Ethereum Holds the TVL… But Solana Owns the Action

Crypto markets love one metric more than anything: Total Value Locked.

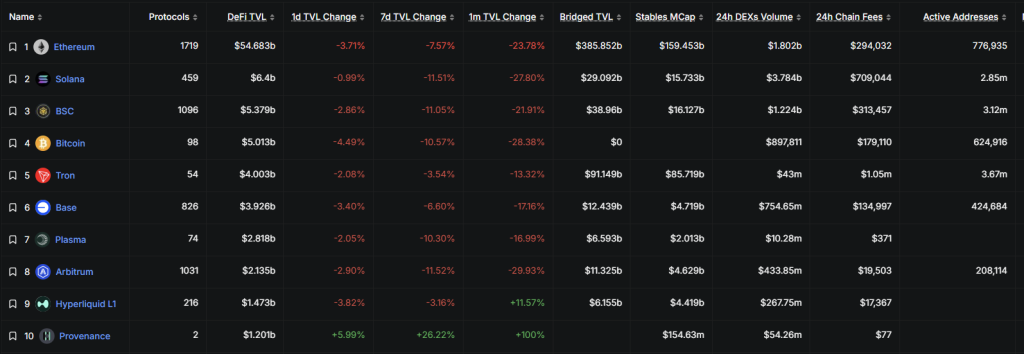

TVL has become the scoreboard that investors point to when deciding which chain is “winning.” And by that measure, Ethereum still sits comfortably at the top, holding over $54.6 billion in DeFi liquidity. That number is massive, and it reflects years of dominance, institutional trust, and the deepest capital base in the entire ecosystem.

But the more interesting story right now is not where the money is sitting.

It’s where the activity is happening.

Because when you look beyond TVL and into real usage (trading, fees, addresses, and daily volume) Solana is starting to look less like an “Ethereum alternative” and more like the chain where the actual action has moved.

Ethereum Still Controls the Deep Capital Layer

Ethereum remains the heavyweight leader in DeFi liquidity. With 1,719 protocols deployed and nearly $55 billion locked, it still represents the most mature financial base in crypto.

That kind of TVL is not something that disappears overnight. Ethereum has the strongest infrastructure for large-scale DeFi, lending markets, liquid staking, and institutional-grade applications. Even in a down month, it continues to attract long-term capital that prefers stability over speed.

However, the same data also shows Ethereum’s weakness right now: capital is sitting, but it isn’t moving aggressively.

Ethereum’s monthly TVL change is down roughly -23.8%, and weekly flows remain negative. That indicates that even though Ethereum holds the biggest pool of liquidity, traders are not rotating into it with urgency.

It’s acting more like crypto’s “banking layer” than its trading floor.

Source: defillama.com

Source: defillama.com

Solana’s Volume Lead Is the Real Signal

This is where Solana stands out sharply.

Despite having only around $6.4 billion in TVL (a fraction of Ethereum’s) Solana is processing far more trading activity. The data shows Solana posting about $3.78 billion in 24-hour DEX volume, more than double Ethereum’s roughly $1.8 billion.

That is not a small difference.

It means that Solana users are not just parking capital in DeFi protocols. They are actively swapping, trading, speculating, rotating, and using the chain at a much faster velocity.

Ethereum may still be where liquidity lives.

But Solana is where liquidity moves.

And in markets, movement matters.

Fees Reveal Where Demand Is Concentrated

Another key piece of the picture is fees.

Solana is generating roughly $709,000 in daily chain fees compared to Ethereum’s $294,000. That gap is big because fees are one of the clearest signals of demand.

People don’t pay fees unless they are doing something.

High fee generation often reflects real transactional intensity; trading activity, memecoin speculation, DeFi loops, or user engagement that goes beyond passive capital storage.

Ethereum still has strong fundamentals, but this data suggests its on-chain demand is currently softer than Solana’s, at least in terms of raw daily activity.

Read also: Ethereum Is Losing the Stablecoin War – Tron (TRX) Already Won the Rails

Active Addresses: Solana’s User Scale Is Exploding

Perhaps the biggest difference is user participation.

Ethereum is showing around 776,000 active addresses, which is still impressive.

But Solana is sitting near 2.85 million active addresses, nearly four times higher.

That tells a clear story: Solana has become the chain where the crowd is.

Whether that crowd is driven by DeFi, trading, meme cycles, consumer apps, or low-fee accessibility, the network effect is real. Activity attracts liquidity, liquidity attracts builders, and builders attract more users.

Solana’s growth is hard to dismiss as temporary.

BSC and Tron: Still Relevant, But Different Games

The data also highlights how Binance Smart Chain and Tron fit into this cycle.

BSC holds around $5.37 billion in TVL and maintains over 3.12 million active addresses, showing it still has massive retail scale. However, its DEX volume remains lower than Solana’s, and its monthly TVL trend is still negative.

Tron is the outlier: only $4 billion in TVL, but a massive $85.7 billion stablecoin market cap. Tron’s role is increasingly centered around stablecoin settlement and payments rather than speculative DeFi dominance.

That makes Solana’s position unique: it’s not just stablecoin plumbing or passive liquidity.

It’s becoming the main arena.

TVL vs Volume: The Shift Crypto Investors Keep Missing

The broader takeaway from this table is simple:

TVL measures where money is stored.

Volume measures where money is moving.

Ethereum still wins the storage layer.

Solana is increasingly winning the movement layer.

In past cycles, Ethereum dominated both. But this cycle is different. Capital is fragmenting, users are chasing speed and usability, and trading activity is consolidating where friction is lowest.

Solana’s ability to generate more DEX volume with far less TVL indicates its liquidity efficiency is far higher right now.

That is often what early regime changes look like.

Read also: Why Ethereum Is Getting Wrecked Right Now – Don’t Touch It

The Market’s Real Question Going Forward

The key question is not whether Ethereum is “dead” or Solana is “flipping” it tomorrow.

The real question is:

Will Solana’s activity eventually pull in deeper liquidity?

Or will Ethereum’s capital base eventually pull activity back?

If Solana can keep scaling its ecosystem while attracting more long-term DeFi liquidity, the gap could narrow faster than most expect.

And if Ethereum cannot reignite user demand beyond passive TVL, its dominance may start to look more historical than structural.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

The post Ethereum Holds the TVL… But Solana Owns the Action appeared first on CaptainAltcoin.

You May Also Like

American Bitcoin’s $5B Nasdaq Debut Puts Trump-Backed Miner in Crypto Spotlight

RWA Crypto Projects Gain Momentum with Chainlink, VeChain, and Avalanche Surging in Engagement