Crypto Isn’t Broken, It’s A US Liquidity Squeeze, Says Raoul Pal

Raoul Pal is pushing back on the idea that crypto’s current drawdown signals a broken market cycle, arguing instead that bitcoin and high-beta risk are being hit by a temporary US liquidity air pocket tied to Treasury cash management and government shutdown dynamics.

In a weekend post on X framed as a takedown of “false narratives,” the Global Macro Investor founder said the prevailing story—“that BTC and crypto are broken. The cycle is over”—has become an “alluring narrative trap,” especially as “prices [are] puking each and every fucking day.” But Pal said a separate question from a GMI hedge fund client about beaten-down SaaS equities prompted him to re-check the data and rethink the driver.

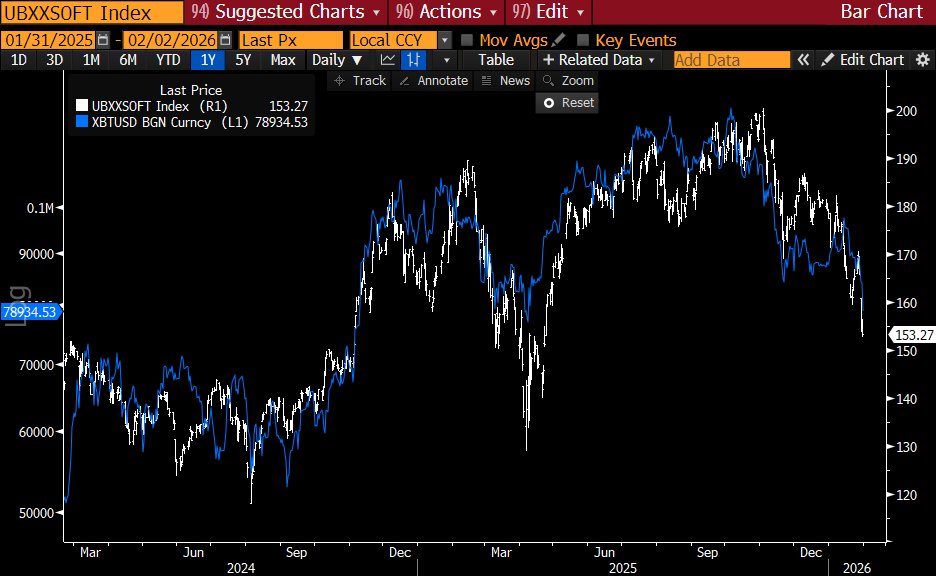

“What I found destroyed both the BTC narrative and the SaaS narrative,” Pal wrote. “SaaS and BTC are the EXACT same chart. Huh? That means there is another factor at play that we have all missed…”

Crypto Slide Due To US Liquidity Drain?

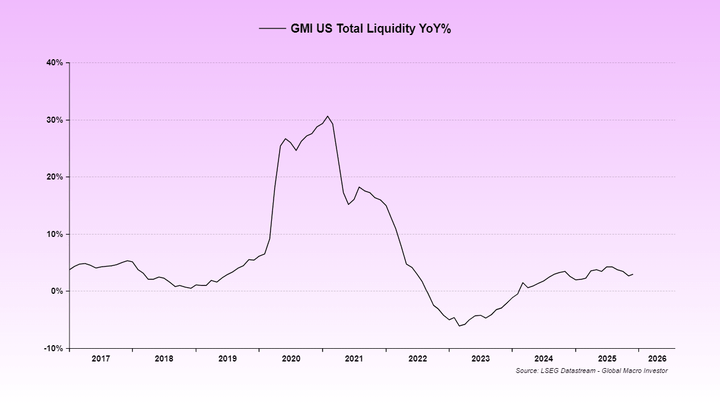

Pal’s answer is liquidity. He argues US liquidity has been “held back” by two shutdown episodes and “issues with US plumbing,” adding that the drain of the Fed’s reverse repo facility was “essentially completed in 2024.”

That, he said, left the Treasury General Account (TGA) rebuild in July and August without the kind of offset that would normally soften the impact, turning it into a net drain. In his telling, the same lack of liquidity helps explain why macro activity gauges have looked weak, writing that “lackluster liquidity is the reason why the ISM has been so low.”

