Ripple XRP Price Analysis: Millionaire Wallets Rise as Treasury Platform Launches

TLDR

- XRP millionaire wallets (holding over 1 million tokens) increased by 42 since January 1, reversing a decline seen between October and December

- Ripple launched Ripple Treasury, combining GTreasury’s software with blockchain technology following a $1 billion acquisition

- XRP spot ETFs recorded $9.16 million in net inflows while Bitcoin and Ethereum ETFs saw major outflows

- Smart money traders increased XRP accumulation by 11.55% over the past 30 days according to Nansen

- XRP currently trades around $1.87-$1.92, with analysts predicting potential move to $2.00-$2.30 if resistance breaks

XRP wallets holding more than 1 million tokens are increasing for the first time since September 2024. Crypto analytics platform Santiment reported that 42 new millionaire wallets have appeared since January 1.

This growth comes after a period of decline. Between October and December, the number of these large holder wallets dropped by 784.

The return of millionaire wallets signals potential strength for XRP’s long-term outlook. At current prices around $1.87, a wallet holding 1 million XRP tokens represents approximately $1.87 million in value.

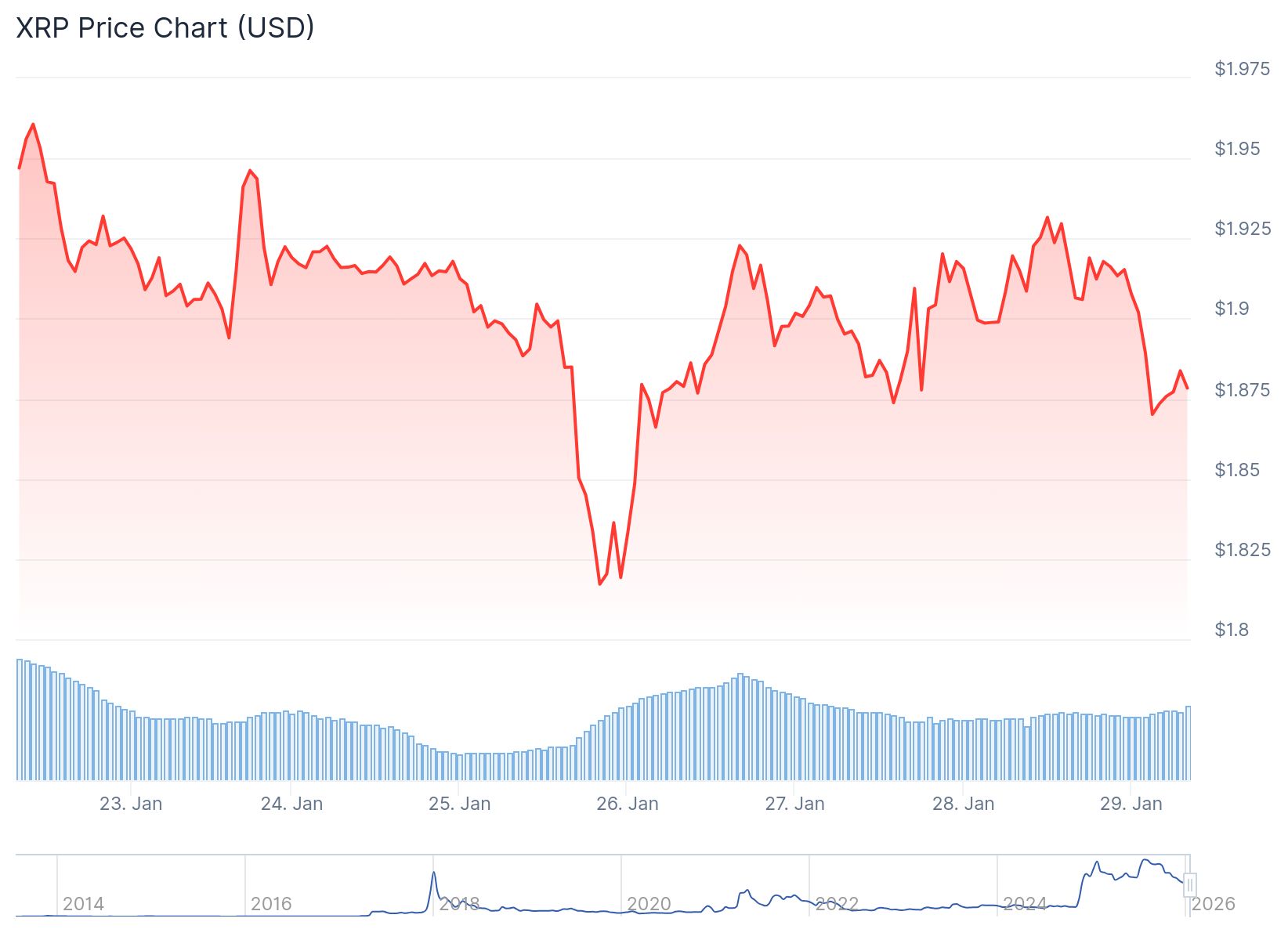

XRP Price

XRP Price

Smart money traders have also been accumulating XRP. Data from Nansen shows these successful traders increased their XRP holdings by 11.55% over the past 30 days.

Ripple Treasury Platform Goes Live

Ripple recently launched its Treasury platform. The new system combines GTreasury’s traditional software with Ripple’s blockchain technology.

The platform emerged from Ripple’s $1 billion acquisition of GTreasury. It aims to simplify cash and digital asset management for businesses.

Ripple Treasury offers real-time solutions for global companies. The system allows firms to manage both cash and digital assets in one unified platform. It focuses on improving liquidity management and speeding up cross-border payments.

Strong ETF Inflows Show Institutional Interest

XRP spot ETFs attracted $9.16 million in net inflows. The consistent demand reflects growing institutional confidence in the asset.

Source: SoSoValue

Source: SoSoValue

Bitcoin and Ethereum spot ETFs saw different results. Bitcoin ETFs recorded outflows of $147 million while Ethereum ETFs lost $63.53 million.

The positive XRP ETF flows stand in contrast to the broader market weakness. The Crypto Fear & Greed Index currently shows a fear score of 26, indicating cautious investor sentiment.

Price Predictions Vary Among Analysts

