Circle shares drop following forecast of $618 million revenue hit from rate cuts

- Circle could shed $618 million from its revenue if the Fed cut rates by 100 bps, according to Dragonfly's Omar Kanji.

- He stated that USDC supply will need to grow by $28 billion to minimize the impact of rate cuts.

- CRCL closed trading with a 9% decline on Thursday.

Circle (CRCL) closed trading with a 9% decline on Thursday after Dragonfly investor Omar Kanji predicted that a potential interest rate cut by the Federal Reserve (Fed) in September could result in a $618 million drop in the company's revenue.

Circle could suffer $618 million hit if Fed lowers interest rates

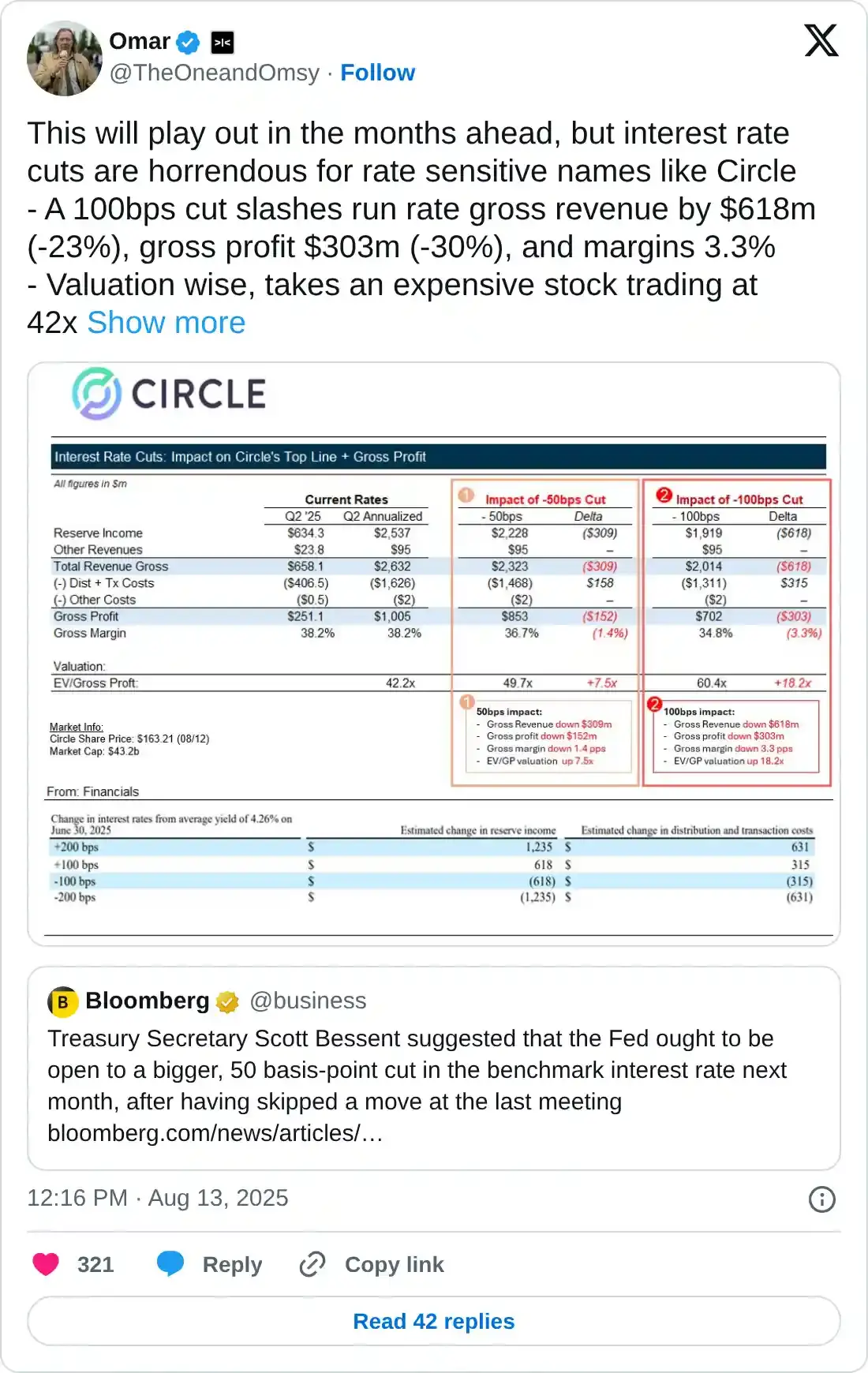

Dollar-backed stablecoin USDC issuer, Circle, could face a gross revenue decline of $618 million, representing 23% of its total income if the Fed cut interest rates by 100 basis points (bps), Omar Kanji stated in an X post on Wednesday.

When the Fed lowers interest rates, it could prove to be "horrendous" for more "rate sensitive names" such as Circle, whose major source of revenue stems from its US Treasury holdings that back USDC.

The company revealed a growth to $658 million in total revenue and reserve income in Q2, a 53% YoY increase, according to its earnings report on Tuesday.

Circle's reserves are highly reactive to changes in interest rates, as a potential rate reduction could tighten the firm's income. Omar noted that for Circle to mitigate the risk of losses, it needs to mint $28 billion worth of USDC, equivalent to 44% of the stablecoin's $67 billion market cap.

The development comes as US Treasury Secretary Scott Bessent said on Tuesday that the Fed should consider a 50 basis-point cut in September, following its decision to hold rates steady at its last committee meeting.

President Donald Trump has repeatedly called for Fed Chair Jerome Powell to cut interest rates, calling him "too late."

Omar further pointed to Circle's 10 million shares sale on Tuesday, worth $1.4 billion, being fueled by concerns over rate cuts. The sale includes 2 million shares from the company and 8 million shares from shareholders, including CEO Jeremy Allaire.

Circle also disclosed plans on Tuesday to launch a Layer-1 (L1) blockchain with Ethereum Virtual Machine (EVM) compatibility later this year. The blockchain is expected to debut a public testnet under the name Arc and will use USDC as its native gas token, enabling fee payment in stablecoins.

Circle completed its IPO in June after raising $1.2 billion from the sale of 19.9 million shares, according to the report. The stock rose over 400% in the weeks following its public listing, reaching a high of $298 before declining.

CRCL closed trading at $139 on Thursday, a 9% decline from its close of $153.

You May Also Like

Fed Decides On Interest Rates Today—Here’s What To Watch For

CryptoMiningFirm turns phones, computers into passive crypto income tools