Crypto PACs Amass Millions Ahead of Midterms

As the United States moves toward the 2026 midterm elections, crypto industry lobbying and fundraising activity has accelerated, highlighting a strategic shift in how the sector seeks to shape policy. Super PACs linked to crypto interests have begun pooling funds, with a notable fundraising push that includes a main industry vehicle and prominent tech donors. The landscape features a blend of bipartisan engagement and party-aligned advocacy, underscored by legislative efforts such as the CLARITY Act, which has stalled in the Senate even as committees in the House advance. This push comes amid a broader backdrop of regulatory scrutiny, market volatility, and debates over how best to foster innovation while protecting consumers.

Key takeaways

- The crypto sector’s political spending surged last cycle, with total contributions reaching at least $245 million in 2024, signaling a robust, well-funded lobbying posture ahead of midterm elections.

- Fairshake, the industry’s leading super PAC, raised about $133 million in 2025 and now holds more than $190 million in cash on hand, reflecting significant donor commitments from major players including a16z, Coinbase, and Ripple.

- Discontent about influence in Washington is real among reform groups, who warn that large, industry-aligned money can marginalize ordinary voters and complicate democratic processes.

- Crypto donors are pursuing a bipartisan strategy, supporting both parties or pivoting to align with policymakers who promise a friendlier regulatory environment, while some in Congress push for a unified framework like the CLARITY Act.

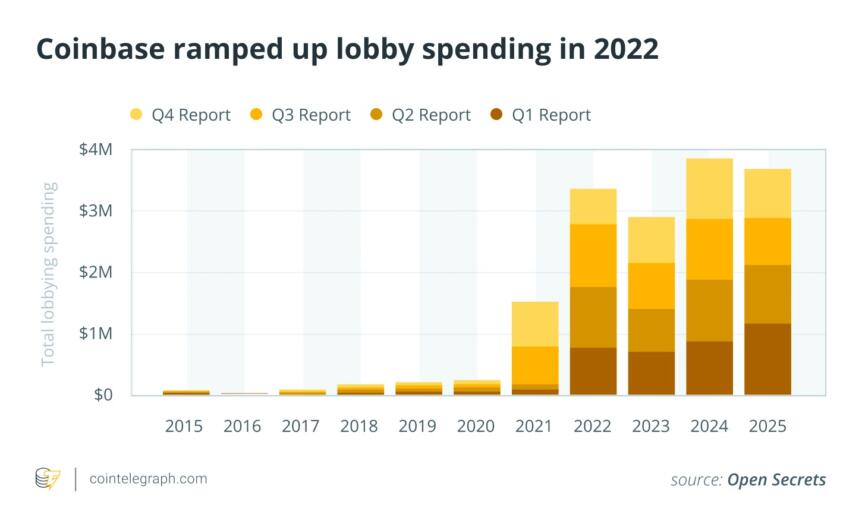

- Historical context matters: the sector’s political clout has grown since the 2020–2021 lobbying surge and the FTX collapse, which did not halt the industry’s push to engage lawmakers and shape policy on market structure and consumer protection.

Tickers mentioned: $BTC, $ETH, $COIN

Market context: As the midterm cycle sharpens, the crypto lobby’s visibility in Washington mirrors broader regulatory debates and a shifting investment climate. The policy trajectory—particularly around market structure and stablecoins—remains uncertain, even as lobby groups deploy sizable resources to influence committees and votes.

Why it matters

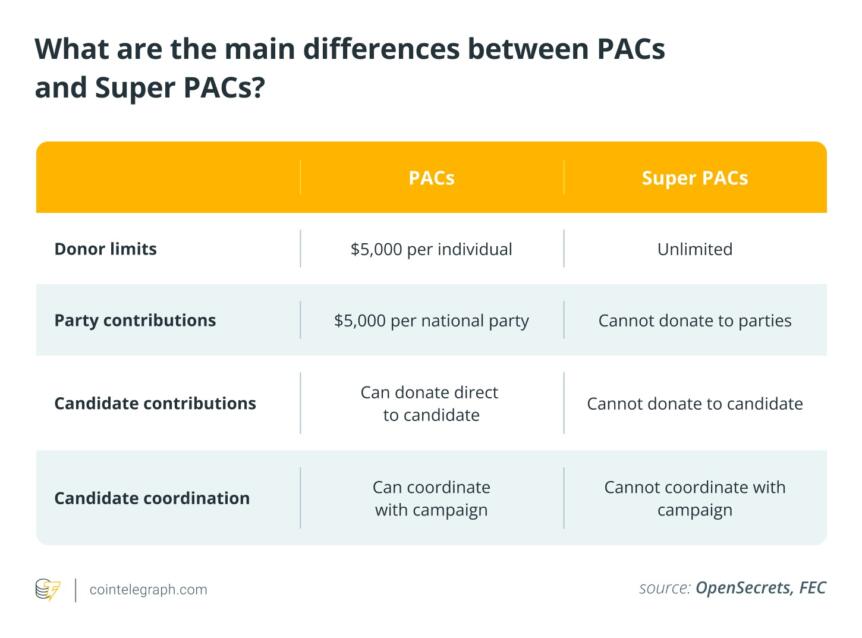

The scale of money funneled into crypto lobbying marks a meaningful departure from earlier eras of campaign finance. Industry-aligned super PACs have become major players, capable of marshaling independent expenditures and transfers to allied committees in a way that can outpace more traditional advocacy channels. This dynamic matters for users, investors, and builders because policy decisions—ranging from regulatory clarity to enforcement actions—directly affect product innovation, market access, and consumer protections.