While Pal said he typically tracks global total liquidity because of its long-term correlation with bitcoin and US tech, he argued the US measure is dominating this phase of the cycle because the US remains the system’s key liquidity supplier. That matters, he said, because the assets most exposed to a withdrawal of liquidity are long-duration, high-volatility exposures—exactly where bitcoin and SaaS sit in many portfolios.

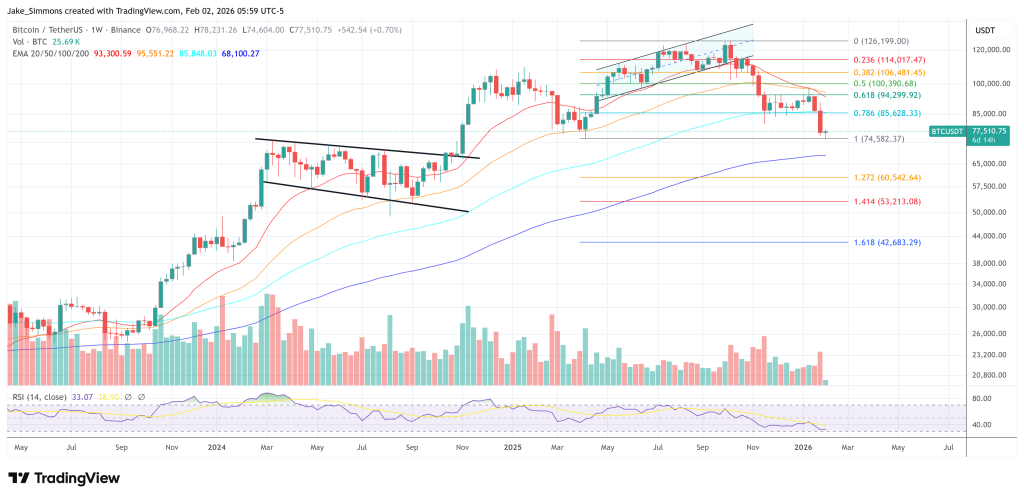

“Those are both the longest duration assets that exist and both got discounted because liquidity was temporarily withdrawing,” Pal wrote, tying their drawdowns to the same macro impulse rather than project-specific failure or a broken crypto “cycle.”

He also pointed to gold’s rally as an additional constraint on marginal flows. “The rally in gold essentially sucked all marginal liquidity out of the system that would have flowed into BTC and SaaS,” Pal said. “There was not enough liquidity to support all these assets, so the riskiest got hit.”

Pal described the latest shutdown as a further headwind, claiming the Treasury “hedged” by not drawing down the TGA after the prior shutdown and instead “added more to it,” deepening the drain. That, he said, is the “current air pocket” behind the “brutal price action” across risk.

But he also argued the squeeze is close to clearing. “However, the signs are that this shutdown will get resolved this week and that is the FINAL liquidity hurdle out of the way,” Pal wrote, adding that the next phase could bring a “liquidity flood” from factors he listed including changes around eSLR, partial TGA drawdowns, fiscal stimulus and rate cuts.

He extended the “false narrative” theme to Fed expectations, rejecting the idea that Kevin Warsh would run policy as a hawk. “On the subject of rate cuts, there is another false narrative going around that Kevin Warsh is a hawk,” Pal wrote. “It is utter fucking nonsense. These were comments mainly from 18 years ago.”

Pal argued Warsh’s mandate would align with what he called the “Greenspan era playbook”—cutting rates, letting the economy run hotter, and leaning on productivity gains to restrain core inflation—while avoiding balance-sheet moves that could collide with reserve constraints and destabilize lending.

Pal included a mea culpa, acknowledging GMI “was not seeing the US liquidity as the current driving factor,” after years of emphasizing global measures. “There is no disconnect,” he wrote. “It’s just that the confluence of events Reverse Repo drained >TGA rebuild > Shutdown > Gold rally > Shutdown was not forecastable by us, or in any event we missed the impact.”

His bottom line was less about calling the exact bottom and more about time-in-cycle. “Often in these full cycle trades, it is time that is more important than price,” he wrote, urging “PATIENCE!” and reiterating he remains “HUGE” bullish on 2026 if the policy and liquidity playbook he expects materializes.

At press time, BTC traded at $77,510.

You May Also Like

UAE Authorizes AE Coin for Federal Government Payments

Exploring Market Buzz: Unique Opportunities in Cryptocurrencies