Direct traffic accounts for 44% of US crypto media visits — even as overall traffic falls

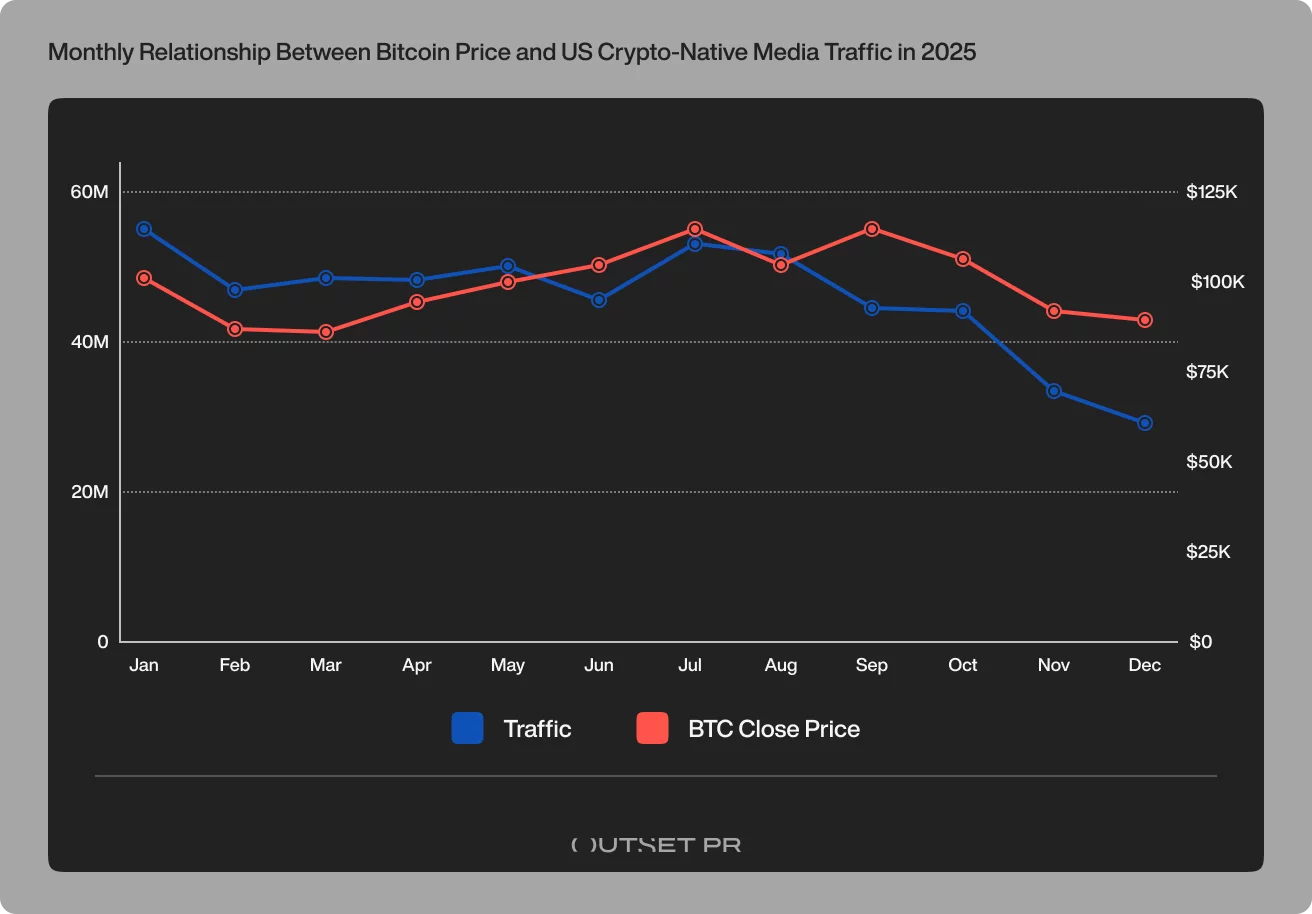

After a fairly optimistic mid-year performance, U.S. crypto media visits fell by roughly one-third in the fourth quarter of 2025.

This coincided with the market’s sharp downturn and Bitcoin’s abandonment of hopes of hitting $150,000 by the end of the year.

- Total visits to U.S. crypto-native sites fell by approximately 33% quarter-over-quarter.

- Despite overall traffic shrinking, direct traffic accounted for almost half of all visitors – 44%.