Crypto trader CW believes XRP could reach $2.30 if it breaks through current resistance levels. The trader noted that net buying remains strong and the trend appears to be reversing.

Asset manager 21Shares pointed to XRP’s pattern of multi-year compression followed by sharp price movements. The firm cited growing regulatory clarity and institutional support as positive factors.

Swyftx lead analyst Pav Hundal expressed caution about XRP’s near-term prospects. He warned that further price gains rely heavily on narrative rather than fundamentals.

Technical Indicators Show Mixed Signals

XRP currently trades at $1.92 with a 2% daily gain. The MACD indicator sits above the signal line, suggesting short-term bullish momentum.

The RSI reads 52, placing XRP in neutral territory. The asset is neither overbought nor oversold at current levels.

Key resistance stands at $2.00, with potential upside to $2.10. Support levels exist at $1.85 and $1.75.

XRP has gained 1.27% over the past 30 days but remains down 4% since the start of 2026. The CoinMarketCap Altcoin Season Index shows Bitcoin outperforming most top 100 altcoins over the past 90 days with a score of 31 out of 100.

The post Ripple XRP Price Analysis: Millionaire Wallets Rise as Treasury Platform Launches appeared first on CoinCentral.

You May Also Like

Crypto execs met with US lawmakers to discuss Bitcoin reserve, market structure bills

Lawmakers in the US House of Representatives and Senate met with cryptocurrency industry leaders in three separate roundtable events this week. Members of the US Congress met with key figures in the cryptocurrency industry to discuss issues and potential laws related to the establishment of a strategic Bitcoin reserve and a market structure.On Tuesday, a group of lawmakers that included Alaska Representative Nick Begich and Ohio Senator Bernie Moreno met with Strategy co-founder Michael Saylor and others in a roundtable event regarding the BITCOIN Act, a bill to establish a strategic Bitcoin (BTC) reserve. The discussion was hosted by the advocacy organization Digital Chamber and its affiliates, the Digital Power Network and Bitcoin Treasury Council.“Legislators and the executives at yesterday’s roundtable agree, there is a need [for] a Strategic Bitcoin Reserve law to ensure its longevity for America’s financial future,” Hailey Miller, director of government affairs and public policy at Digital Power Network, told Cointelegraph. “Most attendees are looking for next steps, which may mean including the SBR within the broader policy frameworks already advancing.“Read more

Messari and Warden Protocol have partnered to launch an AI research assistant to aid in real-time crypto market analysis.