CME Altcoin Futures Go Live, Unlocking Institutional Access to ADA, LINK and XLM

This article was first published on The Bit Journal.

CME altcoin futures launch is scheduled to introduce regulated futures contracts for Cardano, Chainlink, and Stellar as the Chicago Mercantile Exchange moves toward a February 9 rollout. The initiative expands institutional access to select altcoins during a period when broader market confidence remains restrained.

By adding these assets to its regulated derivatives platform, CME is incorporating three established blockchain networks into its crypto framework. The move supports the exchange’s long-term digital asset strategy, even as short-term price trends across the market remain under pressure.

How does the CME altcoin futures launch reshape market structure?

The CME altcoin futures launch adds futures contracts linked to Cardano (ADA), Chainlink (LINK), and Stellar (XLM) to one of the world’s largest derivatives exchanges. These contracts are built for institutional and professional traders who want price exposure or risk management options without holding the actual tokens.

CME Altcoin Futures Go Live, Unlocking Institutional Access to ADA, LINK and XLM 3

CME Altcoin Futures Go Live, Unlocking Institutional Access to ADA, LINK and XLM 3

With the inclusion of these assets, CME’s crypto futures lineup now covers seven cryptocurrencies, alongside Bitcoin, Ethereum (ETH), Solana, and Ripple (XRP). This expansion highlights a steady improvement in regulated market access rather than an expectation of short-term price strength.

Why are ADA, LINK, and XLM being added now?

The timing of the CME altcoin futures launch reflects ongoing institutional demand for a wider range of crypto trading tools, even while overall market sentiment remains cautious. Giovanni Vicioso, CME Group’s global head of crypto products, said the new contracts aim to give market participants more choice, improved flexibility, and better capital efficiency as digital asset markets continue to develop.

From the exchange’s perspective, the priority is responding to client needs and reinforcing market structure. The move is not intended as a signal on short-term price movements but as a long-term infrastructure step.

What contract sizes will traders be able to access?

Under the CME altcoin futures launch, each listed asset will be offered in both standard and micro-sized contracts. Cardano futures will feature a larger contract covering 100,000 ADA, along with a smaller version set at 10,000 ADA.

Chainlink contracts will be available in a standard size of 5,000 LINK and a micro size of 250 LINK, while Stellar futures will include a larger contract of 250,000 XLM and a smaller one representing 12,500 XLM. This contract structure follows CME’s existing crypto derivatives model and is designed to accommodate traders with different risk limits and capital requirements.

Do earlier CME listings suggest a strong price response?

Earlier listings indicate the CME altcoin futures launch may not lead to an immediate price rise. When Solana futures were introduced on March 17, 2025, they recorded $12 million in notional trading volume on the first day, but SOL continued to trade sideways below $130 as market sentiment stayed weak.

A comparable trend was seen after the XRP futures launch on May 19, 2025, which reached $19 million in notional volume before the token’s price declined. These examples show that futures listings often represent long-term market development rather than short-term speculative momentum.

What are on-chain signals indicating ahead of the launch?

In the period ahead of the CME altcoin futures launch, on-chain data points to cautious but targeted positioning by large holders. As ADA declined to $0.2, wallets holding between 1 million and 10 million ADA, as well as those with balances near 100 million ADA, added to their positions over recent weeks.

Chainlink showed more stable behavior during this phase. The amount of LINK held on exchanges stayed close to 119 million, similar to levels seen in late 2025, suggesting selling activity remained limited.

How are prices behaving in the current risk-off phase?

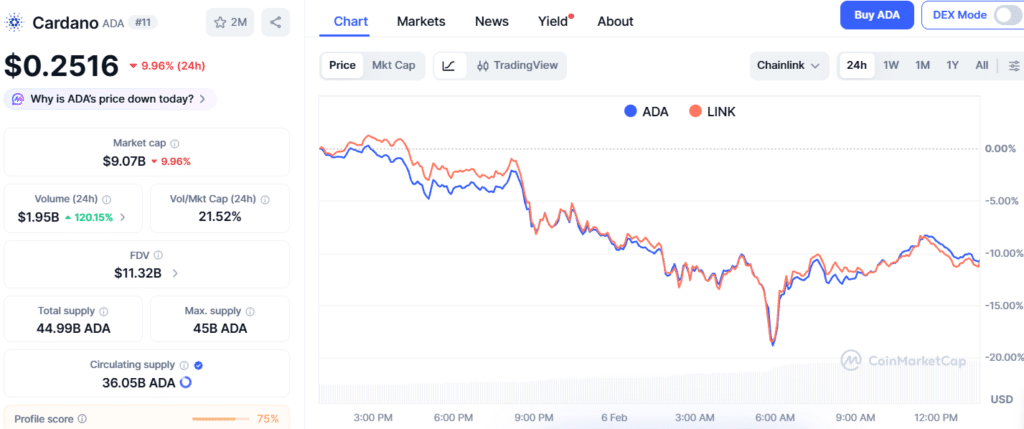

Market conditions heading into the CME altcoin futures launch remain fragile. ADA is trading around $0.2520 after declining 9.82% over the past 24 hours, while LINK is trading near $8.09 following a 10.73% drop during the same period.