Observers say the growing influence of well-funded crypto PACs is changing the calculus inside Congress. While some lawmakers welcome clearer rules and a predictable regulatory environment, critics argue that high-dollar donations risk sidelining everyday constituents and distorting legislative priorities. The tension between fostering innovation and imposing guardrails is at the core of ongoing debates about market structure, stablecoins, and the broader crypto economy. The argument is not merely about dollars and elections; it touches the core question of how the American political system can balance rapid technological change with responsible oversight.

Within this landscape, the industry’s messaging is increasingly tailored to bipartisan themes, while some prominent figures invest in politically aligned avenues that promise favorable outcomes. The Winklevoss twins’ support for a conservative pro-crypto fund, for example, underscores a strategic tilt toward candidates perceived as crypto-friendly, even as others push for more centrist or Democratic support to maintain broad accessibility to policymakers. The result is a more nuanced, multi-faceted lobbying approach that seeks to hedge policy risk across party lines and ideological spectrums.

Looking back, the sector’s political activity has evolved alongside its own evolution as a market sector. During the 2020–2021 bull run, crypto firms ramped up advertising and public-relations campaigns, while high-profile names in the industry entered politics or attempted to influence policy through visible campaigns. The FTX saga and related enforcement actions accelerated a broader embrace of Washington engagement, as industry participants sought to define a path toward functioning product rails under a potential regulatory framework.

In Congress, the debate often centers on balance. Proponents argue that a comprehensive framework could unlock innovation and reduce uncertainty, while opponents warn against overreach that could stifle the development of new financial products. The debate around a major piece of legislation, commonly referred to as the CLARITY Act, illustrates this tug-of-war: supporters contend that clear rules would legitimize the sector and invite responsible participants to operate within a defined system, whereas critics warn that the bill may still fall short of satisfying industry stakeholders and ethics officials in the Senate.

One notable donor in the crypto space—Bankman-Fried—made headlines years earlier with immense campaign contributions, a fact cited by prosecutors as part of a broader indictment about how influence was used to push for policies favorable to his business interests. His case serves as a cautionary backdrop to current financing strategies, illustrating how the line between political advocacy and business priorities can blur in high-velocity markets. While Bankman-Fried has faced severe legal scrutiny, the broader ecosystem continues to pursue access to policymakers, albeit with increased attention on governance, compliance, and transparency.

As the 2024 cycle demonstrated, crypto funding did not merely surge; it also diversified. The Fairshake network, originally built as a single-issue pro-crypto fund, grew into a hub for multiple committees and independent expenditures. Its disclosed activity included substantial support for Democrats during the 2023–2024 period, alongside other, more conservative-aligned committees. This diversification is indicative of a broader strategy: deploying resources to achieve leverage across the political spectrum, while maintaining an emphasis on lawmakers perceived as aligned with crypto-friendly regulatory approaches.

“Super PACs are increasingly becoming in vogue for special interests who want to make their presence known in Washington,” said Michael Beckel, research director of Issue One, noting that large, industry-backed reservoirs of cash have become a significant force in shaping policy outcomes. As a result, the cadence and flow of money—both donations and independent expenditures—have become a persistent feature of the policy landscape, with significant implications for how regulations are written and how quickly they move through Congress.

Beyond the halls of Congress, attention has turned to broader governance questions, including the ongoing debate around market structure, consumer protections, and the role of stablecoins in a broad financial ecosystem. The White House has hosted closed-door discussions among crypto and banking leaders in a bid to bridge gaps, but public progress remains cautious, with officials signaling that meaningful consensus may require additional time and negotiation. The dynamic between White House oversight, Senate deliberations, and industry lobbying will likely shape the regulatory timetable for years to come.

As election season resumes, the crypto lobby’s influence remains a core variable in policy outcomes. The sector’s strategy—balancing donor networks, bipartisan outreach, and legislative pressure—highlights how political influence now intersects with technology policy in a way that goes beyond traditional lobbying. If lawmakers can craft a coherent, forward-looking framework that protects consumers while enabling innovation, it could mark a watershed moment for both the crypto industry and the broader financial ecosystem. If not, the divergence between policy ambitions and practical implementation could prolong regulatory uncertainty for years ahead.

What to watch next

- Tracking the CLARITY Act’s status in the Senate and any new consensus on market structure legislation (dates and committee votes).

- Updates on major crypto donors’ disclosures and whether new transparency rules affect PACs and independent expenditures.