- The casual crowd pulled back, but loyal readers kept showing up.

What mattered most was where the remaining attention came from: readers who stayed were coming directly, out of habit. When markets are hot, attention comes from everywhere. When things cool down, most of that traffic disappears, and what’s left is the steady reader base that comes back on purpose, not by accident.

That’s why direct traffic became the anchor in Q4, even as casual discovery faded out.

Naturally, the extra eyeballs that were very interested during the peak of the bull run started disappearing when markets soured.

Our latest Outset Data Pulse analysis indicates that what is described as “summer tourists,” that is, casual readers drawn by the bull market, left as quickly as they came. Earlier in the year, many of these readers were searching on Google for topics like “Should I buy Bitcoin now?” or clicking on trending links on X and Reddit.

By the fourth quarter, with no new all-time highs or memecoin rags-to-riches story dominating headlines, that influx of casual traffic simply evaporated. Once the casual audience dropped off, the real shape of the U.S. crypto media market came into focus. This trend played out nearly identically in Asia throughout the third quarter. The summer hype brought an influx of visitors for a few months before it ended.

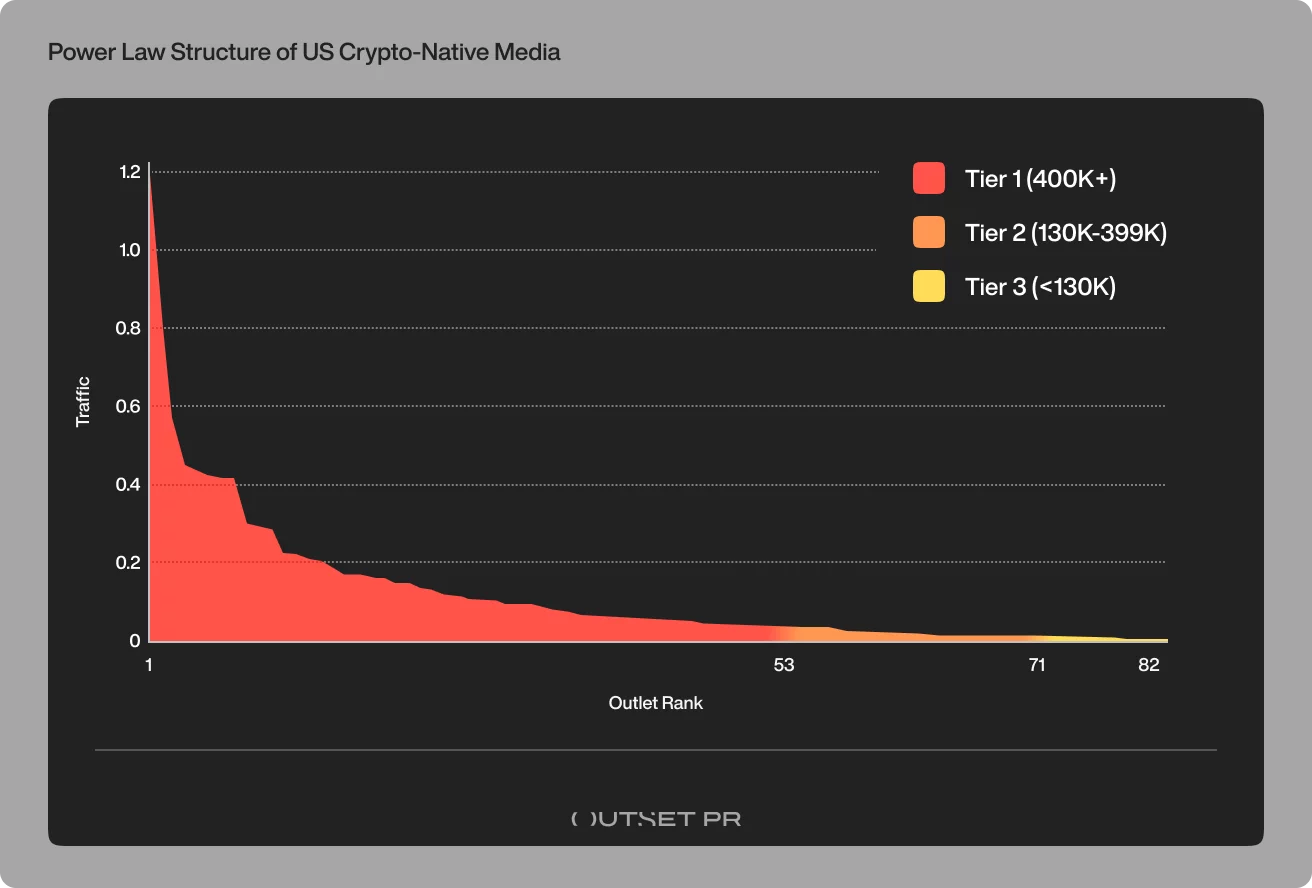

What remained was a market increasingly defined by concentration: in Q4, just 53 publishers captured more than 95% of all crypto-native traffic, underscoring how uneven visibility has become. Latin America wasn’t much different. In our earlier report, just six sites pulled in nearly 70% of all traffic across 38 crypto-only outlets.

Q4’s traffic crash hid surge in direct-only readers

Search and social traffic were the first channels to give way. That makes sense: when crypto is moving fast, casual readers often arrive through whatever is circulating on social media.