CME Altcoin Futures Go Live, Unlocking Institutional Access to ADA, LINK and XLM 4

CME Altcoin Futures Go Live, Unlocking Institutional Access to ADA, LINK and XLM 4

XLM is also under pressure, trading around $0.1524 after falling 7.06% in the last 24 hours. These price moves indicate that broader risk-off sentiment continues to outweigh the impact of new product developments.

Conclusion

The CME altcoin futures launch highlights a steady increase in institutional access to altcoins through regulated markets. Martin Franchi, CEO of NinjaTrader, described the expansion as a watershed moment for the futures industry, pointing out that digital assets are becoming more firmly embedded in investor portfolios worldwide.

While the February 9 rollout is likely to see a restrained market response, it adds depth to the crypto derivatives landscape. Overall, the development signals continued institutional involvement that extends beyond short-term price movements.

Glossary

Futures Contract: A futures contract sets a price to trade an asset later.

Altcoin Futures: Altcoin futures track the prices of coins like ADA, LINK, and XLM.

CME (Chicago Mercantile Exchange): CME is a regulated market for futures trading.

Micro Contract: A micro contract is a smaller futures trade with lower risk.

Notional Volume: Notional volume shows the total value of trades in a period.

Frequently Asked Questions About CME Altcoin Futures Launch

When will CME launch altcoin futures?

CME plans to launch altcoin futures for Cardano, Chainlink, and Stellar on February 9.

Who are these futures contracts designed for?

These futures contracts are mainly designed for institutional and professional investors.

What contract sizes will be available for ADA futures?

ADA futures will offer a large contract of 100,000 ADA and a micro contract of 10,000 ADA.

What contract sizes are available for LINK and XLM futures?

LINK contracts include 5,000 LINK and 250 LINK, while XLM contracts include 250,000 XLM and 12,500 XLM.

How did past CME futures launches affect prices?

Past launches for Solana and XRP showed strong trading volume but weak or falling prices.

Sources

AMBCrypto

AInvest

Read More: CME Altcoin Futures Go Live, Unlocking Institutional Access to ADA, LINK and XLM">CME Altcoin Futures Go Live, Unlocking Institutional Access to ADA, LINK and XLM

You May Also Like

U.S. Moves Grip on Crypto Regulation Intensifies

The Role of Blockchain in Building Safer Web3 Gaming Ecosystems

- Immutable Ownership of Assets Blockchain records can be manipulated by anyone. If a player owns a sword, skin, or plot of land as an NFT, it is verifiably in their ownership, and it cannot be altered or deleted by the developer or even hacked. This has created a proven track record of ownership, providing control back to the players, unlike any centralised gaming platform where assets can be revoked.

- Decentralized Infrastructure Blockchain networks also have a distributed architecture where game data is stored in a worldwide network of nodes, making them much less susceptible to centralised points of failure and attacks. This decentralised approach makes it exponentially more difficult to hijack systems or even shut off the game’s economy.

- Secure Transactions with Cryptography Whether a player buys an NFT or trades their in-game tokens for other items or tokens, the transactions are enforced by cryptographic algorithms, ensuring secure, verifiable, and irreversible transactions and eliminating the risks of double-spending or fraudulent trades.

- Smart Contract Automation Smart contracts automate the enforcement of game rules and players’ economic exchanges for the developer, eliminating the need for intermediaries or middlemen, and trust for the developer. For example, if a player completes a quest that promises a reward, the smart contract will execute and distribute what was promised.

- Anti-Cheating and Fair Gameplay The naturally transparent nature of blockchain makes it extremely simple for anyone to examine a specific instance of gameplay and verify the economic outcomes from that play. Furthermore, multi-player games that enforce smart contracts on things like loot sharing or win sharing can automate and measure trustlessness and avoid cheating, manipulations, and fraud by developers.

- Cross-Platform Security Many Web3 games feature asset interoperability across platforms. This interoperability is made viable by blockchain, which guarantees ownership is maintained whenever assets transition from one game or marketplace to another, thereby offering protection to players who rely on transfers for security against fraud. Key Security Dangers in Web3 Gaming Although blockchain provides sound first principles of security, the Web3 gaming ecosystem is susceptible to threats. Some of the most serious threats include: