Collect&Exchange: How a reliable B2B crypto exchange is built

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Collect&Exchange has evolved from a niche crypto–fiat bridge into a global B2B payments platform, delivering fast, secure, and compliant transactions for businesses.

Table of Contents

- What is Collect&Exchange?

- Cryptoexchange as the core of the B2B platform

- Main advantages

- Why do businesses choose Collect&Exchange?

- Who works with Collect&Exchange?

- Conclusion

- Collect&Exchange enables businesses to exchange crypto and fiat quickly, with most transactions completed in under 30 minutes.

- The platform supports over 100 jurisdictions, offers multi-currency operations, and ensures full KYC/KYB and AML compliance.

- Serving industries from IT to logistics, C&E combines crypto flexibility with banking infrastructure for predictable, cross-border payments.

When it comes to cryptocurrency businesses, speed and security are not a bonus, but a critical necessity. Especially in the B2B sector, where every delay can cost a deal and every failure can cost trust.

When the Collect&Exchange team first started out, they had a clear vision, to simplify the interaction between cryptocurrency and traditional money. Today, that idea has evolved into a large-scale fintech business with an international presence and its own technology platform. In just a few years, the company has gone from being a technical intermediary to an independent player, building an infrastructure that is trusted by customers around the world.

The company was born as a response to this customer request. Since 2021, it has been building a solution that relieves businesses from the pain associated with classic exchangers, unstable OTCs, and fragmented platforms. Today, Collect&Exchange is an international player in the B2B cryptoexchange sphere, providing companies with a tool for fast, secure, and fully controlled exchange of cryptocurrencies and fiat around the world.

What is Collect&Exchange?

In a world where business boundaries have long been digital and payments require instantaneousness, traditional financial instruments often prove ineffective. This is especially true for international B2B transactions with cryptocurrencies, here you need not just an exchange, but a full-fledged payment partner. And this is exactly the role that Collect&Exchange plays.

This is not just an exchanger. This is a specialized platform created for legal entities that need a stable partner in the world of digital assets. Unlike traditional solutions, C&E does not offer spot trading or stock exchange speculation, everything here is tailored to real business scenarios: settlements with partners, employee payments, purchases, withdrawals, cross-border transfers.