- White House-industry talks outcomes and potential regulatory proposals touching stablecoins and consumer protections.

- Upcoming midterm dynamics and how shifts in party control may influence crypto-friendly policy initiatives.

- Monitoring any shifts in the funding strategy of Fairshake and its affiliated committees as the 2026 cycle approaches.

Sources & verification

- FEC committee records for Fairshake (C00835959) and its 2024–2025 activity.

- Open Secrets data on Fairshake expenditures and donor contributions from 2023–2024.

- Reuters reporting on Bankman-Fried’s political donations and related investigations.

- Politico commentary on the blockchain network and party strategy in 2025.

- Senate roll-call votes related to the GENIUS Act and related crypto policy debates.

Crypto money and the midterm race: donors, policy, and power

Political action committees representing the crypto industry have already mobilized substantial funding as the United States heads toward its 2026 midterm elections. The focal point is a blend of large, unrestricted sums and more targeted campaigns designed to influence key policymakers and committees. The industry’s flagship super PAC, Fairshake, has emerged as a central vehicle for fundraising and political spending, with documented contributions and independent expenditures that exceed a century-and-a-half in collective capacity when combined with allied groups.

Last year, the crypto industry spent at least $245 million on campaign contributions, a figure that underscored the sector’s appetite for influence. The main super PAC funded by the industry, Fairshake, raised about $133 million in 2025, and its cash on hand now exceeds $190 million. Notable backers include venture-capital powerhouse a16z which contributed an initial $24 million, with Coinbase and Ripple each donating $25 million. The scale here is not merely academic: it represents a deliberate attempt to tilt regulatory and legislative outcomes in ways that supporters argue will create a more predictable environment for innovation and growth, while critics warn of the democratic perils of concentrated influence.

Activist groups have pressed back, arguing that large, industry-backed money undermines the voice of everyday Americans. “This kind of influence buying ultimately undermines the democratic process by marginalizing everyday Americans, ensuring that their voices and interests take a backseat to the crypto industry’s deregulatory desires,” said Saurav Ghosh, director of the Campaign Legal Center. The concern is not limited to the abstract; it centers on the real-world risk that policy outcomes could skew toward a narrow set of corporate interests rather than broad public goals, particularly as midterm dynamics favor the party controlling the House, Senate, or White House.

The broader political calculus shows crypto lobbying pursuing a degree of bipartisanship, even as the industry remains most comfortable with a regulatory posture that favors innovation. The Senate’s posture toward the CLARITY Act remains a barometer of how far policymakers are willing to go in crafting a comprehensive framework. The act advanced in the House this summer, but in the Senate it has yet to reach a conclusion that satisfies the governance and ethics concerns raised by many Democrats. In the interim, crypto advocates have sought to demonstrate broad-based appeal, balancing support within both major parties and pushing a long-term vision of a policy regime that accommodates new financial technologies without compromising consumer protections.

Publicly, some in the industry emphasize the necessity of nonpartisan engagement. Representative Sam Liccardo, a crypto-friendly Democrat, suggested that no industry should “put eggs in one basket,” signaling a preference for diversified political support. Yet others warn that aligning too closely with one party could backfire as political winds shift. The Winklevoss twins’ strategic donations to Digital Freedom Fund illustrate how industry actors are attempting to influence the policy conversation from multiple angles, covering both conservative and liberal lanes in pursuit of favorable regulatory outcomes.

The policy dialogue has also intersected with discussions about market structure and consumer protections, with Coinbase’s leadership engaging in public debates about proposed restrictions on stablecoin yields. Coinbase argued that a blanket ban could stifle innovation and impede legitimate financial services, while supporters of tighter controls contend that consumer safety cannot be compromised in the name of rapid innovation. The White House has attempted to broker a dialogue on these issues, hosting a closed-door summit with leaders from both crypto and banking sectors; however, Reuters reports that the gathering did not yield a definitive breakthrough on policy alignment.

The broader context is a political environment in which the crypto industry’s influence is increasingly visible and, for some observers, troubling. Critics warn that a system in which wealthier donors shape policy can cast doubt on the electorate’s ability to influence outcomes. Election-oversight advocates argue that this trend could erode trust in democratic institutions if policy results appear engineered to accommodate corporate interests rather than public benefit. In this light, the ongoing lobbying activity surrounding the CLARITY Act, the market structure debate, and related regulatory proposals will be essential to watch as the 2026 midterms approach.

As with any sector undergoing rapid evolution, the stakes are high for users, investors, and builders who rely on a stable, transparent policy framework. The current cycle demonstrates that money, messaging, and momentum can affect the speed and direction of regulatory developments, even in a landscape as complex and dynamic as crypto. The coming months will reveal whether policymakers can translate high-level objectives into clear, workable rules that support innovation while safeguarding the integrity of financial markets.

This article was originally published as Crypto PACs Amass Millions Ahead of Midterms on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

Why the USDT stablecoin could challenge Bitcoin and Ethereum for crypto leadership

CEO Sandeep Nailwal Shared Highlights About RWA on Polygon