive market volatility. This milestone demonstrates that crypto’s underlying infrastructure is robust and operates independently of token speculation.

It’s Not Just About Coin Prices – Revenue Beyond Speculation

Modern crypto infrastructure increasingly generates revenue from actual usage rather than token price appreciation. Enterprise blockchain adoption has grown rapidly, with investments projected to reach $16 billion by 2023, reflecting a 60.2% compound annual growth rate. The Enterprise Blockchain Market is expected to reach $287.8 billion by 2032, driven by digital transformation initiatives and data protection requirements.

Source: Enterprise Blockchain Market

Real companies are solving operational problems with blockchain technology that functions independently of Bitcoin’s price. For example:

-

JPMorgan’s Onyx division processes wholesale payments using tokenized deposits and smart contracts.

-

Hitachi streamlined procurement using Hyperledger Fabric, increasing monthly contract processing from 333 to over 400 while saving 1,225 labor hours.

-

BlackRock and HSBC launched blockchain-based platforms for fund issuance, focusing on building functional capital markets infrastructure rather than speculating on token prices.

These applications generate revenue through real utility, underscoring a shift from speculation-driven to usage-driven growth.

The Diversification Effect

The crypto ecosystem is no longer solely dependent on Bitcoin. While correlations do indeed spike during panic selling, periods of divergence are becoming more common. In 2023, for example, Bitcoin’s 30-day correlation with Ethereum dropped to 77%, the lowest since 2021, signaling a market regime change.

Source: Kaiko

Multi-chain infrastructure and interoperability protocols have enhanced resilience. Cross-chain bridges allow applications to migrate between chains, ensuring continuity even if one network experiences issues. DeFi Total Value Locked (TVL) has maintained significant levels during market downturns, confirming that utility-driven platforms can operate independently of speculative cycles.

Interestingly, the shift away from Bitcoin dominance extends to illicit activity as well. as Bitcoin accounted for 97% of illicit crypto volume in 2016 but only 19% by 2022, highlighting the ecosystem’s growing diversity.

What Actually Breaks vs. What Keeps Running

Not all elements of the crypto market survive crashes, however. History has shown that overleveraged firms such as Celsius, BlockFi, and Three Arrows Capital collapsed during the 2022 downturn due to unsustainable business models built on borrowed capital and unrealistic yields.

However, these failures occurred at the business model level, not the infrastructure level. In the midst of the FTX contagion, blockchain networks like Ethereum continued operating normally, processing billions in transactions even as token prices fell sharply. The pattern is clear: speculative businesses fail, but utility-focused infrastructure endures.

The Institutional Buffer

Institutional adoption further reinforces infrastructure resilience. A 2023 survey of 603 global business leaders found that 87% planned to invest in blockchain solutions within 12 months, and 81% expected increased technology budgets despite economic headwinds.

Leading enterprises are implementing blockchain solutions to solve operational challenges rather than speculate on Bitcoin prices. Microsoft Azure, Amazon Web Services, and Oracle now offer Blockchain-as-a-Service (BaaS) platforms, allowing organizations to deploy blockchain networks without building infrastructure from scratch. This institutional layer provides a buffer against market volatility, reducing the severity of drawdowns.

Indeed, Bitcoin’s largest correction this cycle has been approximately 26%, compared to 84% after 2017 and 77% after 2021, indicating that institutional inflows and long-term holders help absorb downside risk.

Conclusion

The next Bitcoin crash will likely trigger short-term panic and correlation across crypto assets. Yet the underlying infrastructure has matured into a robust, diversified ecosystem. Blockchain networks will continue processing transactions, enterprise applications will maintain operations, and institutional support will provide stability absent in earlier cycles.

The critical insight is not that crashes won’t occur, they will, but that the infrastructure supporting real-world applications now functions independently of any single asset’s speculative value, laying a resilient foundation for the next phase of adoption.

You May Also Like

Galaxy Digital’s 2025 Loss: SOL Bear Market

Why This New Trending Meme Coin Is Being Dubbed The New PEPE After Record Presale