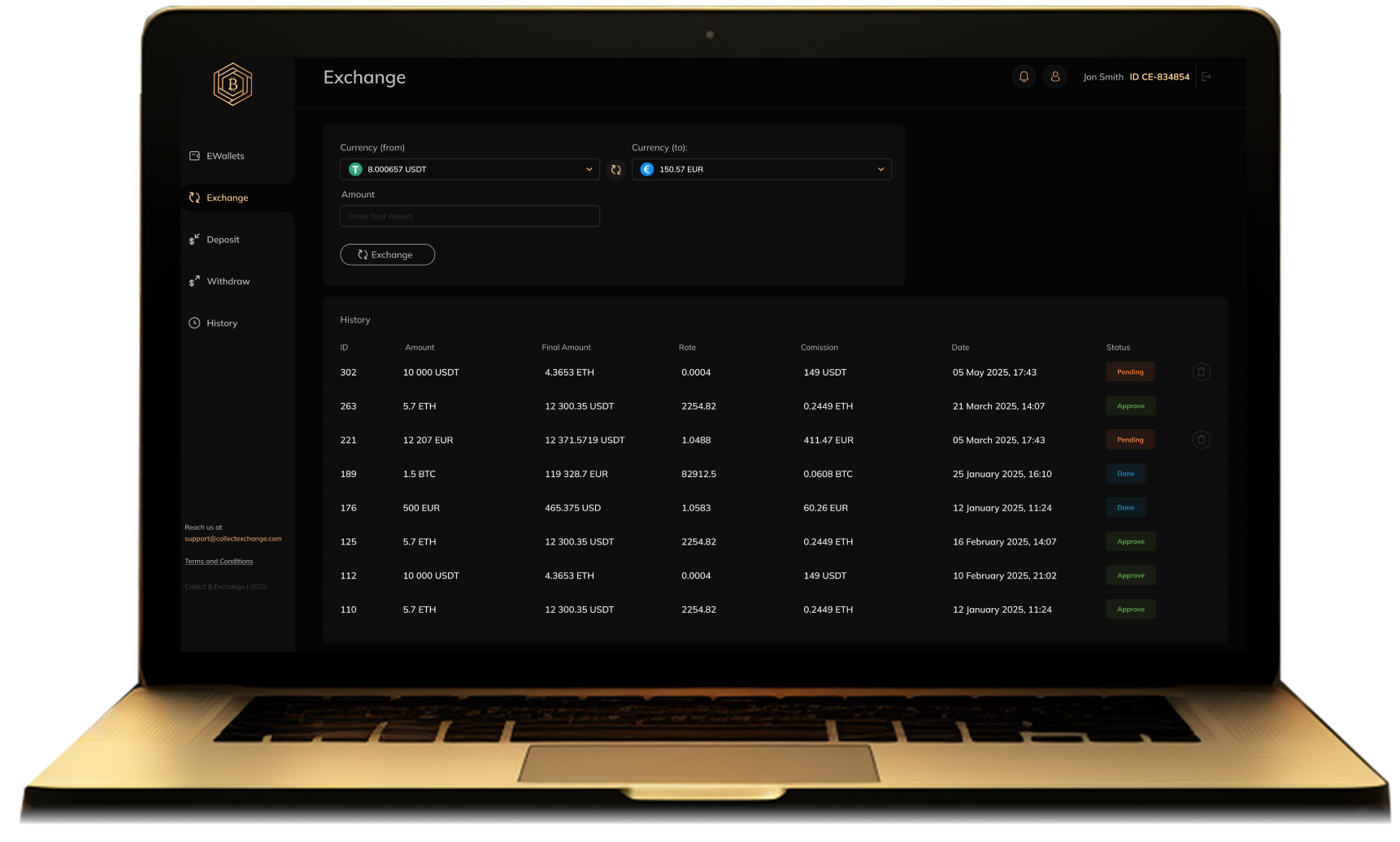

Cryptoexchange as the core of the B2B platform

The main goal of Collect&Exchange is to exchange cryptocurrencies and stablecoins for fiat money (and vice versa) for the benefit of business. It is not an exchange for traders or a platform for private investors. Collect&Exchange is an infrastructure that helps companies around the world:

- Pay suppliers and contractors in different currencies

- Accept payments from clients in cryptocurrency

- Simplify cryptocurrency operations in line with regulatory standards

- Optimize cross-border payments, reducing costs and speeding up settlements.

C&E works only with proven businesses, and that is why it can guarantee partners high transparency, speed and reliability at every stage.

Main advantages

- Registration and support of companies from 100+ jurisdictions, including the EU, UAE, Hong Kong, Singapore, Turkey and other key markets.

- Working with fiat and cryptocurrency in one window: The platform supports USDT (TRC20, ERC20, BEP20), BTC, ETH and other tokens.

- Fast exchanges: Most transactions are completed within 30 minutes.

