70% Bitcoin Crash Incoming? CryptoQuant CEO Says It Depends On This

Bitcoin’s latest drawdown is being framed less as a technical breakdown and more as a liquidity problem, with Ki Young Ju arguing that the key inputs that sustained the rally fresh capital inflows have stalled. In that setup, he says, calls for a full-cycle, -70% style capitulation hinge on a single variable: whether Strategy turns from buyer to meaningful seller.

Will Bitcoin Experience Another -70% Bear Market?

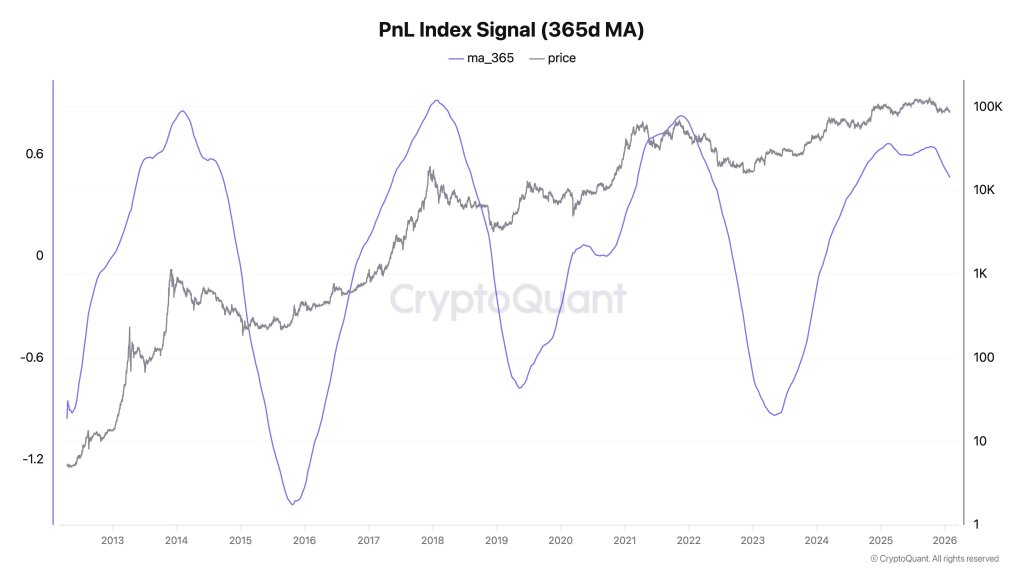

In a Feb. 1 post, Ki said “Bitcoin is dropping as selling pressure persists, with no fresh capital coming in.” He pointed to a flatlining Realized Cap as evidence that incremental money is no longer entering the market, and tied that directly to market structure. “Realized Cap” has flatlined, meaning no fresh capital. When market cap falls in that environment, it’s not a bull market.”

His read is that the profit-taking has been there for a while, it was simply absorbed. Early holders, he wrote, were “sitting on big unrealized gains thanks to ETFs and MSTR buying,” and “have been taking profits since early last year, but strong inflows kept Bitcoin near 100K.” The change now, in his telling, is that the bid that mattered most has faded: “Now those inflows have dried up.”

That’s where the crash math changes. Ki described Strategy (MSTR) as “a major driver of this rally,” but argued the reflexive downside seen in prior cycles is unlikely without a decisive reversal from the company’s balance sheet strategy. “Unless Saylor significantly dumps his stack, we won’t see a -70% crash like previous cycles,” he wrote, carving out an explicit condition rather than presenting the drawdown as inevitable.

Even so, he didn’t claim the market has found a floor. “Selling pressure is still ongoing, so the bottom isn’t clear yet,” Ki said, adding that the more probable path is time, not a straight-line liquidation. His base case is “a wide-ranging sideways consolidation,” a regime where volatility can persist but direction becomes harder to sustain without new marginal buyers.