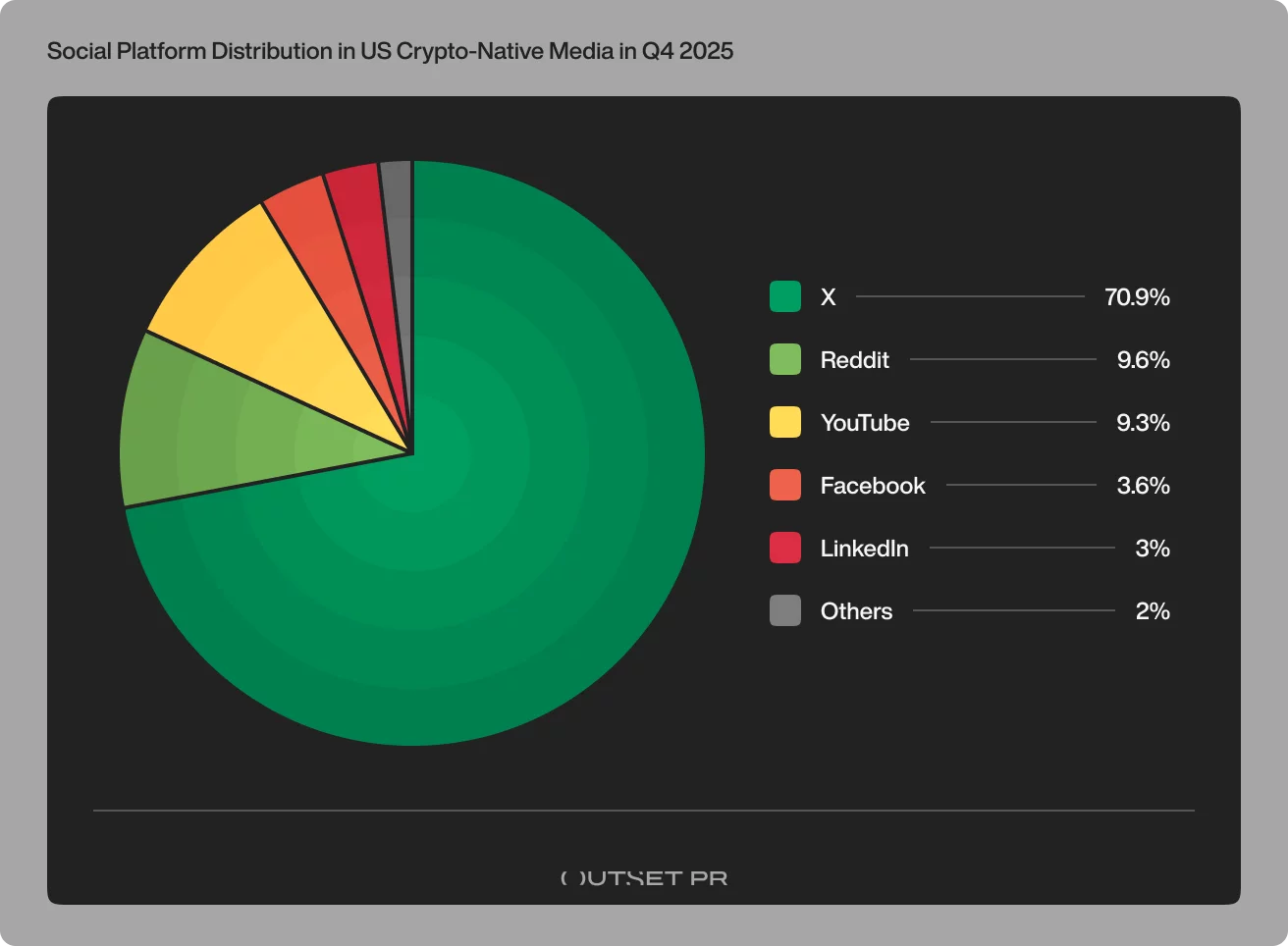

But in the U.S., “social discovery” effectively meant X. In Q4, more than 70% of all social traffic across crypto-native outlets came from a single platform, while the remaining networks: Reddit, YouTube, Facebook, LinkedIn contributed only small fractions.

Social itself was a relatively thin layer overall, representing only about 6% of total traffic, which meant most publishers were exposed to a small channel that was almost entirely dependent on one platform.

“Once the feeds quiet down, what’s left is the audience that comes deliberately, the people who already know where to go,” said Maximilian Fondé, senior media analyst at Outset PR. “That’s when direct traffic stops being just another channel and becomes the main thing holding publishers up.”

The Q4 numbers bear this out in dramatic fashion. As search and social weakened, another discovery layer began to stand out: AI tools already drove roughly 25% of all referral traffic across U.S. crypto-native media, creating a new visibility filter alongside direct readership.

Even as total visits plunged, nearly half of all remaining traffic came from readers navigating directly to crypto sites. This was the strongest direct share we observed across any region in recent data.

What this means is nearly one out of two visits to American crypto press websites came from a reader who meant to be there, not through some external search or prompt. That’s the overall picture, but for some outlets, direct traffic was basically the whole story. Bankless pulled in almost 58% direct visits, which is about as close as crypto media gets to a built-in audience.

These aren’t accidental clicks but a more crypto-savvy crowd, consisting of traders checking the news, analysts keeping up with industry updates, or long-term investors making sure they never miss an opportunity.

Why direct readers are the loyal core of crypto media

Direct traffic in Q4 reflected a committed reader base that continued returning even as broader interest cooled. As Maximilian Fondé previously observed,

“Every direct visit reflects intent, not chance.”

Even when speculative interest wanes, there’s still a major audience for crypto news. At the same time, the broader ecosystem operates under a strict power law: below the top tier, smaller outlets face rising barriers to discovery regardless of output or quality.