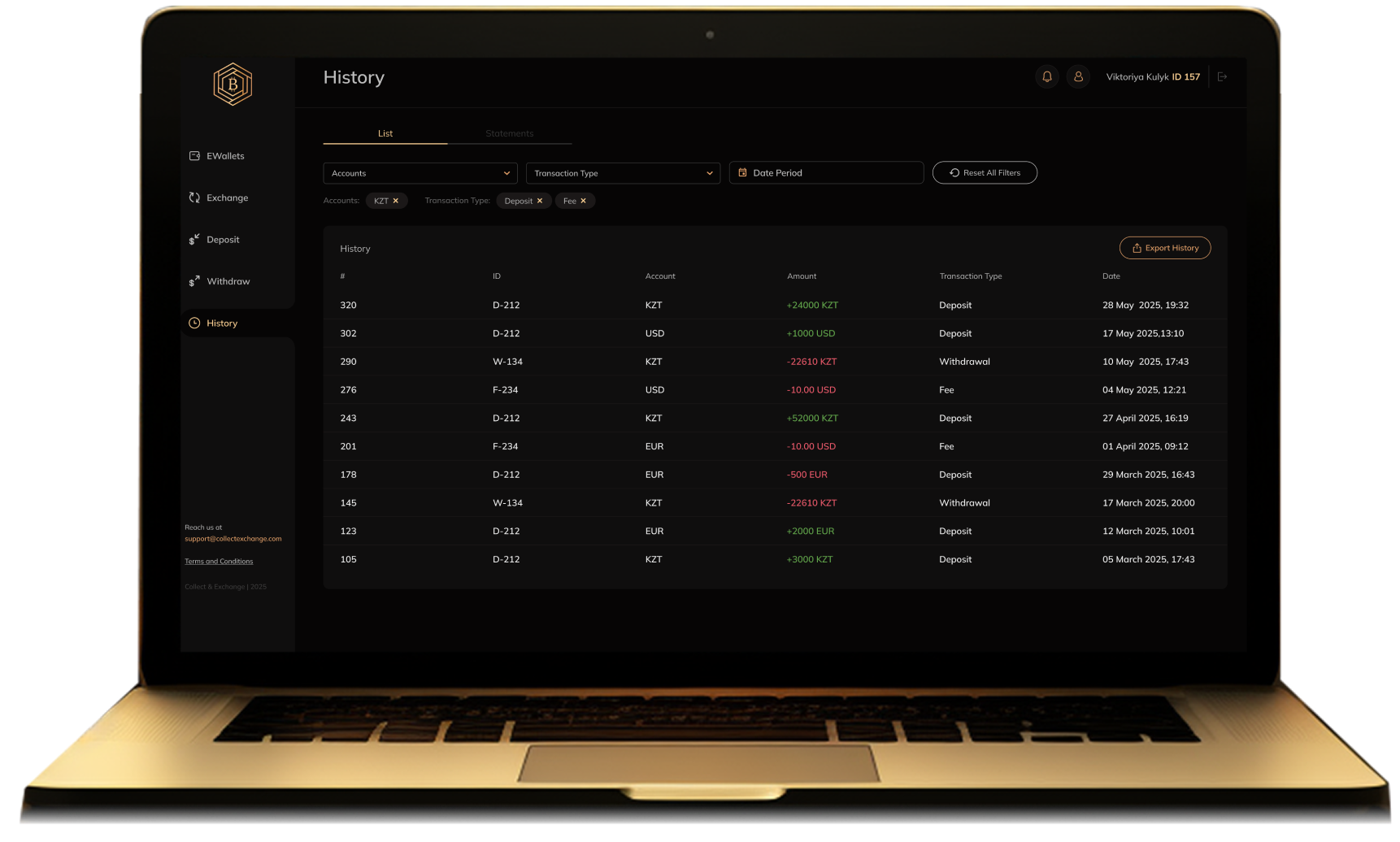

- Security and transparency: All transactions are subject to KYC/KYB, the system monitors risks and ensures compliance with AML requirements.

- Personal approach: Each client is assigned a manager who helps to adapt the platform to specific business tasks.

- Resistance to sanctions restrictions, thanks to multi-bank architecture and geographic diversification.

Why do businesses choose Collect&Exchange?

The key problem for most B2B companies working with crypto is the lack of predictability. Exchanges can freeze an account, banks can reject payments, regulators can suddenly change the rules of the game.

Collect&Exchange is building an ecosystem where businesses can plan, not “survive”. On the one hand, crypto as a flexible payment tool. On the other, banking infrastructure built into the product. This allows customers to work in both environments, cryptocurrency and fiat, with minimal costs and maximum control.

Who works with Collect&Exchange?

Clients include IT companies, marketing agencies, traders, consulting and financial services, crypto projects and startups. Some use C&E as a payment gateway for their services, others as the main tool for cross-border transactions.

C&E is trusted because they solve real problems. Collect&Exchange is a platform that is also chosen by importers/exporters, marketplaces, logistics companies, agencies, IT companies, fintech startups. It is important for them that payments are processed without delays, even when working in a complex or multi-level international environment. C&E helps them:

- Safely and efficiently enter new markets

- Speed up and simplify international document flow

- Use cryptocurrency within a clear and transparent infrastructure

And in all these cases, stability is an integral part of the product. The platform is built on a reliable infrastructure with 99% uptime. C&E does not depend on a single provider and uses backup communication and processing channels. This means: even in the event of technical failures or peak loads, transactions will be processed on time.

Conclusion

Collect&Exchange appeared as a logical continuation of the growing market demand: businesses need not just disparate solutions for exchanging and transferring funds, but a convenient, secure and stable platform that they can rely on. And the team did not immediately come up with this platform. The first versions of the system were developed for specific customer cases, with a gradual evolution towards a universal product.

Today, Collect&Exchange is not a startup looking for a model, but a company that has already found its position in the international payments ecosystem. Inside, there is a multi-currency platform adapted to business needs, with the ability to quickly work with fiat and digital assets, flexibly manage cash flows and connect new markets without having to delve into technical details.

One of the leading developments of Collect&Exchange today is white label SaaS solution under the brand CryptoExchangeSaaS is a ready-made platform for launching users’ own crypto exchange service with a focus on the B2B direction.

The company’s plans for the coming years include not only scaling the platform, but also deepening expertise in key verticals such as cross-border trade, web3 services and digital identification. Collect&Exchange no longer just follows trends, it shapes them, especially in matters of transparency, AML/KYC compliance and technological sustainability.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

You May Also Like

nLIGHT to Announce Fourth Quarter and Full Year 2025 Financial Results on February 26th

When silver became a meme stock, retail investors ultimately caught the falling knife.