Stablecoin Liquidity Dries Up

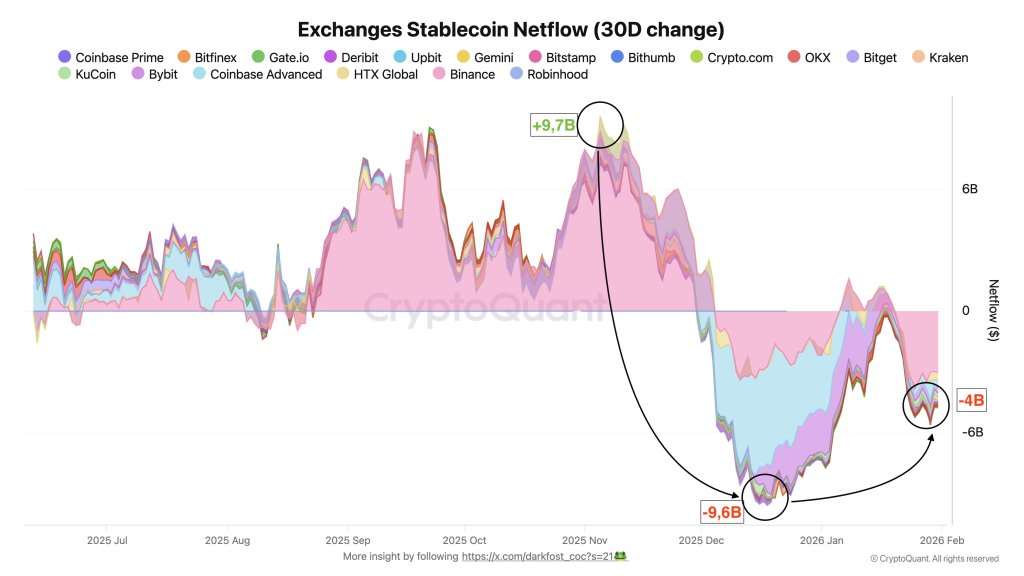

CryptoQuant contributor Darkfost added color on what “no fresh capital” looks like in the plumbing. He argued stablecoin activity, often treated as a near-term proxy for deployable crypto liquidity, has rolled over sharply as uncertainty stays elevated.

“The crypto market is currently going through a delicate phase, marked by a structural lack of liquidity in a context of persistently high uncertainty,” he wrote, calling it an environment “not conducive to risk taking,” especially relative to assets like precious metals and equities that are still drawing flows.

Darkfost said the stablecoin market had expanded by more than $140 billion since 2023, but that total stablecoin market capitalization began declining in December, “putting an end to this sustained growth trend.” The more actionable signal, he argued, is exchange flows: “Strong inflows generally indicate a willingness to gain exposure to the market, while outflows instead suggest capital preservation and a reduction in risk.”

He highlighted October as the last clear liquidity-heavy month, when “average monthly stablecoin netflows exceeded $9.7B,” with nearly $8.8B concentrated on Binance alone—conditions that “supported Bitcoin’s rally toward a new all time high.” Since November, he said, those inflows have been “largely wiped out,” with an initial $9.6 billion drop, then a brief stabilization, followed by renewed net outflows of more than $4 billion, including $3.1 billion from Binance.

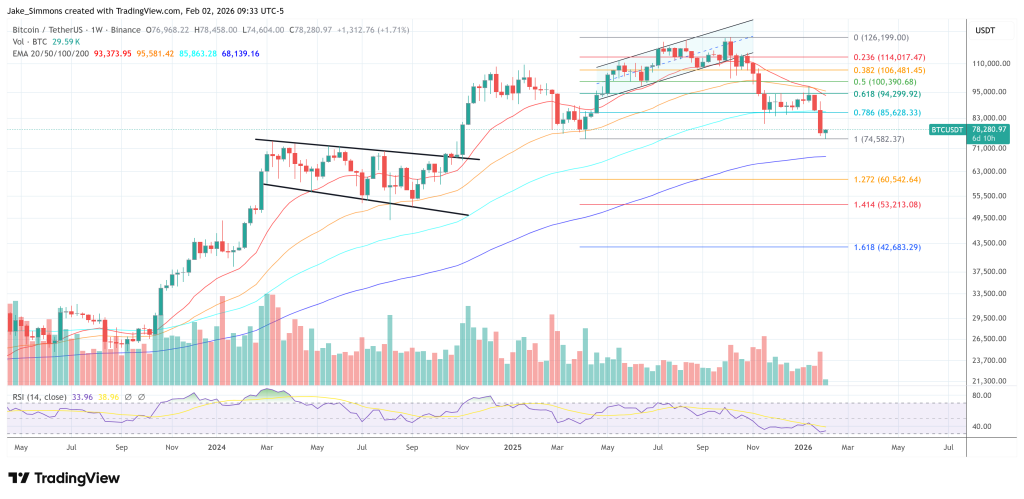

At press time, BTC traded at $78,280.

You May Also Like

The Giants Are Stumbling: Why BlockDAG’s 20-Exchange Launch is the Market’s New Safe Haven

IP Hits $11.75, HYPE Climbs to $55, BlockDAG Surpasses Both with $407M Presale Surge!