If fewer newbies are googling “next 100x coin”, the sites that thrive are the ones with a bookmark on their loyal reader’s browser. This is a testament to the stickiness of crypto brands that offer trust, reliability, fair reporting, and credibility.

They might not be sharing as many articles on Facebook or ranking on Reddit, but they are still attracting readers. This is the base of users who will visit their favorite crypto news sites through thick and thin.

When direct loyalty becomes the only real moat

The rise in direct traffic doesn’t just reflect stronger reader habits. It also reflects how concentrated the U.S. crypto media market has become.

Our tier analysis shows that this is no longer an ecosystem where attention is broadly distributed. In Q4, tier-1 outlets (publishers with more than 400,000 monthly visits) absorbed 95% of all crypto-native demand. That top tier alone accounted for more than 101 million visits across the quarter.

Below that, the picture changes sharply. Tier-2 outlets, despite operating at meaningful scale, accounted for just over 4% of total traffic, while tier-3 publishers accounted for less than 1%. The “middle class” of crypto media has largely vanished.

“At this point, competition mostly happens inside the top tier,” said Fondé. “Below that, catching up becomes structurally difficult, regardless of editorial quality.”

This is why direct readership matters so much. In a market shaped by compounding visibility, publishers cannot rely on discovery alone. Search, social, and now AI referrals increasingly reinforce the same incumbents. Direct traffic is one of the few channels that smaller or mid-tier outlets can truly own.

In practice, the Q4 contraction clarified what keeps outlets alive. The publishers that held up best weren’t the ones chasing volatility-driven clicks. They were the ones with readers who still typed the URL, opened a bookmark, or returned out of routine.

In a market like this, the readers who come straight to you are the only attention you really own. With that said, the implications are clear for crypto websites: cater to your core audience. These are the readers who value substantive reporting, because that’s what keeps them coming back.

You May Also Like

CME Group to Launch Solana and XRP Futures Options

China Blocks Nvidia’s RTX Pro 6000D as Local Chips Rise